- April 8, 2025

When markets change quickly, working the plan, rebalancing, dollar cost averaging, and reviewing your plan remain the best courses of action.

Do you remember what markets felt like when I wrote to you about 90 days ago? As a quick reminder, they didn’t feel great.

I published Your Financial Plan is More Important than Tariffs or Volatility on April 8, 2025, to acknowledge the market situation at that time and share longer-term market perspectives that influence your financial plan. I don’t know if the timing of that post was lucky or prescient, but either way, I appreciate how things have improved since then.

Here’s a brief trip back in time:

In the final weeks of the first quarter, markets started to expect a higher chance of a tariff announcement, leading stocks to decline slightly. That decline quickly intensified, with the S&P 500 dropping a total of 10.5% on April 3 and 4, marking its largest decline since the COVID-related drops of 2020.

On April 7, the S&P 500 hit an intra-day low of 21.3% below its February 19th high and closed at a low of 18.9% below that peak on April 8th. Technically, a bear market is defined as a 20% decline in closing prices from a peak. I don’t know about you, but a 19% decline at the close or a 21% intra-day drop both feel about the same as reaching the 20% closing threshold for an official bear market.

When markets closed on April 8th, indexes around the world were between 13% and 19% off their February peaks.

One might be forgiven for thinking 2025 would be difficult. But as markets often do, they unexpectedly changed direction and started to recover. And it happened quickly. The S&P 500 rose 9.5% on April 9th.

I closed that post 90 days ago with the following:

“…the one thing that every stock decline has had in common is that they proved temporary. And they tend to start their recovery not when everything is better but when the news and developments begin to get “less bad.”

The recovery on April 9th marked the announcement of the tariff pause and, at least for the time being, helped maintain stocks’ perfect record of declines being temporary.

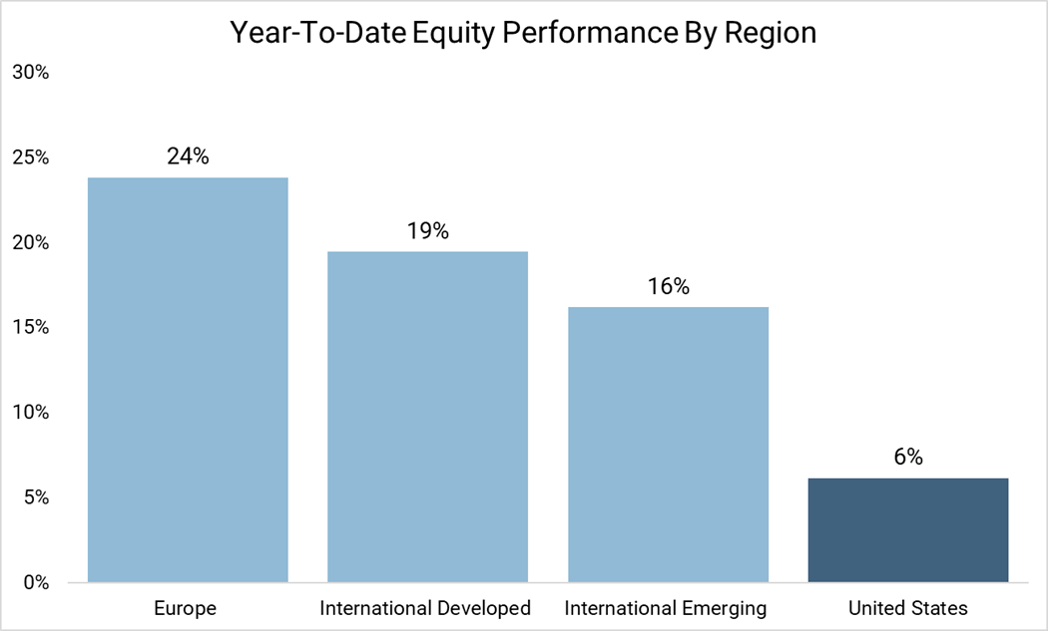

As the second quarter ended, the S&P 500 reached a record level as the recovery continued. Perhaps the bigger story, though, is the notable outperformance of non-US stocks on the global stage. This trend was also evident in the first quarter but was temporarily overshadowed by developments on the tariff front. Not only did non-US stocks not decline as much in the spring, but their recovery was also swift and continued similarly through the second quarter.

Let’s take a look at the recovery that started on April 9th.

Now let’s combine the two and see where things stand for the full year. I’ll also add low-risk bonds to this chart to highlight their importance during times of stock market disruptions.

Although this stock decline was brief, the chart above shows that bonds’ relatively stable path compared to stocks provided a valuable counterbalance. It also illustrates the potential benefit of diversification. Non-US stocks’ outperformance in 2025 has resulted from broad-based country performance, and nearly all major global markets have participated.

After experiencing relatively unchecked strength over the past fifteen years, the US dollar has declined by about 10% against global currencies this year. In addition to the strong performance of local markets outside the US, for those of us measuring investment returns in US dollars, the dollar's weakness on the global stage in 2025 increased our returns from non-US stocks.

If we zoom out a little more, we can see that the recent trend of non-US stocks quietly started as we emerged from the longer Bear Market of 2022.

Your Financial Plan and Changing Markets

As we’ve observed this year, markets can shift swiftly. Stocks may experience a quick and unexpected decline without warning and can start their recovery just as suddenly and silently. Market leadership can change quietly and without notice. All of this has been evident recently.

In the most basic terms, having the right risk allocation, such as a mix of stocks and bonds or other low-risk assets, helps you either protect yourself or benefit from unexpected broad stock price declines, depending on your stage of investing. Additionally, diversifying across various types of stocks and bonds helps you take advantage of whichever category is leading the way, especially when that leadership shifts.

Both of these fundamental elements of successful investing can seem easier said than done. However, having a plan that considers your investment goals and time horizon, and is based on the idea that stock prices will go through periodic declines on their way to strong long-term returns, along with the understanding that asset classes will shift leadership, provides a solid foundation to build on.

Of course, your financial plan won’t prevent market declines, make recoveries come quicker, or even ease the pain when declines occur. But it provides a decision-making framework for market events that might otherwise cause us to react to market movements, predictions, or our natural impulses of fear and greed.

I wrote near the end of Your Financial Plan Is More Important Than Tariffs or Volatility five things that can be done during market declines.

Work the plan. Particularly for those drawing from portfolios, withdrawals will be funded from bonds as intended. For those adding to portfolios, unless otherwise planned, those additions will purchase stocks.

Rebalance. If bonds become overweight in your portfolio, we’ll sell some to return them to their target weight and use the proceeds to buy stocks.

Dollar Cost Average. If your portfolio is in the process of a dollar cost averaging plan, this market environment is what it is designed for, so it's important to continue that plan.

Tax Loss Harvest. For those with taxable brokerage accounts, selling investments with losses and reinvesting in similar positions maintains your portfolio’s diversification while capturing a loss that can save future taxes on capital gains.

Review your plan. If your goals and circumstances change, your plan should also change.

It turns out that at least four of those are valid in recoveries and rising markets as well – the one exception is perhaps tax loss harvesting.

But when markets change quickly, working the plan, rebalancing, dollar cost averaging, and reviewing your plan remain the best courses of action.

I hope everyone is having a great summer, enjoying stocks’ recovery from their April lows, and had a wonderful 4th of July holiday.

Thanks for reading.

Matt Weier, CFA, CFP®

Partner

Director of Investments

Chartered Financial Analyst

Certified Financial Planner®