- July 8, 2025

A CEO of a large investment firm once told a story about a dinner conversation with the head of a large investment fund.

The head of the investment fund described his fund’s objectives as multi-generational to which the CEO asked, “How do you measure performance?”

“Quarterly,” replied the head of the investment fund.

Investing is often a discipline that is susceptible to a disconnect between the time horizon of investment objectives and that of the measurement or expectation of results.

Most of us have investment goals that are best measured by decades. Yes, even if you’re retired or about to retire, it’s likely that the primary goal for your investments is to sustain your lifestyle during retirement. An average retirement period can span decades.

To be fair, it may be two or three decades compared to the four or more for a mid-career investor. Nonetheless, measuring time in decades can be considered “long-term” investing.

What we’re often made most aware of is the performance of financial markets today, last month, last quarter or last year. And what dominates expectations is what they might do tomorrow, next month, next quarter, or next year.

It’s understandable why we would focus and grab onto short-term market activity. Financial and popular media broadcast negativity bias and sensationalism, which can pull at our emotions. Moreover, biologically our brains have evolved to focus on short-term opportunities and threats. And the fact of the matter is that it's just more interesting to tune into “how the markets are doing.” It's more interesting and engaging than thinking about investments in terms of 10-, 20-, or 30-year periods.

But this all begs the questions:

What can we expect as long-term investors?

And if we’re likely to focus on short-term returns anyway, if only for entertainment, what should we expect along the way?

The average is not the normal

There is a fictional story about a six-foot tall person who drowned trying to walk across a river with an average depth of five feet. Hearing only the average water depth they set out on their journey to walk across the river not knowing that depths along the way ranged from two to eight feet. Investment returns can follow a similar path. Long-term averages can hide much of the short-term fluctuations that we feel much more acutely and remember more vividly. Whether we are thinking about the depth of the river or investment returns, water depths and investment returns aren’t uniform.

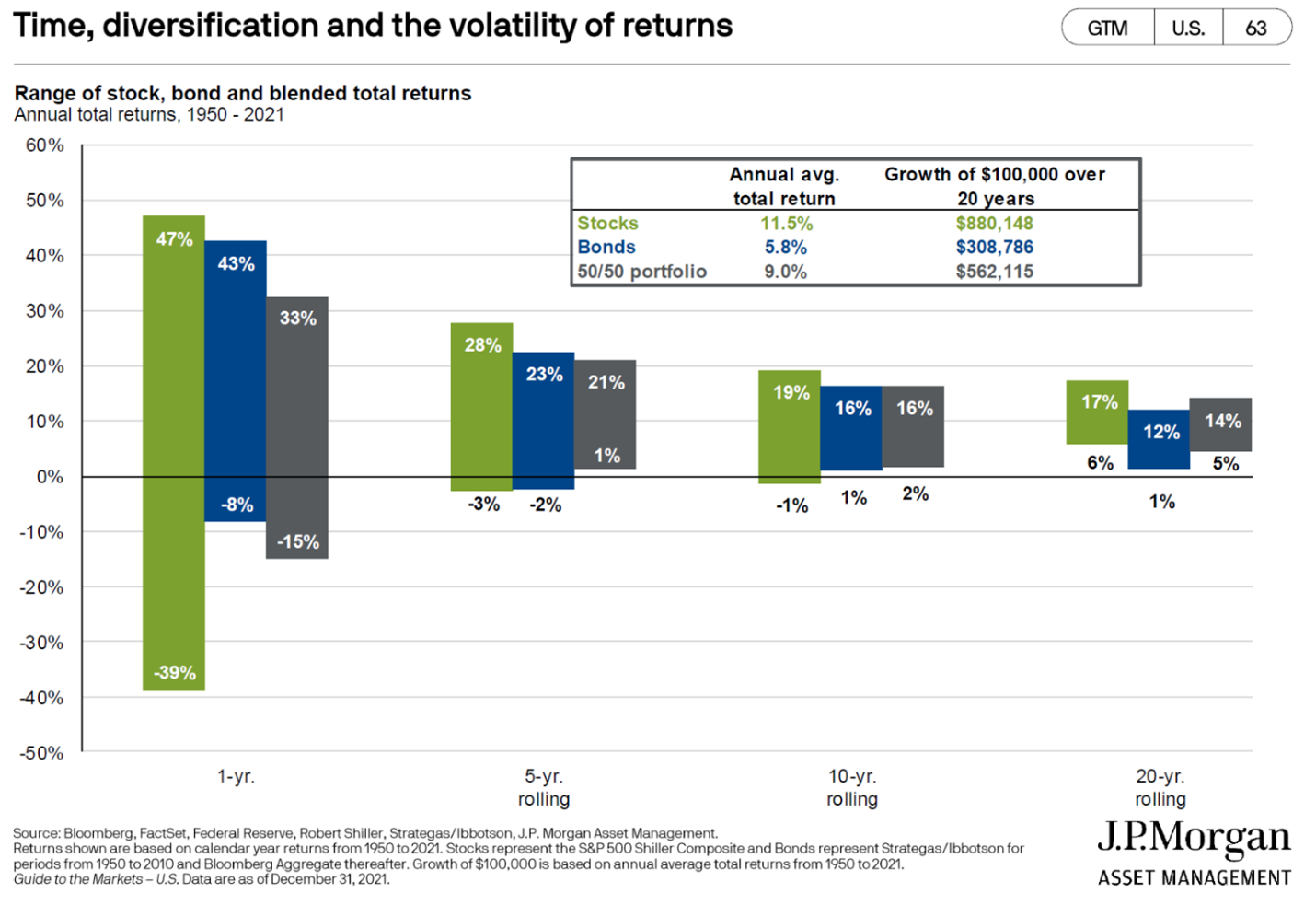

The image below shows that since 1950 stocks have posted average annual returns of 11.5% in all rolling 20-year periods. Does that mean we should consider 11.5% to be a normal year for stock returns? Not quite. During that time there were 864 rolling 12-month periods and 14 of them had returns that round to 11.5%. So, average doesn’t necessarily mean normal or something that should be expected to occur in a given year.

Within those 20-year periods are single years where stock returns could have been as high as 47% (!) or as low as -39% (!!). But there is a distinct pattern that takes place as the period increases from 1-year to 5 years and to 20 years. As we extend our investment time horizon, the range of potential returns narrows and the probability of negative returns diminishes.

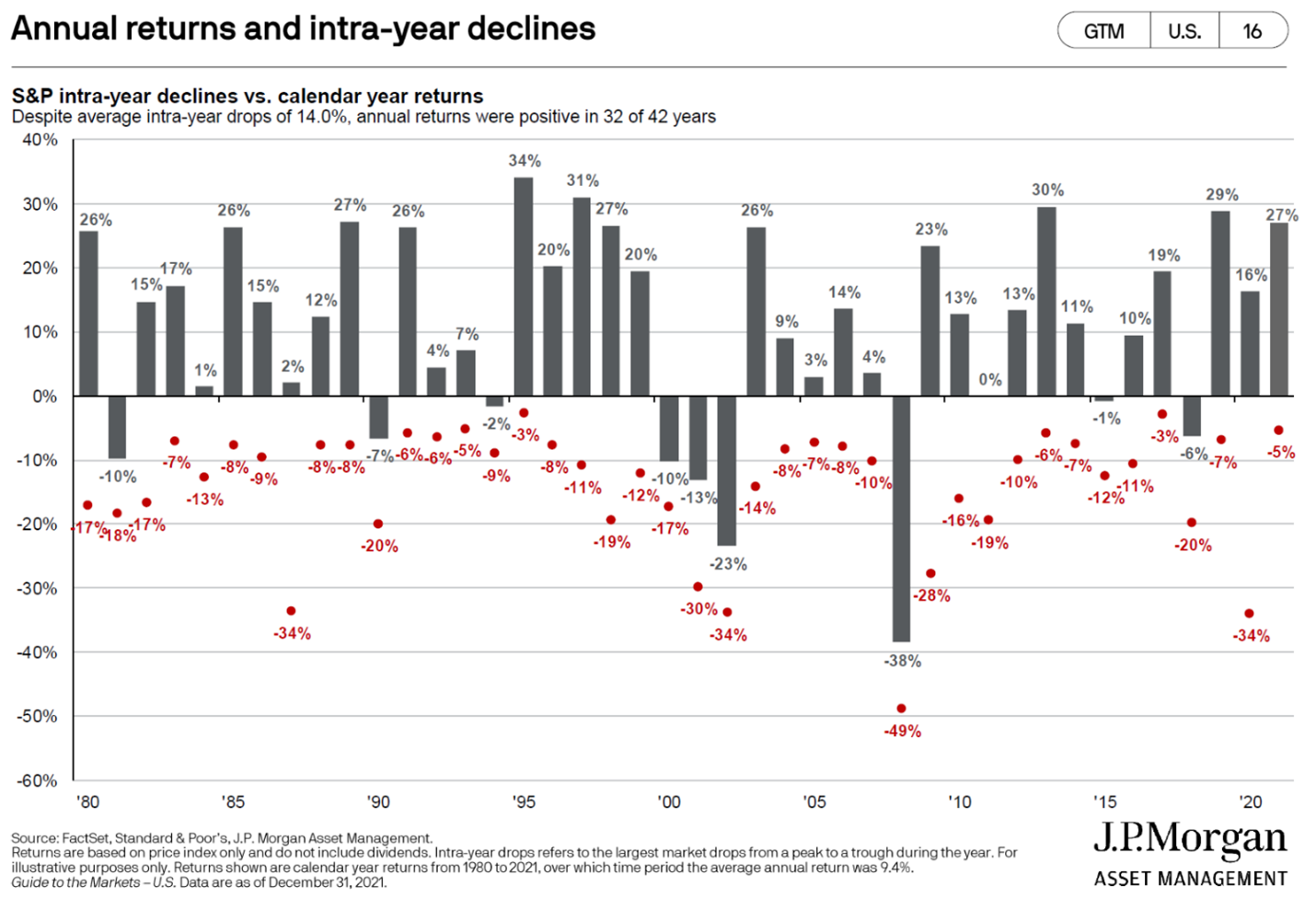

In the short-term, the expectation of a “normal” year should be different than that of an “average” year. The image above shows the range of returns each year, but we can even look at what can be expected within a year. The image below shows all calendar years going back to 1980 when 32 out of 42 years posted positive returns for the full year. But all 42 of the years had declines in stock prices during the year that averaged 14%.

Again, the average doesn’t tell the whole story. The intra-year declines ranged from a benign –3% to a shocking –49% and the cause of those declines was different every year and rarely expected ahead of time. So, while there is a lot of noise smoothed by the average, the “normal” is that we should expect there to be something that causes a stock price decline every year. Even when the full year ends with positive returns!

Elroy Dimson of the London Business School said, “Risk means more things can happen than will happen.” The shorter the period the more the noise of all the things that could happen can overwhelm markets. As time goes on, the things that actually did happen are reflected in the long-term returns.

But in the short-term our human nature can get the best of us as we place more emphasis on all the things that can happen and too often assume they all will happen. This is why we are drawn to predictions and forecasts and tend to extend our recent experiences into the future.

“Just as nature abhors a vacuum, people hate randomness. The human compulsion to make predictions about the unpredictable originates in the dopamine centers of the reflexive brain.” - Jason Zweig; Your Money & Your Brain

Surveys of individual investors conducted in 2017, 2019, and 2021 by Natixis Investment Managers found that as stock returns increased during those years, investors’ expectations of future investment returns also increased. Survey participants’ future annual return expectations in 2017 were a modest 8.9% in 2017, close to long-term average at 10.9% in 2019, and an astonishing 17.5% in 2021.

That’s not the only time surveyed investors expected stock returns to go straight up indefinitely. In 1999 after the S&P 500 posted average returns of 22.7% over the prior three years, a similar study conducted by Bernstein Investments found that investors expected returns of 19% per year for the next 10 years.

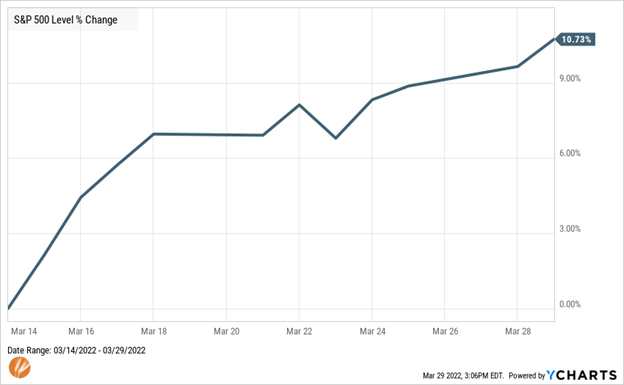

These extrapolations of recent returns into the future aren’t limited to positive returns. In a less formal survey, a Twitter poll, conducted on March 15th by Charlie Bilello of Compound Capital Advisors asked whether a 10% further decline or a 10% rally in the S&P 500 would be more surprising. The prior day was when the S&P 500 reached its closing low during the recent correction, closing 13% off its peak.

The results of the survey showed a modest majority of respondents saying that a 10% rally would be more surprising. Since then, from that closing low on March 14th, the S&P 500 did in fact rally over 10% in the following two weeks.

Asked recently by a reporter about the secret to a happy life, Charlie Munger, the 98-year-old Vice Chairman of Berkshire Hathaway replied:

“The first rule of a happy life is low expectations. … You want to have reasonable expectations and take life’s results good and bad as they happen with a certain amount of stoicism.”

How do we make it to the other side of the river?

The character in our story could have easily made it across the river by swimming or boating. Either way, they should at least consider that average does not mean uniform.

In the interest of self-preservation, knowing how deep the water is at its deepest point, how wide the river is, or if there are other perils to be wary of increases their chances of successfully reaching the other side. It may be necessary to learn how to swim or pilot a boat before embarking. The journey may be daunting but planning ahead will increase our character’s odds of survival.

We can make similar assumptions for investors. It is important to understand the potential outcomes when we invest in stocks. Investors invest for an important reason... to achieve a financial goal. Having a reasonable expectation of what you can expect to experience as a long-term investor is critical. Investors depend on the long-term average returns. On the other hand, we should expect “normal”, not average outcomes in the short-term.

Howard Marks said “The important thing to remember about investing is that it is not sufficient to set up a portfolio that will survive on average. The key is to survive on the low ends.”

We’ll be following up shortly with a continuation of this piece to look more into risks that can be expected along the way to achieving long-term returns.

*All data sourced from YCharts unless otherwise specified

Matt Weier, CFA, CFP®

Partner

Director of Investments

Chartered Financial Analyst

Certified Financial Planner®

Luke Murray, CFP®, CPWA®

Senior Wealth Manager

Certified Financial Planner®

Certified Private Wealth Advisor®