- July 8, 2025

Those of us in Minnesota heard much about the “Snowiest February Ever!” (for those of you not in Minnesota, please take our word that it snowed a lot), but here’s a headline that you might have missed: The first quarter of 2019 saw the best returns for US stocks since the second quarter of 2009. It may be easy to dismiss both of those quarters’ returns knowing that they’re both compared against low beginning levels. But both scenarios highlight how quickly and unexpectedly stocks’ fortunes can change.

Why did their fortunes change so rapidly and significantly? It could be the change in tune from the Fed, a still robust job market, soothing of global trade tensions, strong holiday retail sales, continued low inflation, or the Patriots winning another Super Bowl. Or, it could be none of those reasons and instead the simple fact that stocks became cheap enough making expected returns attractive given risk expectations. Regardless of the reason, it was a welcomed turn of events.

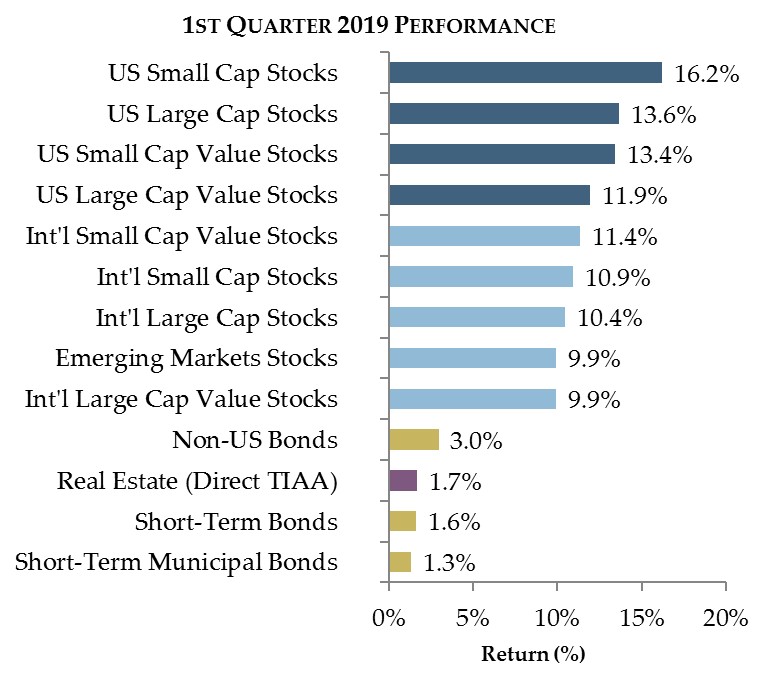

By the time the quarter ended, US Large Cap stocks (the S&P 500) returned 13.6% for the quarter nearly matching its 13.5% decline in the fourth quarter of 2018 – it takes a 15.5% return to get back to even after a 13.5% decline, so we didn’t close the entire gap, but we’re almost there.

US Small Cap stocks were the star performer posting a 16.2% return for the quarter. International stocks, despite staging their own respective recovery, lagged US stocks – their extended period of trailing US stock returns have made them very inexpensive compared to historical valuations.

On the bond side of the ledger, US bond returns reflected the steadying expectations from the Fed’s latest announcements to push the pause button on rate increases. International bonds led the global bond market as many central banks outside of the US continued with their low interest rate policies.

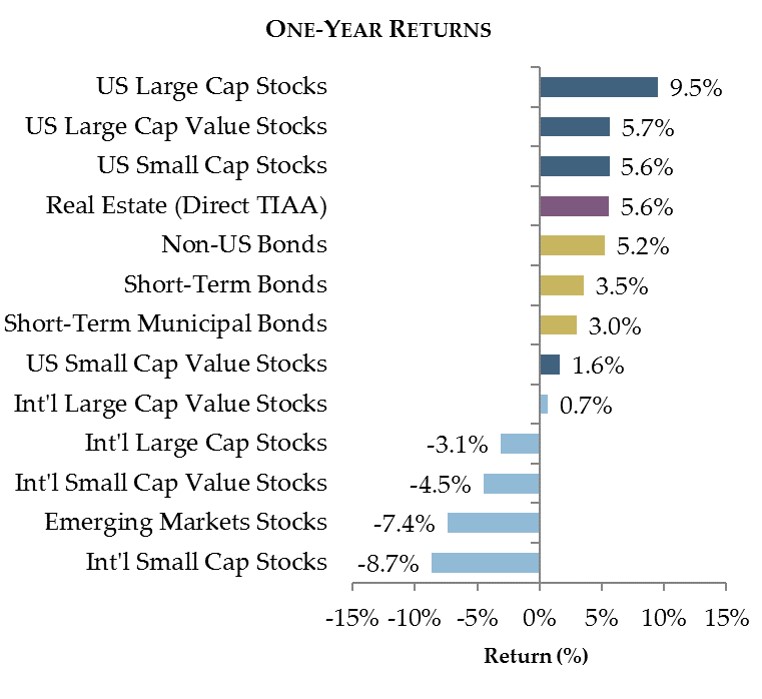

It is also noteworthy that after our recent experience with a bear market, US Large Cap Stocks posted a 9.5% return over the last year. Full return figures for the last quarter and year are illustrated below.

Who expected this?

Before we get too far into this article, I have a favor to ask of you as the reader. Can you think back to final the days of 2018 and remember what was happening with share prices at the time? For a quick refresher, broad categories of US Stocks had fallen between 20% and 27% since September.

Now, raise your hand if at that time you thought that prices would rise over 20% from their low in the next three months recouping all but about 2% of their total decline from the September high. It’s ok if you can’t raise your hand for this, because if you’re like most of us you also didn’t expect prices to decline as much and as fast as they did last year.

Markets and expectations can turn the corner rapidly with no warning leaving the unprepared investor unsure of what to do next. (Just look at the chart below of the last two quarters). And it’s nearly impossible to pinpoint the reason for changing market dynamics because markets are always incorporating countless competing assumptions and expectations into share prices.

This is one of the many inherent problems with short-term market expectations – it becomes all too easy to extrapolate the present into the near future as we deem that which we’ve most recently experienced to be the most likely outcome going forward. Add in a constant flow of headlines from financial and popular media that only serve to reinforce or exaggerate the sentiment du jour, and it becomes easy to think that either stocks are going to the moon or the sky is falling at any given time. And, of course, there is nothing but shock when stocks don’t go to the moon and the sky yet again does not fall.

But here’s the good news. If we plan for the occurrence of periodic stock price declines and build portfolios that reflect that, we can take the declines in stride when they do happen. And we can tune out the headlines that are constantly berating us to do something because some expert changed their expectations.

That might sound great, but I haven’t even got to the really good news yet. If we don’t need to spend time wondering when stock prices might turn the corner or if more decline is coming during times like last December, we have more time and energy to be present with our friends and families around the holidays or spending our time doing what we love. That’s the really great part about doing the planning ahead of time!

Not only can the planning help us be present with those who matter most to us, it also helps us stay invested when the market is offering returns.

The Secret is out…

There is a not so well kept but often forgotten secret about the stock market that I’m going to share with you. It is usually ready to offer us returns and the only thing we as investors need to do to accept the market’s offer is show up and invest. The only catch is that it doesn’t tell us when we need to be there. We could try to guess when to invest, but it only offers returns randomly about 54% of any given day so we might miss a lot of offered returns.

Our odds of collecting the returns offered increase if we can be there for a year because it offers returns about 75% of any given year, but that still opens us up for missing some returns if we’re not on schedule. If we can stay invested with the market for ten years our odds of being available for return hand-outs goes up to 95%, and after 20 years it goes up to 100%. Now we’re getting somewhere!

So all we need to do is spend time with the market for ten years and we have a 95% chance of collecting the returns the market offers. Seems pretty simple, right? Not necessarily. A lot can happen in ten years that can shake our confidence that it’s still able to give out returns. Not to mention all that can happen in our lives over the span of ten or twenty years that might make us wonder if stocks are still the best thing for us. Planning ahead of time for those periods when the market isn’t offering returns or when our lives are changing is what allows us to spend all the time needed with stocks to collect the returns offered.

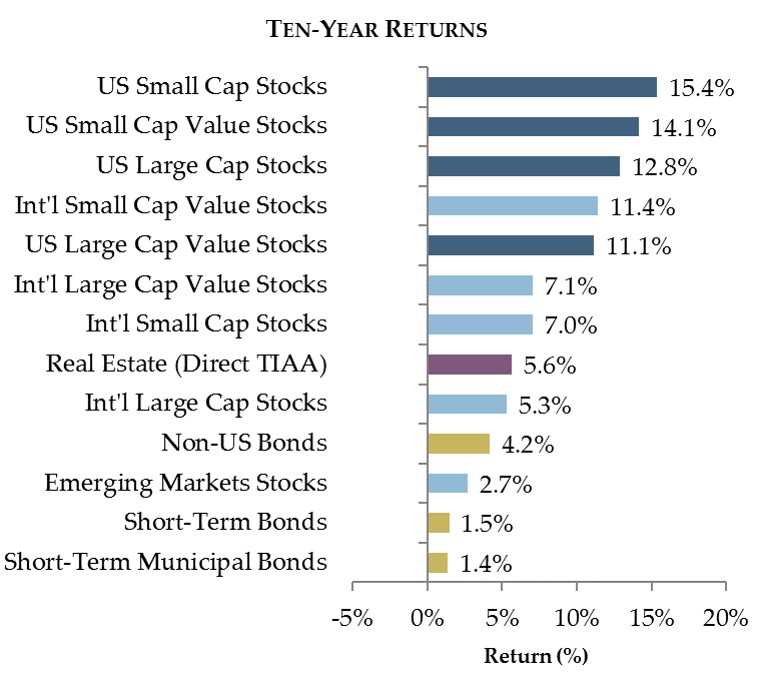

This is a good place for us to mark the 10th anniversary of the bottom of stock prices during the financial crisis. Maybe some of you remember that experience, but for some it may have been before your investing years. To return to the topic of expectations for markets, back in March of 2009 expectations for stocks were often extrapolated to zero. Even then, there came a time that prices became so cheap that they warranted the expected risk and before anyone realized it, prices started recovering.

As the market resumed giving out returns, many investors quit showing up to invest and many who did worried that the next time the sky was expected to fall, it might actually happen and decided to spend a little less time with the market. But the market gave out returns over the last ten years that were more than enough to make up for those that were taken back during 2008 and 2009. All we had to do was be present with the market the whole time and patiently collect the returns offered.

To be sure, there were some trying times when returns weren’t being offered during the last ten years. This is again where doing the planning ahead of time becomes important. Because we never know and can’t control when the market will be giving out returns or how much it might be giving out, understanding the needs of our portfolios allows us to be present whenever the market does offer returns – often they come when least expected. This is as true in 2019 as it was in 2009 or 1999.

In the ten years beginning from the lowest expectations for stocks in generations, US Large Cap stocks have given us returns of nearly 13% per year and US Small Cap stocks over 15% per year. It was hard to expect those kinds of returns given the expectations of March 2009. Below is an illustration of the returns over the last 10 years.

What the NCAA Basketball Tournament has in common with investing

The NCAA basketball tournament seeding is similar to a market index in investing and when selecting what team might win we can choose the higher seeded team or attempt to pick for the upset win either from our own analysis or an expert’s prediction. In investing, we can buy the index fund or we can attempt to pick an investment that might outperform the market. We know how that tends to work out in investing.

I wanted to see how that might play out when filling out my bracket for our PrairieView tournament challenge because my knowledge of basketball starts and ends with the difference between a two and a three point shot. So, I selected the favorite in every game only deviating to let a little home bias prevail in my selection of both Michigan and Michigan State making the Final Four (I spent over 10 years living in Michigan).

At the conclusion of the tournament, my index fund bracket took fourth place among my 13 office competitors. A few of our team members who professed to know a little about the teams and match-ups and tried to pick a few upsets finished no better than eighth place. One of our team members didn’t complete a tournament bracket and will end with zero points.

So, as with investing, expert predictions often don’t pan out, a few lucky ones may randomly out-perform, and we need to at least show up to earn points.

Thank you again for allowing us to serve you and please let us know if you have any questions or comments. We always look forward to hearing from you.

Best wishes,

PrairieView Partners

Source: YCharts. Indices: S&P 500, Russell 1000 Value, CRSP US Small Cap, CRSP US Small Cap Value, MSCI World Ex USA, MSCI ACWI Value, MSCI ACWI Small Cap Value, MSCI Small Cap World Ex USA, MSCI Emerging Markets, Barclays US Government/Credit 1-5 Year, Barclays Global Agg Ex-US Hedged, Barclays Municipal Bond 1-5 Year, TIAA Real Estate Account. All index returns presented as total return inclusive of dividends.

Matt Weier, CFA, CFP®

Partner

Director of Investments

Chartered Financial Analyst

Certified Financial Planner®