- July 8, 2025

I recently read an article in The Economist that discussed topics related to the current state of journalism. It contained a line that could also apply to market expectations – specifically when those expectations morph into predictions or forecasts about the short-term.

The line went: “A journalism that starts out assuming it knows the answers can be far less valuable to the reader than a journalism that starts out with a humbling awareness that it knows nothing.”

With some creative latitude, we can apply this line to investing. Investment decisions based on an assumed short-term outcome are less valuable, and often more harmful, than approaching investing with a healthy dose of humility. It’s nearly impossible to know an exact outcome. Especially in the short term.

It’s better to have an expectation of what our experience might be as long-term investors over many years and several market cycles. Then, invest accordingly. Over the many short-terms that make up the long-term there will be events that temporarily cause market returns to deviate – sometimes a lot – from what a reasonable long-term expectation should be.

There will be predictions and forecasts that call for something significant or unexpected to happen in the short-term. They will often sound reasonable given current circumstances. These are not reasons to abandon an investment strategy. Rather, they are reasons to maintain a long-term investment strategy in the face of changing short-term conditions and expectations. Because outcomes often differ greatly from expectations.

Let’s look at a few recent examples.

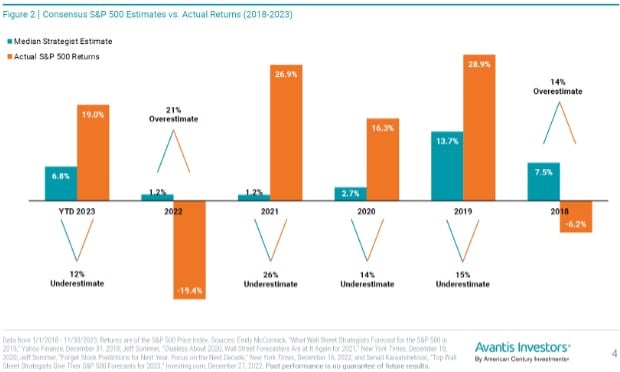

Along with the turning of the calendar into the new year comes Wall Street prediction season. One of the most widely viewed elements of this is when the brightest minds on Wall Street project the level of the S&P 500 at the end of the year. The compilation of all these views forms the “consensus” view from Wall Street. Many investors set their investment strategy for a year based on this consensus view. Here is a scorecard for how they have fared over the last six years.

Figure 1: Year to year market returns vary greatly from what may have happened in the prior year or years and from "expert" forecasts.

Figure 1: Year to year market returns vary greatly from what may have happened in the prior year or years and from "expert" forecasts.Over the last six years, the consensus estimates for yearly S&P 500 returns were off by an average of 18% and varied from being 26% too low to 21% too high. Again, these estimates are from the best and brightest on Wall Street – that’s not to say they’re not well informed or good at their jobs. It is to say that predicting the future is hard.

To use a quote that has been attributed to Niels Bohr and Yogi Berra, “Prediction is very difficult, especially if it’s about the future!”

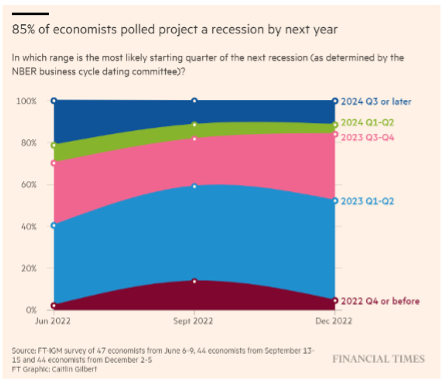

Another widely held prediction going into 2023 was a high probability of a recession. In fact, a poll of top economists conducted by the Financial Times found that in December of 2022, 85% of them forecasted a recession during 2023.

Figure 2: Often, even if economists' recession predictions materialize, market prices already reflect this

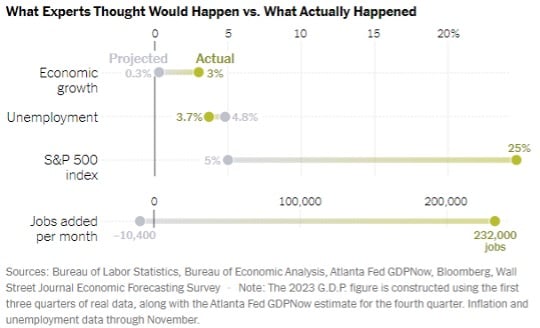

Figure 2: Often, even if economists' recession predictions materialize, market prices already reflect thisNot only did the US economy avoid recession in 2023, it thrived in nearly every way it is evaluated. The illustration below from the New York Times highlights four economic and market data points that turned out to be materially better than economists’ estimates.

Figure 3: Higher economic growth, lower unemployment, more jobs created, and higher market returns than expects. What's not to like?

Figure 3: Higher economic growth, lower unemployment, more jobs created, and higher market returns than expects. What's not to like?It’s understandable to expect that a recession and low market returns could have been the base case going into 2023. There was recency bias from 2022. What turned out to be the bear market bottom was still fresh having happened in mid-October of 2022. Interest rates were still on a rapid upward trend. The Fed was conveying that this would continue since inflation had only begun to fall from its summer 2022 peak.

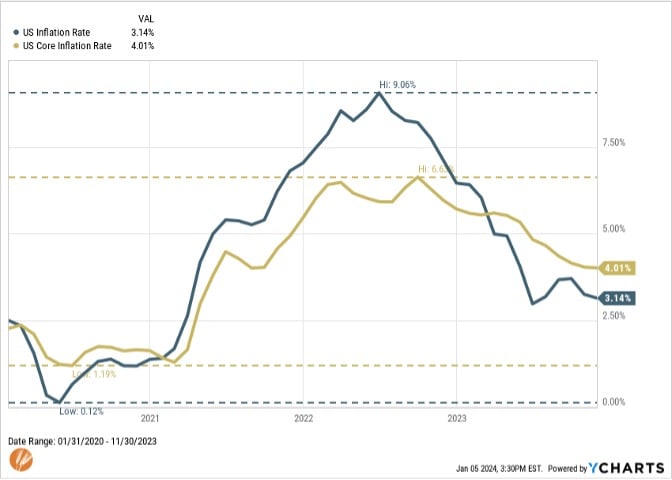

Inflation is another topic that has defied expectations. Widely held expectations among economists going into 2023 was that it would either remain high, or it would take a recession to bring it down. And what would induce the recession that brings down inflation was more interest rate hikes from the Fed.

The combination of expectation for continued rate increases, the potential for a recession, and another year of weak stock returns led many investors to prefer to put more of their assets in money market funds. After many years of near-zero rates on money market funds, they rose to over 5% thanks to higher rates from the Fed. On the surface, that looked attractive compared to recent short-term experience in stocks and bonds.

Starting in the third quarter of 2022 and continuing into 2023, money market funds saw one of their largest collective inflows in history as they took in over $1 trillion of new assets. I discussed the risks of over-allocating to money market funds last year here. To be sure, earning 5% on money market funds is fantastic given the recent past – as an alternative to other cash vehicles and not as a replacement for a long-term stock and bond allocation.

The Fed did continue hiking rates until the fourth quarter of 2023 and has since indicated that this is most likely done and rate cuts are on the table for 2024. During this time, inflation has fallen nearly as fast as it went up, as indicated in the chart below. And as reported by the Wall Street Journal, if we just look at the last months of the Fed’s preferred inflation measure, it’s now trending at an annual rate of 1.9%.

Figure 4: Many inflation expectations were based on a repeat of the 1970s. So far it appears to be trending more like a repeat of the 1940s post WWII that saw inflation fall as quickly as it rose.

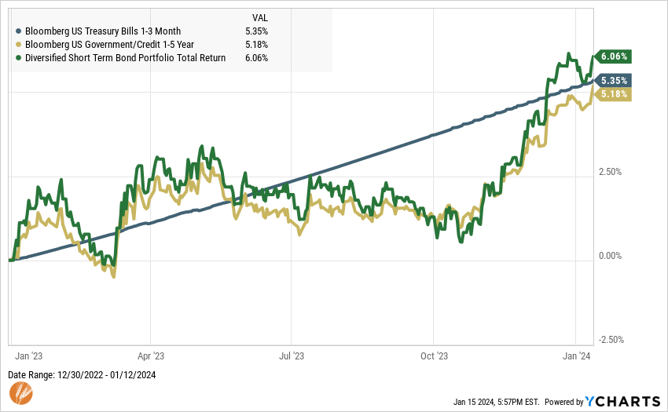

Figure 4: Many inflation expectations were based on a repeat of the 1970s. So far it appears to be trending more like a repeat of the 1940s post WWII that saw inflation fall as quickly as it rose.As inflation fell faster than expected and the Fed began to signal that they were done raising rates and might begin cutting rates in 2024, the market began to price that into market-based interest rates on bonds. This sent bond prices up meaningfully in the closing months of the year. By the end of 2023, over the full year, the benchmark Bloomberg US Aggregate bond index had a better total return than money market funds and a short-term bond index was very close to that of money markets.

This is an important attribute of bonds. While it wasn’t great seeing bond prices decline as rates went up so much during 2022 and the first part of 2023, when rates start to decline, their prices increase. The total return from bonds reflects both the higher interest payments we now receive plus the price appreciation. In money market funds, when rates decline, we’re left with only lower interest payments without the price appreciation.

Figure 5: There is more to bonds than the interest payment. Sure, when interest rates rose the last couple of years their prices declined, but now as we start to see expectations for lower interest rates, bond prices have started to rise, helping total return.

Figure 5: There is more to bonds than the interest payment. Sure, when interest rates rose the last couple of years their prices declined, but now as we start to see expectations for lower interest rates, bond prices have started to rise, helping total return.Closing the Books on 2023

A lot of bad things could have happened in 2023. Many, if not most, expected that. This was priced into markets. When some of them didn’t happen, markets started to price in a different outcome and gains followed. If one were to have invested based on the expectation of those bad things happening, significant gains could have been missed.

Abandoning a long-term investment strategy based on expectations that stock and bond markets would have a repeat of 2022, or that we would experience a recession, brought about additional risks. Stocks always have risk of short-term or temporary declines – whether it’s a rough year like 2022 or a routine decline during a year like we had this fall – but they always pay us for that risk in the long-term.

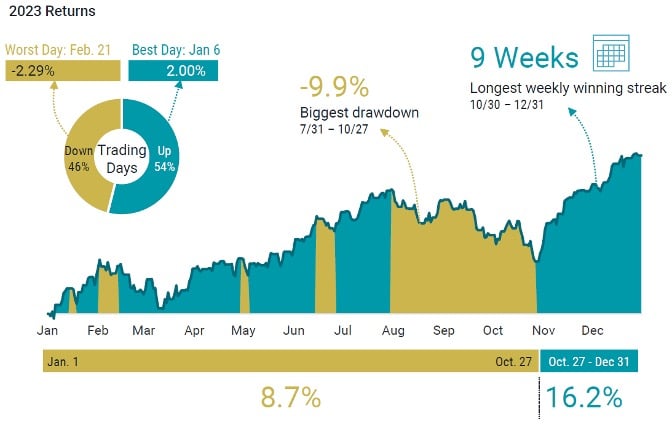

Figure 6: Even in a year that saw returns greater than 20%, we also experienced decline during the year of nearly 10%. Source: Avantis Investors.

Figure 6: Even in a year that saw returns greater than 20%, we also experienced decline during the year of nearly 10%. Source: Avantis Investors.In the face of higher interest rates, high but falling inflation, recession fears, Silicon Valley bank, and many other risks, stocks staged a welcomed rally from 2022. Bonds had a year of positive returns after a couple difficult years on the path to higher interest rates. Very few expected these outcomes.

Long-term expectations versus short-term forecasts

Let’s start to wrap up by returning to an earlier point. Because it’s nearly impossible to know what is going to happen in the economy or markets from year to year, it is so important to have a strong belief of what we will experience in markets as long-term investors.

While markets and economic conditions change from year to year, if we can raise the level of our expectations to a broader view, what actually matters starts to change less and less. Some things are so fundamental they rarely, if ever, change.

One of my favorite authors, Morgan Housel, recently published a book titled Same as Ever based on the premise that so many people try to figure out what is going to change, often unsuccessfully. Often, the real benefits come from the things that don’t change. To summarize a couple of the anecdotes he references:

He notes a story about Warren Buffet driving around Omaha with a friend during the height of the Great Financial Crisis: Warren’s friend says to Warren that ‘this is going to change everything.’ Warren counters his friend’s assumption by asking him what the most popular candy bar is today, which his friend doesn’t know and Warren responds, ‘Snickers’. Warren then asks his friend if he knows what the most popular candy bar was in 1962. His friend also doesn’t know the answer to this question and Warren again responds, ‘Snickers.’

He then notes a story about Jeff Bezos in the early days of Amazon when asked by a Wall Street Analyst what was next for Amazon: Jeff said he didn’t know what was next, but that they would focus on what they thought consumers would always want which is low prices and good service.

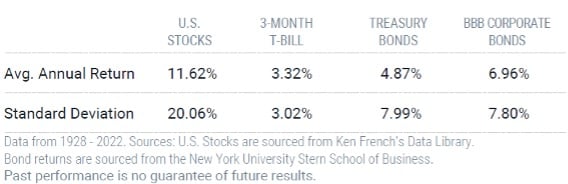

When it comes to investing one of those things that doesn’t seem to change is that over the long-term (we’ll consider the long-term to be at least 10 years) risk is rewarded with return – stocks have higher returns than bonds, which will have higher returns than cash. Along the way, stocks will experience more declines and fluctuations than bonds, which will experience more fluctuations than cash.

Here is table that illustrates these relationships:

Figure 7: Standard deviation is a proxy for risk or how much returns can vary from year to year. A higher number equates to more variability of annual returns.

Figure 7: Standard deviation is a proxy for risk or how much returns can vary from year to year. A higher number equates to more variability of annual returns.The numbers in this table cover nearly 100 years and of course we know these returns aren’t nice and linear and can vary wildly from an annualized number. Short-term returns, expectations, and forecasts can often be very different from the long-term trend. But when we give it a minute and zoom out to look at the longer-term, these relationships tend to remain very consistent over time.

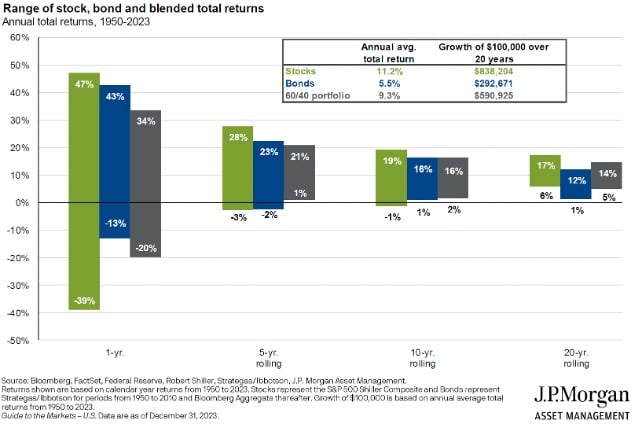

The illustration below shows how the variability of return outcomes narrows markedly going from 1 year to 5 years, to 10 and then to 20 years.

Figure 8: Over longer time periods, actual returns from stocks, bonds, or an allocated portfolio tend toward long-term expected returns. But in the short-term they can all vary much more.

Figure 8: Over longer time periods, actual returns from stocks, bonds, or an allocated portfolio tend toward long-term expected returns. But in the short-term they can all vary much more.Our Investment Strategy

It may be evident now that our investment strategy for 2024 will be the same as it was in 2023 and all the years before.

Your portfolio’s investment strategy will continue to reflect your specific financial plan and will be implemented in a diversified fashion. This strategy will be modified as your plan changes, rather than in response to economic or market conditions. As market conditions change unpredictably, we’ll continue to invest based on long-term probabilities rather than short-term expectations and forecasts.

I would like to take some more creative liberties with another famous quote. I think Winston Churchill’s quote about democracy being the worst form of government except for everything else can be modified to apply to investing.

A long-term investment strategy may be the worst form of investing except for everything else that has been tried. It always seems like there could be something better out there in markets or when economic conditions change it feels like action should be taken. But that often can lead us astray from a long-term approach that has been shown to work over many years and market cycles.

Happy New Year and thanks for reading.

Matt Weier, CFA, CFP®

Partner

Director of Investments

Chartered Financial Analyst

Certified Financial Planner®