- July 8, 2025

I began last week’s post asking that you reach out with any questions or if you want to talk, because conversations are what get us through difficult times. We’ve spoken with many of you since then and I speak for the entire team when I say that we have thoroughly enjoyed our conversations.

If you haven’t had a chance to be in touch with your questions as you adjust to your new routine, we’ll be ready to talk whenever you are. In the meantime, we’re going to continue sending out these posts more frequently and reaching out to you if only to check in and say hello.

A brief disclaimer before today’s message

This post will be a little more data-focused and “wonky” than some of my recent posts.

On to today’s message

Last week I made the connection between how the market processes information and how we do the same as humans adapting to a different reality, e.g. working from home (for some of us). But what can we actually expect from markets as they go through this process? This is the first time in modern markets a recession or bear market has been triggered by a global pandemic. Other triggering events have resulted in similar stock market downturns so while we look for patterns to shape our expectations, we also must be mindful of false signals.

Let’s get a couple baseline things out of the way to set the stage before going any further. We have officially reached bear market territory in the S&P 500 – this is defined as a 20% decline from a recent peak. All bear market declines in modern markets have averaged a 34% decline. At the time of this writing, the recent low point was down 34% from peak on Monday, March 23rd. Also, while it hasn’t been officially announced (and probably won’t be for a while, but more on that later) we can be fairly certain our country’s, and the world’s, economy is currently experiencing a recession.

With those out of the way, we can start to think about what the experience might be going forward based on historical evidence. Of course, these are not predictions, but merely facts that can help us think more clearly about the future.

Bear Markets and Stock Price Volatility

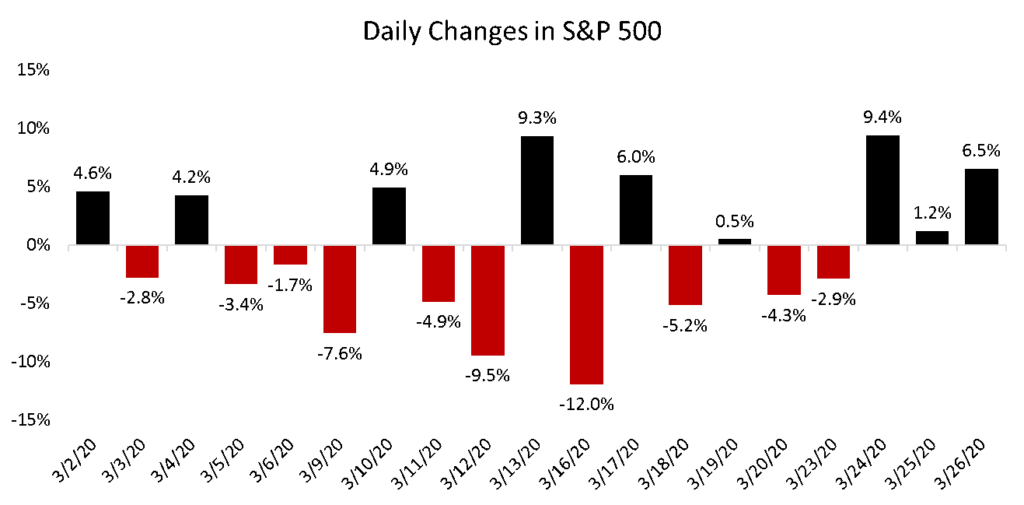

As mentioned last week, what has been so remarkable about the onset of this bear market is the speed at which it has transpired. The S&P 500 crossed the 20% decline threshold in only 16 trading days and reached a 30% decline only three trading days later. All the while, the index experienced two of its six worst single day performances in its history. It’s worth noting, the S&P 500 also experienced some of its best single days in its history during this period, highlighted by a nearly 10% increase on Tuesday, March 24th, the day after its recent low point. Two days after that, the S&P 500 is now sitting at only about 20% below peak.

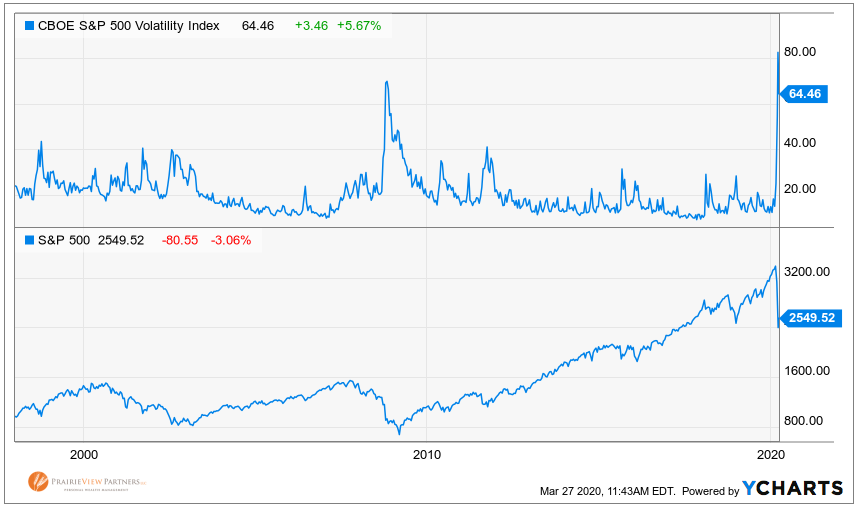

None of this means stocks have bottomed only to rally from here. From past experience, volatility tends to work in both directions and in clusters around times of heightened uncertainty in markets. This volatility is measured by an index called the Volatility Index – sometimes referred to as the market’s “Fear Gauge” or simply its ticker “VIX.” The index tends to peak when uncertainty is most heightened. This was the case in 1998, around 9/11, the summer of 2002 (the bottom of the dot com crash), the fall of 2008, December 2018, and now in March 2020.

This volatility is the manifestation of how markets process information. In fact, the “VIX” reached an all-time peak last week. Higher than October 2008! One possible conclusion to be drawn from this is that when volatility is at its highest, we sit on the “sidelines” and wait for the volatility to “calm down”. But it’s not that simple as the VIX has peaked months before market bottoms and sometimes even months after.

Again, volatility works in both directions. As it clusters, we tend to see some of the best days in very close proximity to some of the worst days and missing out on some of those best days can potentially be devastating to long-term wealth creation.

Missing the single best day from 1990 through 2018 would have reduced total wealth creation by approximately 10% and missing the five best days would have reduced total wealth creation by nearly a third. The last week has provided an example of this – after stocks closed 34% below their peak, two of the following three days were two of the best return days in the last 90 years. We probably won’t know if Monday marked the low point of this bear market for a month yet, but if it was, missing the following three days could have curtailed a portfolio’s ability to recover.

Despite the evidence of the benefits of remaining invested in, or even buying more, stocks during bear markets and heightened volatility, the fact remains that it is the hardest time emotionally to do so. But as we search for commonalities across the many bear markets we have faced, there is one that is consistent and undisputed. They all come to an end.

Yes, we are in a recession, unofficially

The national scorekeeper of official recessions in the US is the National Bureau of Economic Research, or NBER. Their official definition of a recession is two consecutive quarters of negative GDP growth. It’s tough to say yet whether economic contraction in March 2020 is going to be enough to offset the strength from January and February and result in negative growth in the first quarter but let’s assume for a moment that it is. That means that if the NBER needs to wait for two negative quarters to proclaim a recession, they will need to wait at least for the second quarter’s data, which would normally be scheduled for release around the end of July.

While it might seem helpful to learn of an official recession, by the time that announcement happens, or shortly after, the damage is usually already being repaired and often, stocks have already started rising. Why is this? Official data is backward-looking and stock prices are forward-looking. In last week’s post, I mentioned that while new developments might continue to be negative, they can help to narrow the range of potential outcomes. By the time a recession is officially announced later this summer, the market will have been processing information the entire time.

This is how today, a day in which a record number of jobless claims were announced, stocks are enjoying their third straight day of price increases and sitting more than 15% higher than Monday’s near-term low. The range of potential outcomes just narrowed a little, and markets like that. Of course, that isn’t to say we have the all clear signal, but it’s progress, nonetheless, and that’s what markets like more than anything else. Initial price recoveries, which tend to be swift and significant are usually missed if waiting for the all clear signal before buying.

What to expect

If the best course of action is to remain invested through the duration of a bear market and recession, the likely questions might be how long we need to endure it and what do we need to think about along the way. I use the term endure, because as certain as the bear market will end, it will also become harder to remain positive and optimistic before it gets easier. Also, many of us may feel like we missed an opportunity if we didn’t “catch the bottom” when buying.

Since WWII, often defined as the modern era of markets, it has taken stocks an average of 26 months to get back to breakeven after bottoming. The longest was four years following the bursting of the tech bubble, and in the aftermath of the financial crisis it was a little over three years. In every single bear market, stock returns have been higher 1 year, 3 years, and 5 years following the low point with returns in those periods averaging, 52%, 88%, and 132%, respectively.

In the same period, the durations of recessions have ranged from six to 18 months. But, remember, even though we might be only in month one of a recession now, stocks start to rise again when they can see the end of a recession, not after its already ended.

Recessions also tend to bring about various forms of a term called creative destruction, meaning the companies, industries, or sectors that may have been top performers in one bull market are unlikely to be the best in the next bull market. Take the technology sector. It led the way in the 1990’s, lagged in the 2002- 2007 bull market and led again in the recently ended bull market.

The energy sector led during 2002-2007, was one of the worst performers in the recently ended bull market and has suffered the worst decline so far in our current bear market. During the bull market of 2002-2007, the financial sector underperformed the broader S&P 500 and was also hit hardest during the financial crisis. As hard as it would have been to buy financial stocks in 2009, they were one of the better performers of the recent bull market. Unfortunately, as with catching bottoms and watching volatility, there is no clear path forward in choosing sectors.

What to do

Just as a bear market or recession is not a great time to abandon one’s investment plan, it’s also not necessarily the best time to double down on it by overreaching on your stock allocation or trying to time a bottom or a recovery. Here is the time-tested recipe for success, whether in a bull market or a bear market:

- Continue investing by adding to your retirement plans and brokerage accounts

- Rebalance your portfolio (we’re working on this one for you)

- Reinvest dividends (we’re working on this one, too)

- Consider adding more cash to your portfolio to buy stocks ONLY if it is truly cash you don’t intend to need for the next three to five years

- Adjust your plan only when your circumstances call for a change and not in response to market volatility

Lastly, keep in mind that even in the most difficult times, stock investors have been rewarded.

Thanks for reading and be well.

Matt

Matt Weier, CFA, CFP®

Partner

Director of Investments

Chartered Financial Analyst

Certified Financial Planner®