- July 8, 2025

Like the seemingly endless summer road trip, the current decline in financial market prices feels like it is lasting forever. It isn’t hard to imagine ourselves in the back seat shouting at the driver, “Are we there yet?!” After peaking on January 4th this year, we’re more than six months into a broad decline that has spared few investments. Through the first half of the year, only the US Dollar and commodity prices posted positive returns.

For comparison’s sake, the bear market of 2018 took less than three months to bottom and less than seven months to return to where it started. The Covid-fueled crash of 2020 took less than 30 days to bottom and approximately five months to return to where it started. So, it’s understandable that at about six and a half months into this decline we’re getting a little impatient.

On top of that, it feels like all the reasons cited for this bear market are still here and not improving. For anyone keeping track at home, here is a non-exhaustive list:

- Stock prices rose too fast too quickly after the Covid crash to reach unsustainable highs, particularly in the tech space, as they did in 1999 – 2000

- The Russia – Ukraine conflict

- Rising inflation

- Rising interest rates

- Fear that the Federal Reserve will raise interest rates too much

- Supply chain issues

- Labor shortages

- Unaffordable housing and housing shortage

- Lingering concerns about the pandemic

- The possibility that the combination of the above could lead to an economic recession

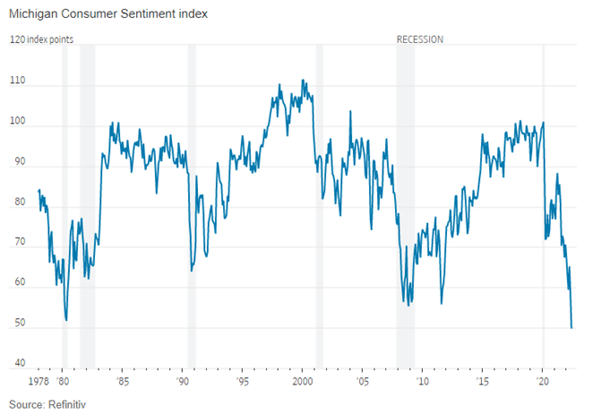

All of this and more has caused national consumer sentiment to fall below where it was during the depths of the Great Financial Crisis. Yes, you read that correctly. The national mood of consumers is now below where it was when there was a literal risk that the entire global financial system could cease to function. And below where it was in early 1980 during a period referred to as the Great Malaise.

This is at a time when unemployment is 3.6% - a near 50-year low. Both of those eras saw unemployment near or above 10%. Job creation remains strong as witnessed by June’s 372k job creation. There are nearly two open jobs per unemployed individual. Sure, inflation is still high. However, recent weeks and months have seen key drivers of recent high inflation readings start to recede, namely energy and new and used cars. From an investment perspective, equity valuations are lower and interest earned on bonds is higher than they have been in years – both of which bode well for future investment returns.

The mood in that survey – one of the longest running and most watched consumer surveys – might seem to depict a national economy so poor that it’s tempting to think,, “It’s different this time”, which famed investor Sir John Templeton once cited as the four most dangerous words in finance.

Let’s take a look at where we are now and try to answer if the current environment deserves the poor reception and if it may, in fact, be uncharted territory.

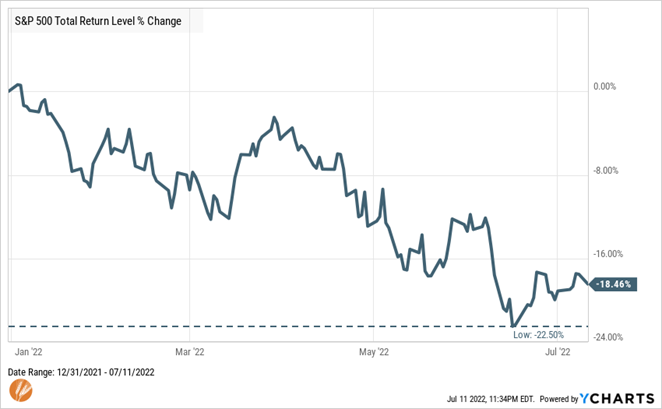

The S&P 500 is down nearly 20% for the year:

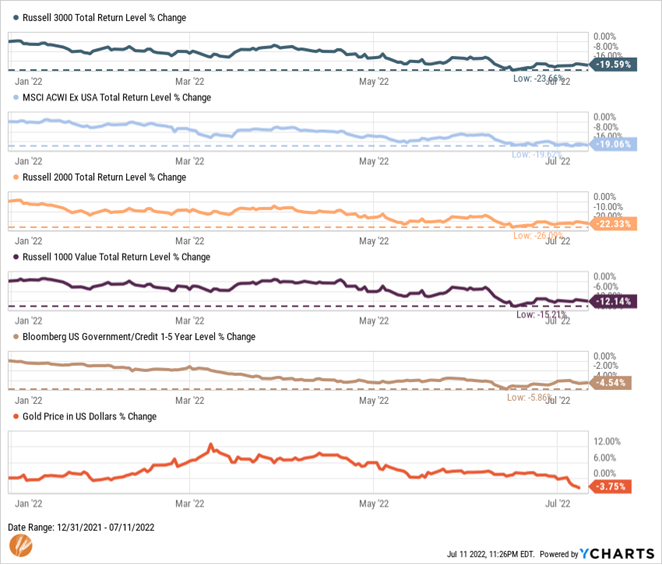

Nearly all other major categories have also posted negative total returns so far this year:

It’s reasonable to wonder if we’ve seen conditions like this before – both in terms of the current market decline and the difficulties facing our national economy – and, if so, how often.

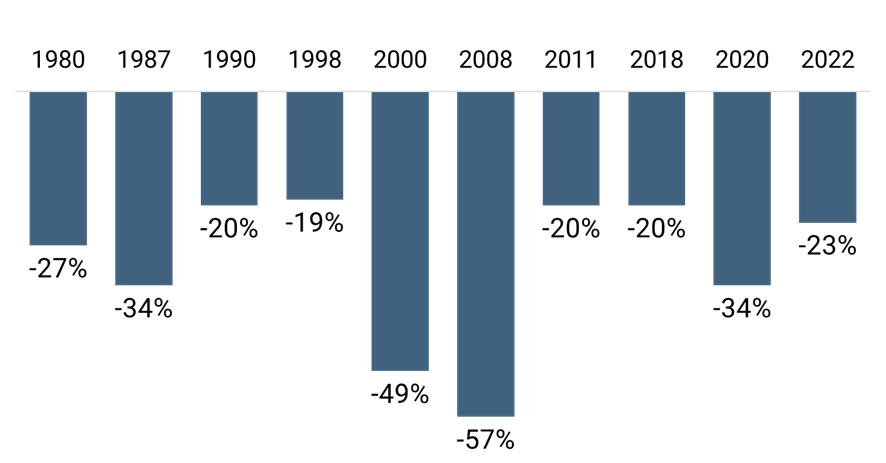

As measured by the S&P 500, we are currently in the midst of the ninth Bear Market since 1980 that has experienced an average decline of 30%. So, a bear market in excess of a 20% decline is not out of the ordinary.

But what about the current difficulties facing our economy? Are those unique enough to be able to say it’s different this time? Let’s take a trip back in time and look at what happened over the last several decades and how stock returns have fared:

1980s:

- High inflation

- High interest rates

- Multiple recessions

- Long bear market of 1980-1982

- Escalated Cold War

- Stock market crash and bear market of 1987

- Score: 400% cumulative return for S&P 500

1990s:

- Recession and bear market to start the new decade

- First Gulf War

- Collapse of Soviet Union

- Significant interest rate increased by the Fed in 1994-1995

- Asian Currency & Russian Debt Crises

- Score: 430% cumulative return for S&P 500

2000s:

- Contested and recounted Presidential election

- Bear market following bursting of Tech Bubble

- 9/11 Attacks and ensuing wars

- High oil and natural resource prices

- Great Financial Crisis and most severe bear market since Great Depression

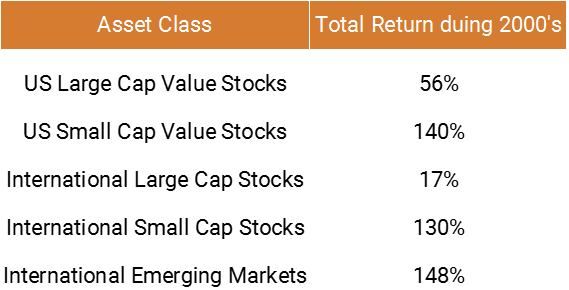

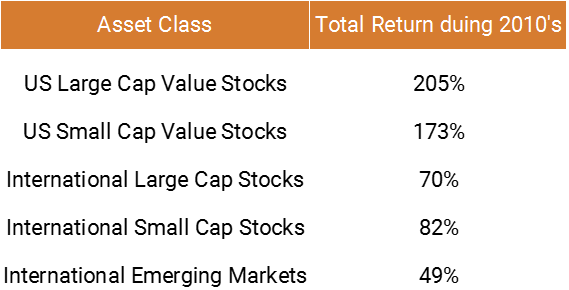

- Score: -9% cumulative return for S&P 500, but a resounding win for a diversified stock portfolio highlighted by the following category returns to help offset weakness from the S&P 500

2010s:

- Eurozone debt crisis and risk of European Union collapse

- Bear market following downgrade of US Debt

- “Taper Tantrum” following efforts to raise interest rates following the Great Financial Crisis

- Heightened global terrorism threats

- Low oil prices

- Slowing global growth

- Score: 256% cumulative return for S&P 500. And for investors who eschewed diversification and gave up on the S&P 500 in an attempt to ride the wave of the previous decade’s winning categories, it provided evidence that diversification needs to be consistently adhered to:

2020s:

- COVID-19 Pandemic

- Disputed Presidential election

- Events outlined in list above

- Many more unknown and unpredictable events will occur before the decade is over

- Score: 23% cumulative return for the S&P 500 in the first two and a half years of this decade (about 8.5% annualized, which despite two bear markets in the young decade isn’t too far off long-term expectations)

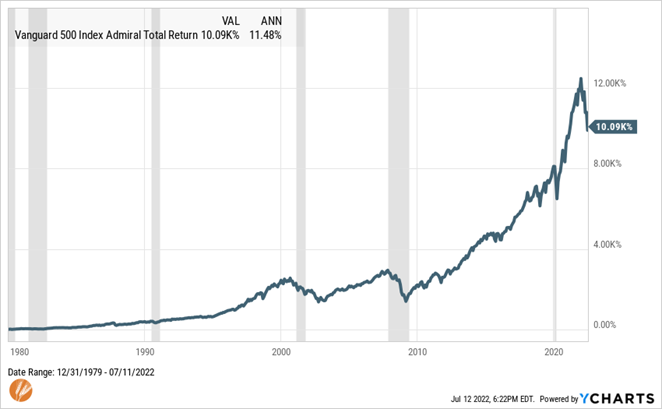

To link together the last four decades and two years, with nine bear markets, six recessions (represented by gray bars in image below), and many troubling economic circumstances, the S&P 500 has produced average annual returns of more than 11%.

Every bear market has been accompanied or caused by different but similar circumstances – they are great examples of history not necessarily repeating but rhyming. The one thing that they all have in common? - They all end.

We can’t quite tell if “we’re there yet” and approaching the end of this financial market decline. That is a prediction that we can’t make and most such predictions will likely prove incorrect. We do, however, know that we’ve been here before. And it’s likely not “different this time.”

While certainly not enjoyable, the current market environment is a result of normal volatility, uncertainty, and economic conditions. It’s something that we should expect to occur with near certainty as it always has in fairly regular intervals.

However, it’s rarely, if ever, phrased that way in the media where it is always described as a surprise, crisis, or catastrophe. It’s appropriate to recall a quote from another famed investor, Howard Marks, when he said, “you can’t predict but you can prepare.” As our anxiety about situations often don’t accurately reflect the true risk of the situation – the occurrence of a bear market is not the true risk, but rather attempting to do something during or otherwise avoid them presents the greater risk. Recognizing their regular occurrence and preparing accordingly tends to be the best recipe for success.

I hope you’re enjoying your summer!

Thanks for reading.

Matt Weier, CFA, CFP®

Partner

Director of Investments

Chartered Financial Analyst

Certified Financial Planner®