- July 8, 2025

Interest rates on Treasury securities, money market funds, and savings accounts are at 15 to 20 year highs, hovering near 5%. With stocks now sitting 10% below their previous high from almost two years ago, the proposition of going all-in on a “sure thing” of a 5% interest rate may sound appealing.

I agree with this appeal and the appropriateness of taking advantage of today’s attractive interest rates. But, only where you would otherwise have allocated your resources to these types of investments or cash vehicles, anyway.

Let’s take a look at some examples where these higher interest rates are clearly beneficial.

- Cash availability – We all need to keep some cash available in our checking and savings accounts. A few years ago, the interest “penalty” for keeping a little extra cash in a checking account was negligible. Now it’s the difference between earning 0.10% in the checking account and 4.5% in an online savings account. That’s missing out on $440 a year for every extra $10,000 kept in a checking account that could be in an online savings account. Sure, it will take a little time to set up automated transfers or shift cash between accounts occasionally, but I’m confident that it will translate into a solid hourly rate for the time invested.

- Short-term goals – If you have a larger amount of cash earmarked for specific future use – maybe a down payment on a house, cabin or condo purchase – it could make sense to look at money market funds or short-term Treasury securities for holding those earmarked funds. The interest rate on a 2-year Treasury note is about 5.2%. That’s not a bad return for “dry powder” set aside for a goal.

- “Waiting Room” Cash – In cases where investment portfolios have received a windfall of cash to be invested in a dollar cost averaging plan, the cash waiting to be invested can now earn 5% in a money market fund. This same money market fund paid less than 0.2% as recently as two years ago. Not a bad interest rate pick-up for cash that is essentially in the “waiting room.”

- Alleviate Stock Pressure - The portion of a long-term, diversified portfolio that is allocated to bonds is also now earning nearly 5% interest compared to only about 0.5% as recently as two years ago. As discussed here, with bonds positioned to earn better forward returns than they have been in quite some time, there is less pressure on stocks to deliver above-expectation returns.

That brings us to the root of the question posed in the title. As stocks have underperformed for nearly two years and with interest rates at 20-year highs, does it make sense to shift some funds from stocks into bonds to take advantage of those higher yields? The short answer is, “No,” but it’s a serious enough question that merits some further thought to address the inevitable follow-up question of, “Why?”

- It is effectively market-timing. There is always an asset that has either done well recently or is widely viewed as more attractive going forward. This can make it seem like a better investment opportunity than others. In reality, though, this usually leads to taking more risk to chase return by over-investing in the investment that has recently performed best. It may seem harmless to allocate more to bonds for risk reduction rather than performance enhancement, as is more often the case with market timing. It may feel good to collect 5% interest at a time when stocks are lagging, but this can introduce different risks to a portfolio or retirement success that we’ll look at in the next two topics.

- Interest rate levels can be temporary and there is no assurance that high rates will persist. Interest rates are at their currently high levels in response to an overheating economy and higher-than-expected inflation. When these issues subside, interest rates are likely to fall in response – just as they went up in response to changing economic conditions. A 5% interest yield today may only be 3% or 4% a few years from now. This then becomes a less attractive proposition.

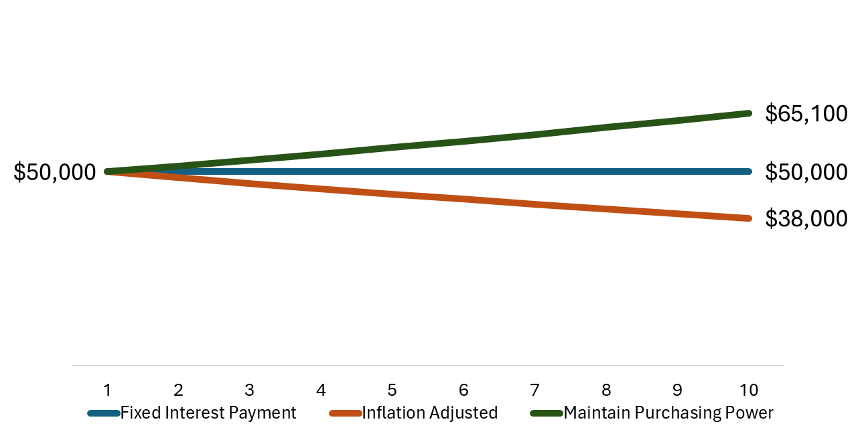

- Bonds are often referred to as “fixed income” investments because their interest payments are indeed fixed and therefore decline in purchasing power. If we start with $1 million invested in a 10-year Treasury earning 5% today, we can collect $50,000 of interest every year. That sounds great, and to be sure, it is. However, it will remain $50,000 and after 10 years that amount equates to $38,000 of purchasing power. Stated differently, we would need to collect $65,000 in the 10th year to equal the purchasing power of the $50,000 we received in the first year, after accounting for inflation.

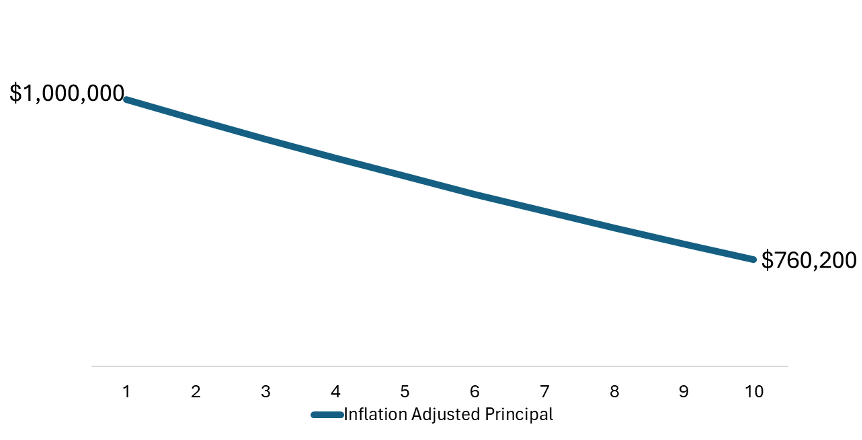

It doesn’t end there, though. The original $1 million invested turns into only $760,000 in inflation-adjusted dollars when it matures and needs to be reinvested. To earn the $65,000 of annual interest required to meet the original $50,000 of purchasing power, the $760,000 bond would need to be reinvested at an interest rate of 8.6% when it matures in 10 years.

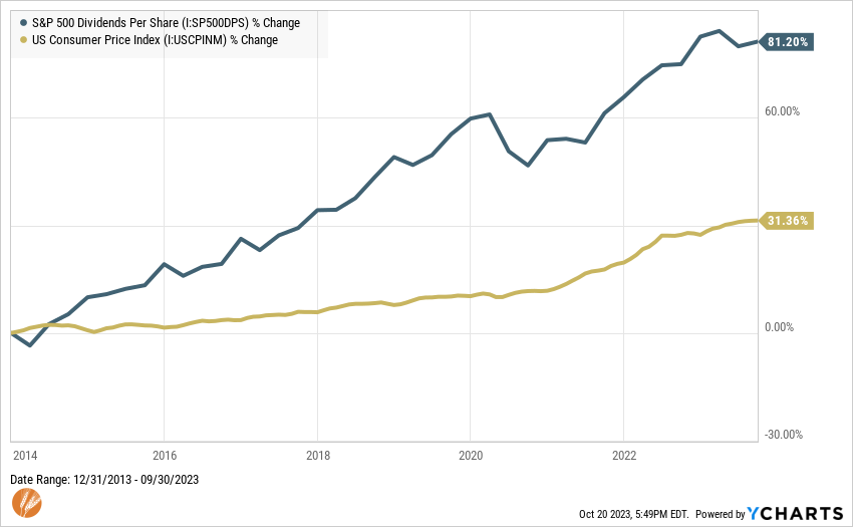

This contrasts with stocks that have a history of increasing price per share and growing their dividend payments over time – both at rates greater than inflation.

- Periodic stock weakness is temporary and expected. As we’ve seen over many market cycles, stock declines – even when a decline lasts for two years – have proven to be temporary. And they typically don’t end and start their next bull market run on a schedule. It usually happens when it’s least expected. For this reason, over-allocating to bonds, money market, or cash – even if they’re earning 20-year high interest rates – comes with an opportunity cost. The opportunity cost of missing early stages of a stock rally can be detrimental to years’ worth of potential returns. What’s more is that the relative feeling of safety and security of bonds or cash can act as a barrier to getting the other side of market timing right – getting back into stocks.

None of this is to diminish the value that thoughtful allocation to bonds can provide for a portfolio. Bonds, money market funds, cash and other interest-bearing vehicles serve very specific and important roles in your portfolio and total balance sheet. Specifically, bonds and other lower-risk interest-bearing investments are most useful in a stock environment as we’ve experienced in the last couple years. But as with stocks, it’s important to not let the attractiveness of a recent market environment overly influence how they are used or attempt to use them for purposes for which they are not designed.

There is one exception though where it may be appropriate, and in fact beneficial, to shift a portion of your portfolio from stocks to bonds. That is if your plan and circumstances warrant a shift in your portfolio’s asset allocation based on risk, return, or cash flow needs.

It’s important to stay grounded and humble in the face of an unknowable future and changing economic conditions. For that reason, it is best to defer asset allocation decisions to the facts and circumstances of your financial plan and evidence from many market cycles rather than recent market trends.

Matt Weier, CFA, CFP®

Partner

Director of Investments

Chartered Financial Analyst

Certified Financial Planner®