- July 8, 2025

3rd Quarter 2018 Market Summary

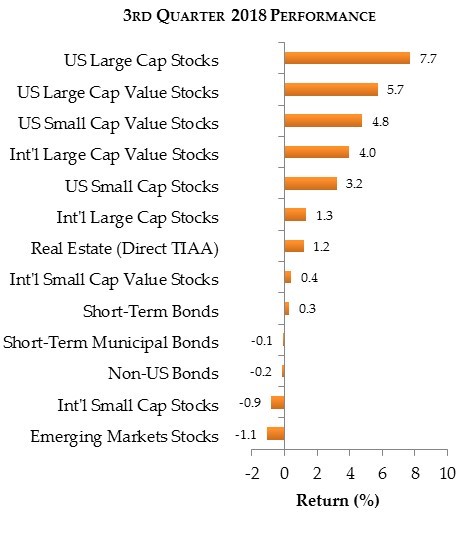

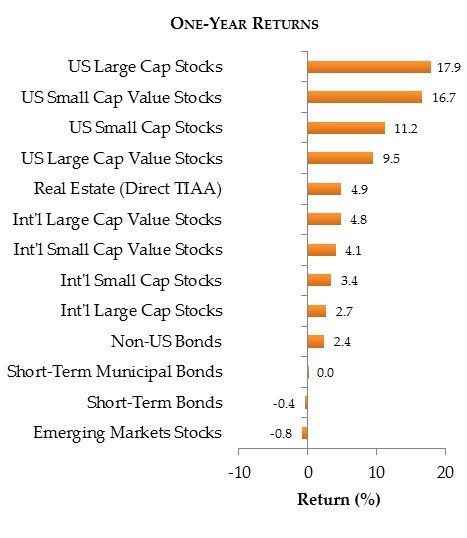

The Third Quarter of 2018 saw US Stocks reach new highs on multiple occasions with the S&P 500 returning 7.7% for the quarter and 18% over the last year. For those of you keeping track at home, you may remember that September 2018 marked the 10th anniversary of a key milestone in the Great Recession. More on that later, but for now it bears noting that the economy and markets are in a much better place than they were ten years ago. That is not to say there is an absence of risk in today’s market – quite the opposite. If there is a consistent theme across all markets over time, it is the presence of risk. At some times risk is more acutely felt than at others and the ways it manifests itself are always changing, which is one of the many reasons prediction remains so difficult. But, for now let’s be thankful for the improvements over the last ten years and keep our focus on the long-term nature of investing!

US Stocks’ strength during the Third Quarter and the last year extend beyond the S&P 500. Small Cap Stocks returned 3% for the quarter and 19% over the last year. Large Cap Value Stocks returned 6% during the quarter and 11% over the last year and Small Cap Value Stocks returned 2% during the quarter and 13% over the last year.

However, not all has been positive on the stock front. International Stocks, following a banner year in 2017, have exhibited weakness most of this year. Rising US interest rates have attracted global investment driving the dollar higher, thus hurting International Stock returns when measured in dollars. Emerging Markets briefly entered Bear Market territory during September, having declined over 20% from their January peak. As counter intuitive as it may seem at the time, investments made in stocks during Bear Markets tend to produce the highest future returns.

Over the last year, the interest rate on the 2-Year Treasury has nearly doubled from 1.45% to 2.8% as the Federal Reserve has continued its path of raising rates in response to the improving economy. Higher interest rates earned on our savings accounts and bond investments have been a welcomed change in recent quarters. That said, it has not been without cost as bond prices decline when interest rates rise. After considering higher rates earned and a decline in prices, short-term bonds returned .3% in the quarter and -0.5% over the last year.

Real Estate measured by the TIAA Real Estate Account continued its steady performance posting a 1% return for the quarter and a 5% return over the last year.

Ten Years to 200%

September 2018 certainly felt a lot different from September 2008! To take a walk down Memory Lane, September 15th, 2008 marked a crucial turning point in what is known as the Great Recession. It was the day Lehman Brothers, a Wall Street bank with a storied history, entered bankruptcy and set in motion a cascading effect of other large financial institutions being acquired, rescued, or a combination of both. It seemed to many of us that the economy and financial markets as we knew them were grinding to a halt.

Ten years later with the broad economy and stock indices performing well by most measures, it is important to take a moment to reflect on what was one of the most influential times in many of our investing lives. Maybe you can remember what it was like investing then. If you can’t, or if you weren’t investing then, it can be summed up by saying that two key ingredients were required: discipline regarding one’s investing plan and a strong sense of optimism about the fundamental relationship between risk and future reward.

Those ingredients bear further investigation given what happened in the ensuing months and how far we have come since. The day before Lehman Brothers failed, the S&P 500 was already in Bear Market territory, having declined 20% from its October 2007 peak. On top of that, stocks whipsawed daily on the news of this bank or that bank was on the brink of failure. Whether your investment plan called for adding more money to stocks or holding on to the ones you already owned, both required a fair amount of discipline and optimism. This was especially true when your discipline was “rewarded” over the next six months with another 46% decline before finally turning the corner.

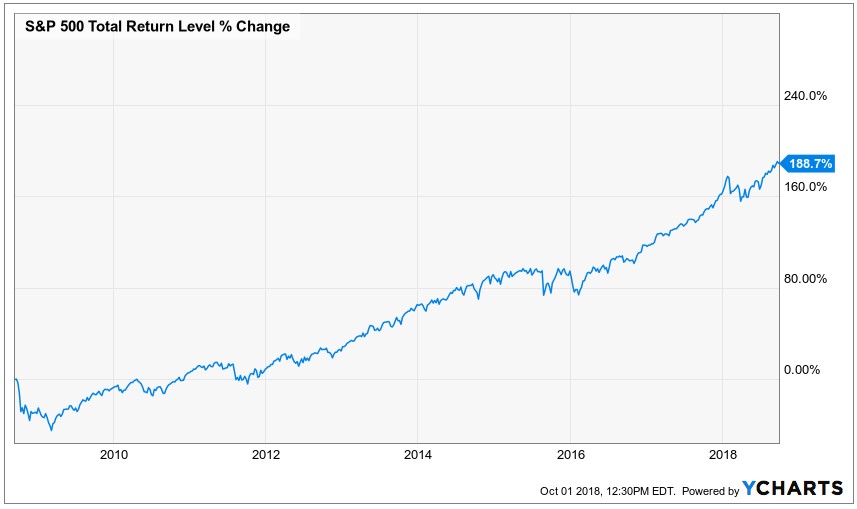

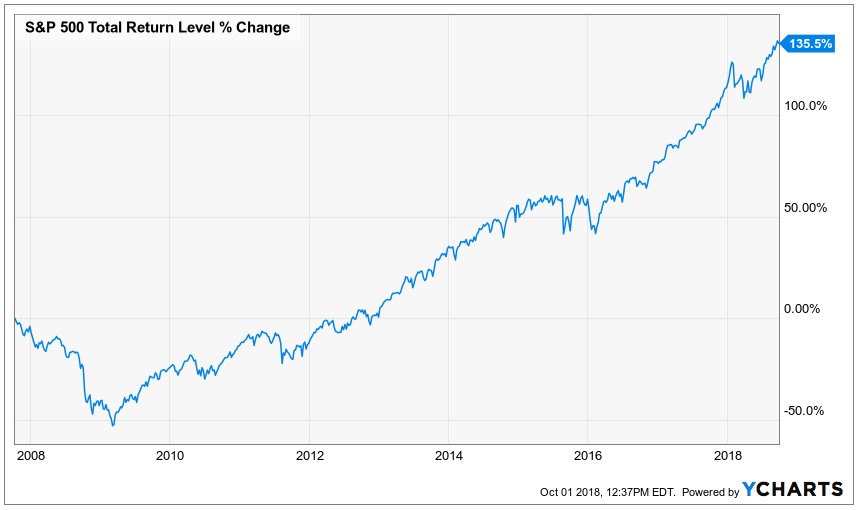

To have been that disciplined, no matter how worried you may have been about the future of stocks during those six months, required at least some optimism that your risk was going to turn into a return on your investment. Today, ten years later, an investment in the S&P 500 the day before Lehman Brothers failed has produced a total return including dividends of nearly 200%. Even if you bought the S&P 500 at its October 2007 peak and endured the entire decline of the Great Recession, you would have a nearly 140% gain 11 years later!

Since September 14th, 2008

Since October 9th, 2007

For those of you able to commit more investment dollars to stocks at the time, it turned out to be a generational opportunity. But what if you didn’t have the good fortune to be adding to your investments when stocks were on a generational sale, but rather needed to use your portfolio to live on? In this case, it was crucial to have had an investment plan that ensured that you had not overextended your risk to help avoid the need to sell stocks and turn a decline into a loss.

Because even though the returns look great now, it took until April 2013 before the S&P 500 broke through its 2007 Peak. That was five and a half years! Oh, and by the way, there was a brief Bear Market to test our resolve along the way in 2011. You may have forgotten about that one by now. If you kept the long-term in mind, and maybe even reinvested some dividends, which diligently grew at double the rate of inflation, along the way, the rewards have been worth the wait and the bumps in the road!

So, what have we learned on our little trip down Memory Lane?

As with many of the anniversaries we celebrate in life, this one might provide an opportunity for thoughtful reflection. While your lessons are unique to you, here are some things to help you get started:

Investing takes time.

It always presents risk.

The future is always uncertain.

Return follows risk.

We never know how long we might have to wait for return.

Predictions aren’t worth the paper they’re printed on.

Your goals matter more than the return of the S&P 500, the 10-year Treasury rate, or any other index.

Your plan helps keep risk, return, and time in harmonious balance.

If you happened to hear that Eliud Kipchoge of Kenya broke the Marathon World Record last month in Berlin with a time of 2:01.39, this was a major milestone in the running world’s quest to break the 2-hour marathon.

Most of us will never be able to (or want to) run a marathon that fast (or at all). But, we can look to champions like him for morsels of wisdom that we can apply to other parts of our lives. He was recently quoted saying, “Only the disciplined ones in life are free. If you are undisciplined, you are a slave to your mood and emotions.”

“Only the disciplined ones in life are free. If you are undisciplined, you are a slave to your mood and emotions.”

Investing is inherently a behavioral endeavor where our mood and emotions can influence other aspects of our lives. The discipline and perspective provided by a financial and investment plan focused on our goals and a long-term view can give us the freedom to enjoy the other aspects of our lives that we value.

Thank you again for allowing us to serve you and please let us know if you have any questions or comments. We always look forward to hearing from you.

Best wishes,

The Partners of PrairieView

Source: YCharts. Indices: S&P 500, Russell 1000 Value, CRSP US Small Cap, CRSP US Small Cap Value, MSCI World Ex USA, MSCI ACWI Value, MSCI ACWI Small Cap Value, MSCI Small Cap World Ex USA, MSCI Emerging Markets, Barclays US Government/Credit 1-5 Year, Barclays Global Agg Ex-US Hedged, Barclays Municipal Bond 1-5 Year, TIAA Real Estate Account. All index returns presented as total return inclusive of dividends.

Matt Weier, CFA, CFP®

Partner

Director of Investments

Chartered Financial Analyst

Certified Financial Planner®