Zero commissions. Just straightforward and honest guidance.

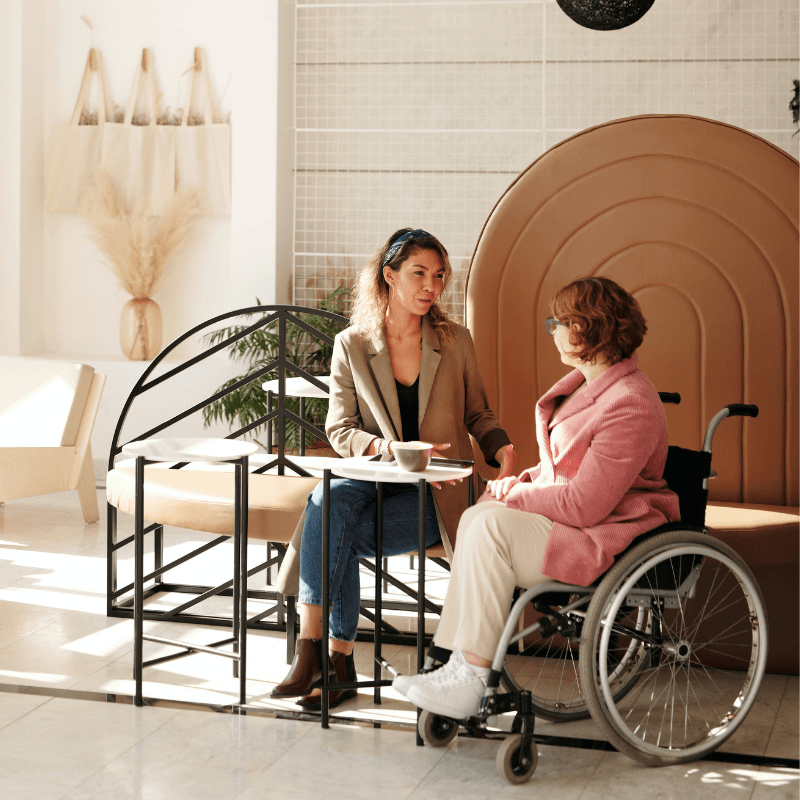

Personal risk management is an important component of any comprehensive financial plan. Although there are a number of ways to control risk, for most people it will involve purchasing insurance. But unlike insurance salespeople, we take your best interests to heart when helping you plan for the future.

We take a different approach to provide you with clear and transparent advice.

The size of potential commissions, in our experience, is often big enough to cloud objectivity. We are knowledgeable enough about insurance products to help you identify and secure appropriate coverage, but we do not sell insurance nor accept commissions.

As a standard part of our financial planning process, we consider what events could jeopardize your family’s wealth. If you have a spouse and/or dependents relying on your earning ability, we assess the need for life insurance.

Similarly, we make sure you understand the need for disability insurance or a long-term care policy. We also look at your liability exposure and suggest appropriate auto, home, professional, and umbrella insurance coverage.

As you’ve probably been following in the news to some extent, and we tax professionals have now had a couple of months to digest, a new tax package was signed into law on July 4, 2025. Despite the...

When markets change quickly, working the plan, rebalancing, dollar cost averaging, and reviewing your plan remain the best courses of action.

In the week or so since the end of the quarter, the direction I was going to take this post changed as quickly as the Duke basketball team’s fortunes over the weekend.