- July 8, 2025

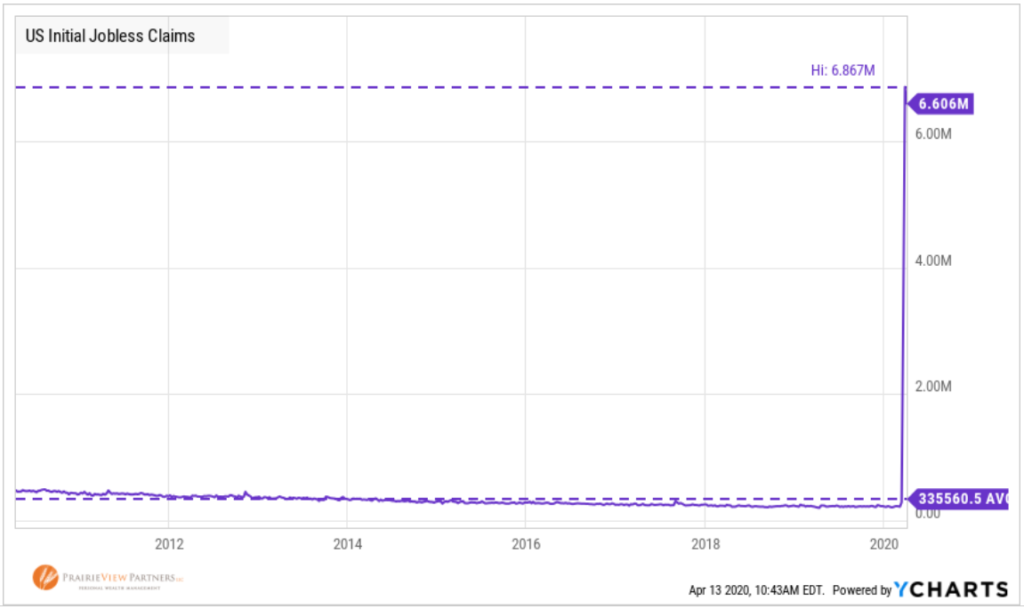

The last six weeks have seen the economy, markets, and more importantly, our lives, change dramatically with little notice. Uncertainty about the near future has reached historic levels. We’ve seen this before when it comes to the economy and markets. However, this time our health and wellbeing are uncertain as well.

Our wellbeing isn’t something we’re accustomed to worrying about on the scale we’ve experienced recently. The addition of this new variable has caused an even deeper search and desire for information – not only about how the economy and markets might respond, but also how the health concern will impact our daily lives.

Correlation between uncertainty and “expert” opinions

“Desire for economic forecasts surges right when our ability to accurately forecast plunges.” This is an apt description posted this week by one of my favorite economic bloggers, Morgan Housel of the Venture Capital firm Collaborative Fund.

The forecasts – from both medical and economic professionals – since we first heard about the new coronavirus early this year have spanned the spectrum from benign to dire. The degree of uncertainty has made it nearly impossible to reliably predict anything about the future. Even if the future was the next day! Yet, “experts” seemed abundant, and we couldn’t get enough of them.

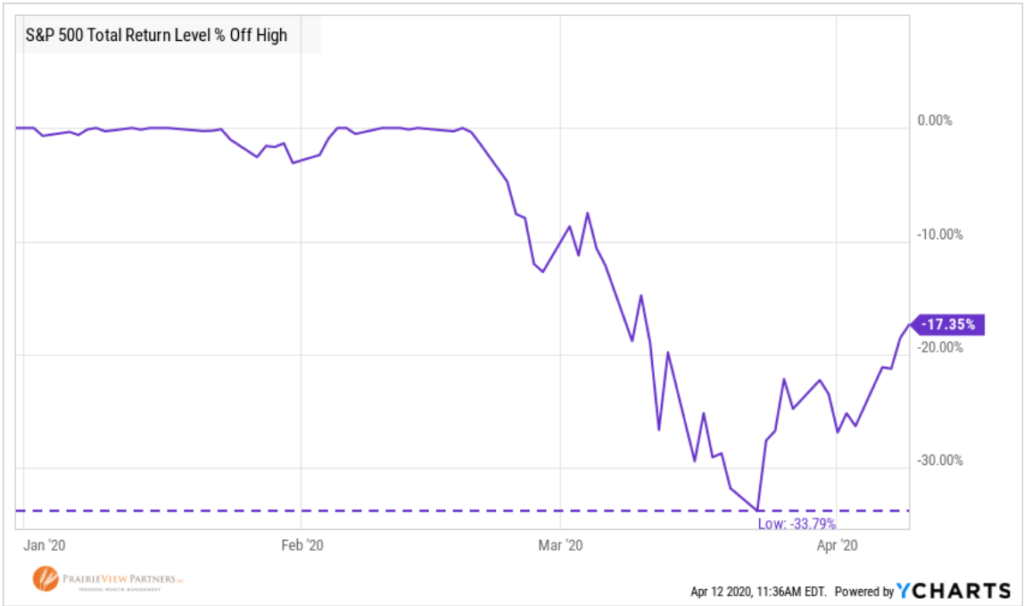

All of these extreme potential outcomes led to the historic volatility we saw during that period. As I pointed out in a recent post, just like we as individuals are searching for and processing information, markets have been processing information over the last several weeks. This started with markets processing how badly things might become. At least in the short-term, this caused stocks to reach their low point on March 23rd with the S&P 500 closing 34% below its February 19th peak.

Since then, focus has shifted to how the economy might look when we get to the other side of this, even as bad news remains prevalent. The simple shift in Mr. Market’s* focus led the S&P 500 to rise 15% from its closing low on March 23rd over the following six(!) trading days. This closed the quarter off 24% from peak and down 20% for the quarter. At the time of this writing, the index is down 13% for the year to date and 17% off its peak. Not great, but certainly better than 34% below peak!

Does this mean the coast is clear and it’s going to be smooth sailing from this point on? Not by a long shot. But we do have some facts that we can work from to help us make a little more sense of the world.

The Facts

Here’s a look at some recent and longer-term market and economic statistics.

Of course, these facts are backward looking as facts can only be – any future outcome is inherently unknown because, well, it’s in the future. We won’t know if March 23rd was the bottom until new highs are achieved, which could be some time from now. Inference from past significant draw downs tells us that, more likely than not, we will at least get close to that level again before the next persistent increase takes hold. But March 23rd very well could have been the bottom.

Even though stock prices have rebounded significantly from their lows, and it’s unknown whether or not those lows will be retested, there is one thing we can say with near certainty. Stock prices are cheaper today than they were two months ago. And cheaper stock prices – particularly those types that have become and remain even cheaper – lead to higher future returns. See “The Facts” above for references to Small Cap, Value and International stocks.

A Note on Diversification

I am going to allow myself one prediction during this bear market. There will again be much financial press and “research” proclaiming that diversification doesn’t work in a bear market and during bear markets “all correlations go to 1.” This outcome is rather simple to observe on the surface when we see that categories of stocks such as Small Caps, Value Stocks and International stocks were all beaten down, and remain down, more than the S&P 500 so far in 2020.

Yet, this observation misses the point. To varying degrees, all stocks’ values are based on the future expected earnings of the companies they represent. When a global recession causes those future earnings to become more uncertain, nearly all companies are negatively impacted in some way regardless of whether they are a large company, small company, US or non-US domiciled.

Over the long-term – through multiple bull and bear market cycles – different companies, industries, countries, etc. will experience different rates and changes of earnings growth. They’ll also experience differences in how the market values those earnings. These changes are inherently unpredictable. Diversification removes the need to predict which stocks or categories of stocks will benefit most or least over time as market dynamics and cycles change.

Enter Asset Allocation

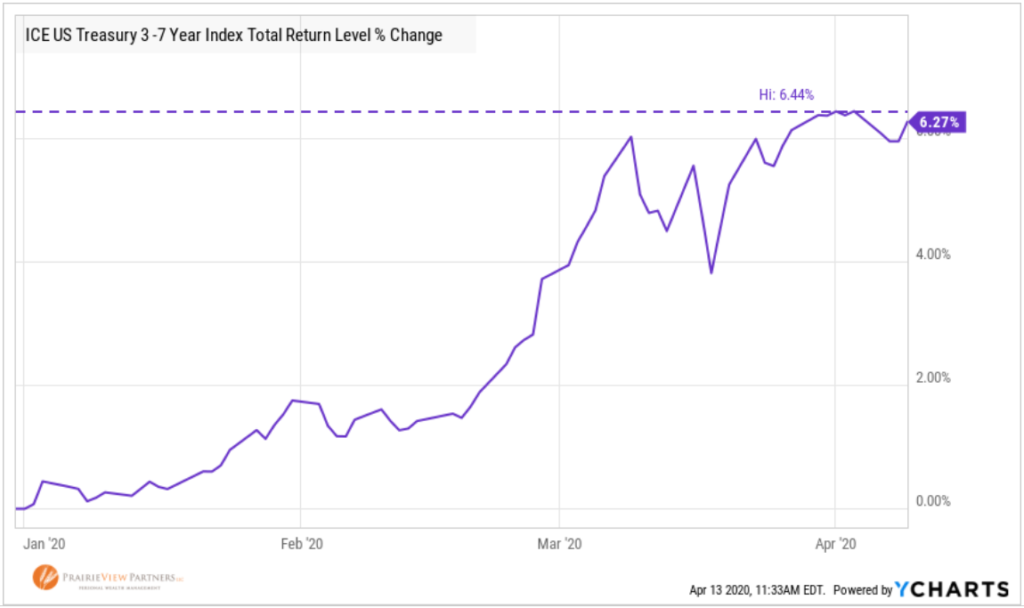

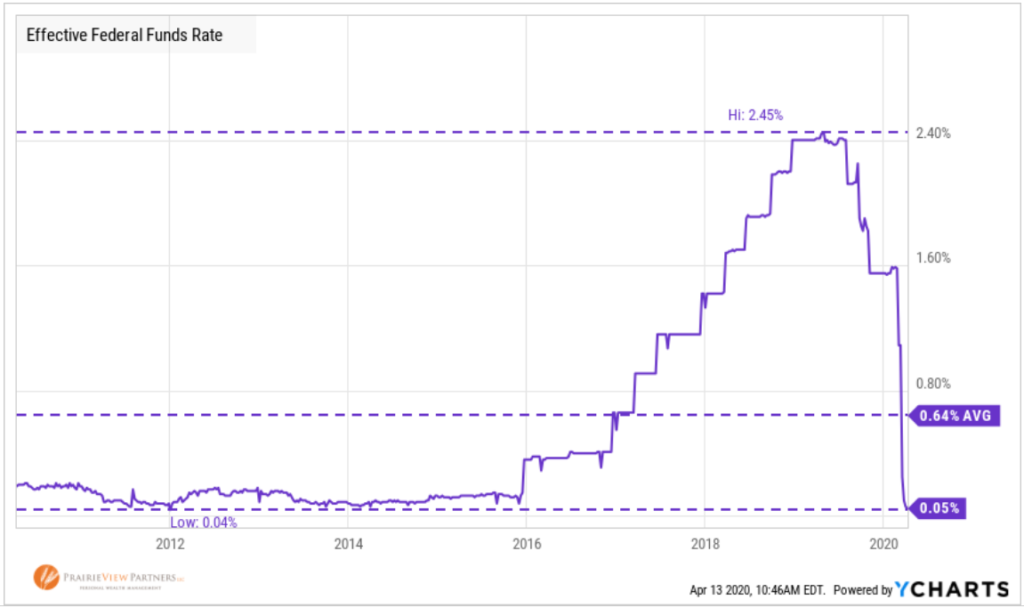

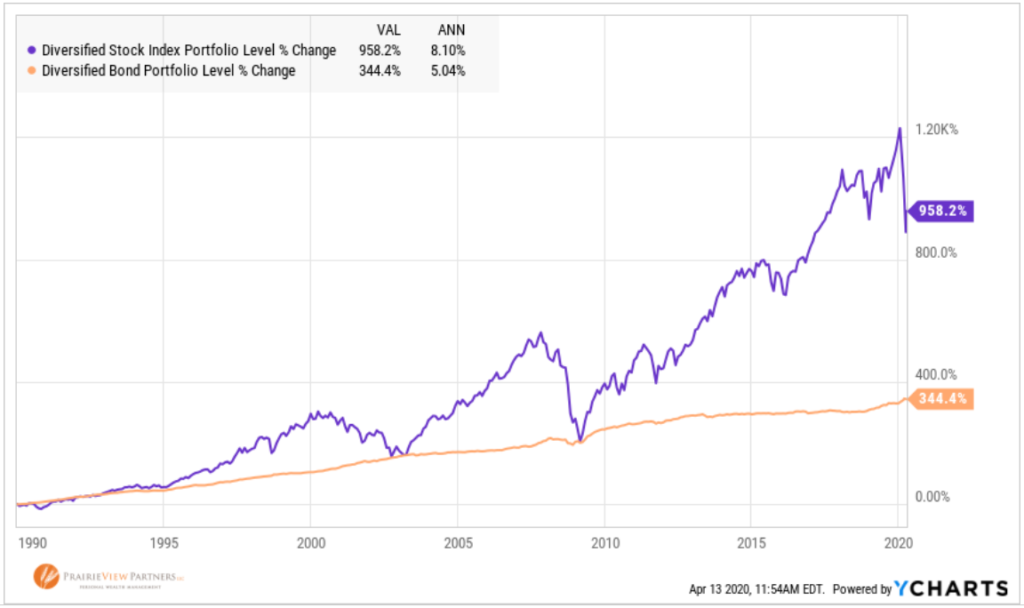

One of the key differences I make a point of distinguishing between is asset allocation and diversification. The former represents investments across broad categories, i.e. stocks and bonds. Asset allocation is where we achieve a mix of assets that will behave differently at different points in a cycle. The latter essentially represents investing within a broad investment category, i.e. types of stocks, as described above.

This difference is most important during points in a cycle such as we are experiencing now. As we see noted above in “The Facts”, high quality bonds have performed admirably in recent months during a time when all types of stocks have declined. It’s this difference in performance that ensures there is a source of funds in a portfolio that can be used to facilitate withdrawals during stock declines. A difference that provides a source of funds that can be used as additional capital to purchase more shares of stocks at lower prices through rebalancing. A difference that ensures we’re able to hold enough stocks to benefit from their long-term growth.

It may even be helpful to view a portfolio as two portfolios – one of stocks and one of bonds. Each represents a different tool with its own part of the job to do. How much of each tool we own, of course, comes down to preparation for the job.

We Can’t Predict but We Can Prepare

I started working with a coach last year to help guide me through my mid-life discovery of mountain bike racing. We spoke this March to discuss goals and develop a training plan for the upcoming season, just around the time that sporting events were beginning to be cancelled. We decided that while we can’t know or control what the impact of the coronavirus will be on my races, we can control how ready I will be for when they do happen and prepare accordingly.

He also made a point to remind me that my motivation is likely to ebb and flow more than normal without some of the early competitions or ability to ride with friends. While stressing that the training plan is intended to keep me focused on the goals, we can make minor changes along the way to take advantage of high motivation times and not push too hard if the motivation drops.

Of all the potential causes of a recession and bear market, a global viral pandemic has to be among the most random and unpredictable. Maybe it could have been foreseen that once it reached a certain level, the stock price declines we’ve seen would have been a foregone conclusion. But, the abrupt turn around? Not only is predicting an event difficult, predicting the market’s response is even more difficult. And the combination of the two make prediction an effectively impossible investment strategy.

Ensuring the appropriate levels and types of diversification and asset allocation align with goals is part of the preparation process. This needs to take place before an unpredictable event occurs to help prepare us for all the unknowns in the future.

Asset allocation helps prepare us for the unknown of how long stocks will remain at depressed levels or how low they might fall in the interim. On the other side of the recovery, asset allocation ensures we can take advantage of stocks’ growth.

Diversification helps prepare us for the unknown of what the recovery and next wave of growth might look like in terms of what companies, countries, or types of stocks may benefit most from the next bull market.

The record of stocks posting positive returns in the ensuing 1, 3, or 5 years following a bear market is nothing short of impressive. But, there will be times along the path to recovery and growth when it’s harder to remain optimistic. This is when we earn what is referred to as the “Risk Premium” from stocks. The “Risk Premium” is the higher long-term returns offered as a premium over less risky assets in exchange for investing during hard times. Whether the recovery and next wave of growth takes one year or five years is ok. As we mentioned in You are Prepared for This, we have planned for events like this before they happen.

Closing Thoughts

Much has been said about when a bull or bear market begins and ends. The S&P 500 recently recovered 20% from its March 23rd low and some market commentators actually said a new bull market had begun. That seems almost laughable in the current economic environment.

We also have what are referred to as “secular” and “cyclical” bull and bear markets. A “secular bull market” is marked by persisting economic growth, improving employment and rising earnings over many years. The classic time period used to illustrate this is 1982 through 2000. Even in a secular bull market we can experience a “cyclical bear market” represented by a 20% or more drop in stock prices that isn’t accompanied by a disruption in the secular trend. Think of the Crash of 1987, Asian Flu of 1997 and the 1998 collapse of the hedge fund, Long Term Capital Management, as representing cyclical bear markets within that secular bull market.

Note, however, that there is no definitive time frame included in the persistent economic growth, improving employment and rising earnings, other than for “many years.” With this it could be said that we have been in a secular bull market since the 1792 signing of the Buttonwood Agreement that created the first official stock exchange and everything since has been cyclical in nature.

Preparation, asset allocation, and diversification all grounded with facts rather than opinions or forecasts will allow us to have positive investment outcomes now and in the future.

Thanks for reading and be well.

*Mr. Market is Warren Buffett’s fictional personification of the behavior of market.

Matt Weier, CFA, CFP®

Partner

Director of Investments

Chartered Financial Analyst

Certified Financial Planner®