- November 20, 2024

On financial and other media outlets, you typically find talk of the next impending doomsday. Recently, the Armageddon is inflation. There is truth to the increase in prices, as anyone who has been to the supermarket or purchased a car lately can attest. At the same time, wages have increased an annualized 4.6% (private sector) as of September and Social Security’s 2021 5.9% Cost of Living Adjustment is the largest increase since 1982!

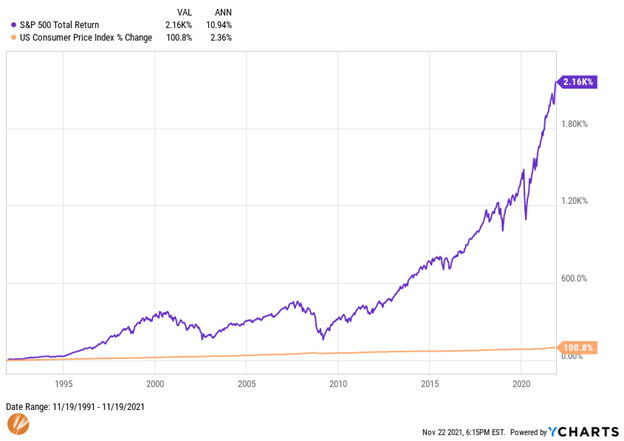

Over the last 30 years, the S&P 500 Total Return has averaged 10.94%/yr. During this time, US Inflation averaged 2.36%/yr (See chart at end). While a diversified stock portfolio offers the best opportunity for long-term, above-inflation returns, there are other instruments that keep up with inflation. This blog post will explore one such vehicle known as Series I Savings Bonds (or I Bonds).

What Are I Bonds?

In a nutshell, they are essentially risk-free bonds issued by the US government with an interest rate that adjusts with inflation.

Timeline

- Term of 30 years.

- <1 Year - You cannot sell—in this respect, it is not a good emergency fund.

- < 5 Years - Selling will forfeit the last 3 months of interest. For example, if you sell after 2 years (24 months), you will only receive 21 months of interest.

- Year 5-30 - Can sell without penalty.

- Year 30+ - No longer earns interest.

Interest Rate

The Composite Rate (or total interest rate) is made up of two components: fixed rate and inflation rate. The fixed rate is set at the time of issue and remains the same throughout the bond’s life. The inflation rate is tied to the Consumer Price Index for all Urban Consumers (CPI-U) including food and energy. If inflation goes up, the interest rate goes up. If inflation goes down, the interest rate goes down. The Composite Rate cannot go below zero, even if there is deflation.

On the first business day of November and May (typically November 1st and May 1st), the Inflation Rate is recalculated based on the CPI-U. This will be the interest rate you receive for the following 6 months.

Example:

From November 2021 to April 2022, the fixed rate is 0% and the inflation rate is 3.56%.

Composite Rate Formula: Fixed Rate + (2 x Inflation Rate) + (Fixed Rate x Inflation Rate)

November 2021-April 2022 Composite Rate: 0% + (2 x 3.56%) + (0% x 3.56%)

November 2021-April 2022 Composite Rate: = 7.12%

In other words, if you purchase a $1,000 I Bond between now and May 1, 2022, you will earn $35.60 over the next 6-months (7.12% annualized rate over 1/2 year). After, your rate will adjust to the new composite rate that will be announced May 2, 2022.

It is worth noting that if you purchase before May 1, 2022, the fixed rate is set at 0%. Meaning, the Composite Rate is 100% based on the inflation rate. If the inflation rate decreases to 1%, then the Composite Rate would drop to an annualized 2%.

*See what the current I bond rate is here!

Compounding Interest

Interest compounds semi-annually. For example, on January 1st you purchase the $1,000 I Bond and earn 7.12% annualized rate over 6 months. On July 1st, the $35.60 is added to your $1,000 principal for a total of $1,035.60. Following, interest begins accruing on that larger principal amount.

Purchase Limits

Each year, an individual can purchase up to $10,000 electronically through TreasuryDirect. You can also gift I Bonds with the amount counting against the recipient’s limit, rather than the giver's. For a child under 18, a parent would need to open a TreasuryDirect account that is linked to their own account. Trusts can also purchase up to $10,000. Lastly, by making an overpayment on your federal taxes and completing Form 8888, you can allocate your refund to buy another $5,000 in paper I Bonds.

Example:

Homer and Marge have three children (Bart, Lisa, and Maggie) and a revocable trust. They can buy up to $65,000 of I Bonds annually i.e., $10,000 Homer, $10,000 Marge, $10,000 Bart, $10,000 Lisa, $10,000 Maggie, $10,000 trust, and $5,000 refund.

The minimum purchase is $25 for electronic bonds and $50 for paper. Electronic purchases can be any denomination $25-$10,000. Paper can be in increments of $50, $100, $200, $500, or $1,000.

Taxes

I Bonds are subject to federal taxes but are state and local tax exempt (excluding state estate/inheritance taxes). This can be more beneficial for persons living in high income tax states (e.g., CA, NY, NJ, MN etc.) than those living in low-no income tax states (e.g., TX, FL, SD, etc.). You could pay federal taxes annually or wait until the earlier of 30 years or when you sell the bond and pay taxes all at once. This can be useful if you expect to be in a lower tax bracket in the future. There is potential to not pay any federal taxes if you use the principal and interest for qualified higher education expenses; however, your income has to be below certain thresholds (2022: MAGI $100,800 Single; $158,650 MFJ).

Parting Thoughts

There are benefits to utilizing I Bonds—interest rate in-line with inflation, limited downside of 0% rate, state and local tax exempt, federal income tax-deferral, potential for federal income tax exemption for higher education expenses, etc. There are drawbacks with the 1-year holding requirement, penalty for sale within the first 5-years, potential for reduced returns in a low inflation environment, and likely small purchase limits in comparison to your overall portfolio.

These characteristics make it a tool for keeping up with inflation, growing assets while avoiding taxes during peak earning years, and spending on goals more than 1-year out (e.g., home purchase), even if it means a 3-month interest penalty.

Regardless of inflation’s path, the best long-term solution for increasing purchasing power and achieving your financial goals is a diversified stock portfolio.

Alexander Graham Bell said, “preparation is the key to success.” Despite media’s chorus of negativity, your financial plan and portfolio have prepared you to succeed.