- July 8, 2025

Inflation is falling. The job market is growing. GDP growth is exceeding expectations. We’re actually earning interest on our cash and bonds. And corporate earnings growth is expected to accelerate this year.

Despite all this, the question that seems to put the markets on pins and needles more than anything these days is… When is the Fed going to make their first quarter point interest rate cut? Not 2%, or even half a percent, but a quarter percent.

Thankfully, the Fed’s next interest rate move has little impact on successful long-term investment outcomes.

As with most worthwhile pursuits, investment success is the result of many inputs in a sound process. To reflect on this idea, let’s start with a few important insights left by two recently departed titans of the financial world.

The first titan, whom you may not be familiar with, but who left a large impact, is Daniel Kahneman. The second, whom you may be more familiar with, is Charlie Munger.

If you either weren’t aware of stocks’ new all-time highs or merely took them in stride without a second thought – particularly when compared with how you may have felt a year and a half ago when stocks were down 25% - you may be somewhat familiar with Kahneman’s work without realizing it. (In the category of “sometimes its better to be lucky than good” I posted this on what happened to be the day of the bear market low)

Kahneman was a psychologist by training who came to be known as the Grandfather of Behavioral Finance. Prior to his work, it was widely accepted that economic and financial decisions were made with perfect information and decision makers acted perfectly rationally. His work brought to light that in the real world, outside of economic models, people’s biases influence the information used in economic and financial decision making. In other words, our emotions and behavior often play a larger role than rationality.

Specifically, he found that we feel the pain of losses two times greater than we feel the joy of gains. As Jason Zweig recently recounted in the Wall Street Journal, Kahneman would ask conference attendees: “If you lose $100 on a coin toss if it came up tails, how much would you have to win on heads before you’d take the bet?” Most respondents said $200 or more. This is the concept of why we may not feel as strongly about new all-time highs in stocks compared to their 25% decline from 2022.

Munger, perhaps known more for his folksy wisdom than scientific rigor, was the longtime Vice Chairman of Berkshire Hathaway and often less in the spotlight than the more famous Chairman, Warren Buffett. Munger has been credited with saying that the first rule of successful investing is to not unnecessarily interrupt compounding. He is also credited with the phrase that the secret to a happy life is having low expectations.

Keep the lessons from these two titans in mind for the next story.

I recently heard an interview with Lance Armstrong where he recounted his seven Tour de France wins1. He may have been an early adopter of Kahneman’s asymmetry between the feelings from loss and gain and Munger’s view on expectations and compounding gains.

Knowing that he disliked losing the race more than he enjoyed winning it, he said he came to love the process of preparing to win the Tour de France more than he actually enjoyed winning it. This was because he knew he could control everything about the process whereas much of what happened during the race was out of his control. He knew that regardless of the outcome, at the end of the race he could look forward to his favorite part – preparing to win next year.

While he was preparing, he knew he was gradually compounding race form through his season, building on his momentum or, never unnecessarily halting his momentum. Tightly controlling his process2 that was focused on his goal, he could minimize noise and other distractions (i.e., what the fed may do at its next meeting) that were not in service of the goal.

Interestingly he also noted that he thought many of his competitors placed too much emphasis on or gained too much of their self-worth from the victory itself only to be let down by the fleeting joy of the win, having set their expectations too high.

Let’s bring Lance Armstrong’s mentality back to Kahneman’s and Munger’s observations when it comes to successful investing.

The pain of loss is felt 2x that of the joy of gains

Knowing we feel the pain of loss greater than the joy of gains can help us focus on the long-term process of investing. Rather than getting overly enthusiastic about high flying investments, or giving into the despair when those investments inevitably decline, we can focus on holding diversified investments. Even when some are underperforming, having a diversified portfolio sets us up for when the underperformers have their day in the sun.

Investing with a plan and having the right amount of risk based on that plan can help reduce the difference between gains and losses (even if the losses are only temporary).

Avoid unnecessary interruptions of investment compounding

Despite setbacks from race losses or poor training days along the way, Lance Armstrong didn’t ease back when it came to investing in his process. Those losses provided the foundation for immeasurable gains. Similarly, we can hold sufficient low risk assets – cash, bonds – to draw from during stock declines. This helps us avoid halting our compounding by selling stocks when they are down.

We can also plan with the assumption that bear markets and other declines are going to happen over the decades we spend investing and avoid succumbing to our stronger feelings of pain when faced with them.

Whether the goal is investment success or winning the Tour de France, planning and process will win the day.

The secret to success is low expectations

This may come across a bit pessimistic after leading into this article with so many positives about the current economic landscape, but it can be translated into a more realistic expectation setting. We shouldn’t base our financial success on the absence of market corrections, bear markets, or on earning exceptionally high returns.

We also shouldn’t place too many bets on the good fortunes of one asset class, category of stock, or company continuing to have good performance. Every asset class tends to have its day in the sun while past stars temporarily fade from the light.

Investment success is built on reasonable return expectations, saving enough to build a strong financial foundation, and diversifying investments.

Back to All Time High Stock Prices

Stock prices have recently fully recovered from their 2022 bear market by returning to and exceeding their previous high-water marks from early 2022. In fact, the S&P 500 has already notched 22 all-time highs so far in 2024 (as of 3/31/24) after not recording an all-time high since January 3, 2022.

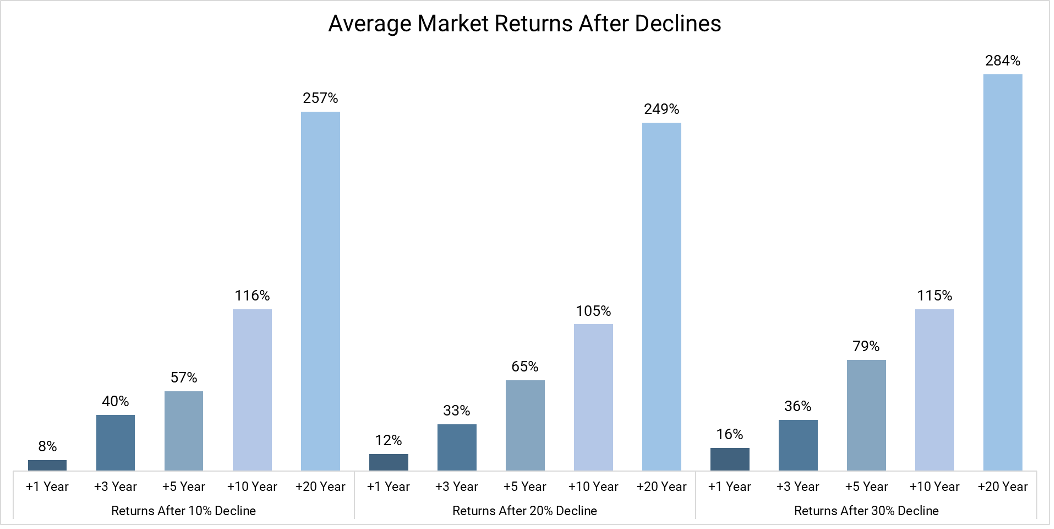

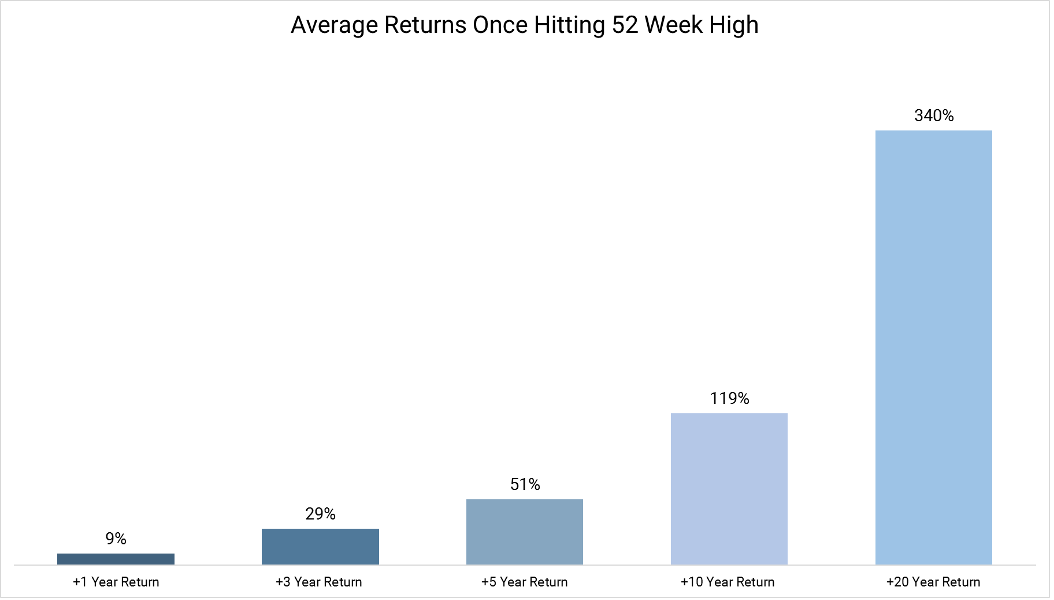

New all-time highs coming out of bear markets often beg the question of whether the market has come too far too fast or otherwise gotten a little ahead of itself. Which, in the short term, is always a possibility, but is often followed by the question, is it a good idea to be investing at all-time high prices? Thankfully, though, we’re not short-term investors and long-term results are relatively similar whether we measure returns from low points in declines or from 52-week highs.

Those of us who have been through a few bear markets may know or have expectations that recoveries should be strong and generate good returns. It’s just a matter of time before that happens – even though that time can feel like an eternity or that we may never get to the other side. But it’s not always as obvious or intuitive when thinking about future returns from high points. The two images below show how similar future returns from declines and high points are.

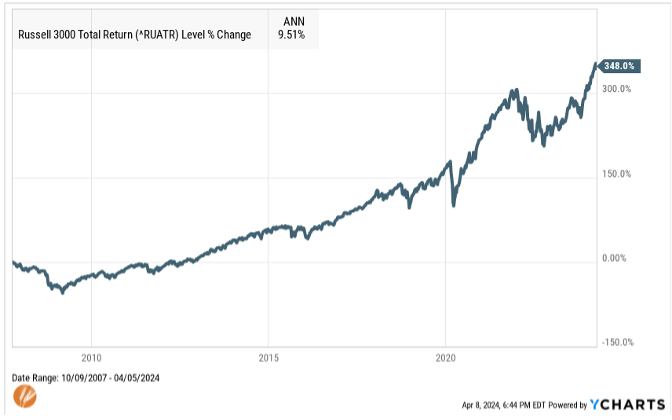

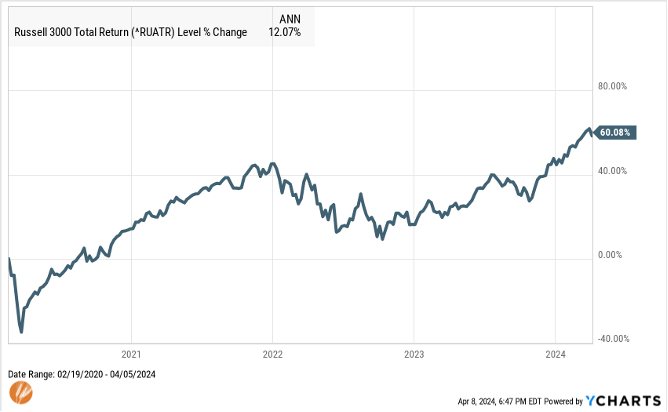

To put some specific examples to this, last month marked the 15th and 4th anniversaries of two historic low points that were preceded by all-time highs: the Great Financial Crisis (GFC) and the Covid-19 induced crash.

For many years following the GFC, there was a heightened focus among investors on avoiding the next decline or bear market much more so than the potential returns coming out of the decline. Much of this could also be traced back to unreasonably high expectations from single investments or categories of investments. Unmet expectations, an emphasis placed on recent losses over long-term potential gains, or a combination of both caused many investors to sell or otherwise change their investments at inopportune times.

The Covid-19 induced crash of 2020 saw many of the same outcomes for investors. And from both instances markets have produced spectacular gains for investors that were able to avoid interrupting the long-term compounding of their investments.

Investing when markets are at a low point or all-time high is unlikely to be key driver of success for the long-term investor. Regardless of market conditions or points in time, investing with process, goals, and keeping in mind a few lessons from Kahneman, Munger, and the unlikeliest of our investment heroes, Lance Armstrong, are more likely to lead to success.

Thanks for reading.

- Due to his admitted use of performance enhancing drugs, he technically has zero Tour de France wins in the history books. But his comments shed light on how he rose above the rest in an era where there were few innocent competitors.

- Yes, that process included performance enhancing drugs, but the point about following a process remains relevant.

Matt Weier, CFA, CFP®

Partner

Director of Investments

Chartered Financial Analyst

Certified Financial Planner®