- July 8, 2025

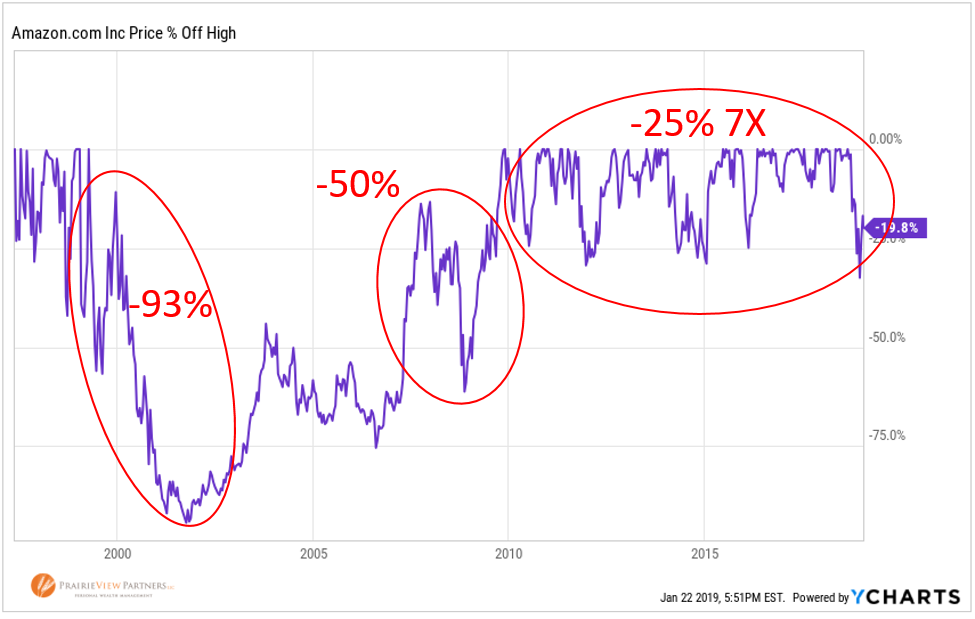

I’d like to tell you about a hot new investment that has made some people very rich in recent years. In the past nine years, it has lost at least 25% of its value of total of seven separate times, then rocketed back to new highs almost every time. That’s seven bear markets during an unprecedented bull market run in the broader stock market. You’re thinking, it’s Bitcoin, of course. But alas, no, I’m talking about Amazon.

A bumpy ride to the top

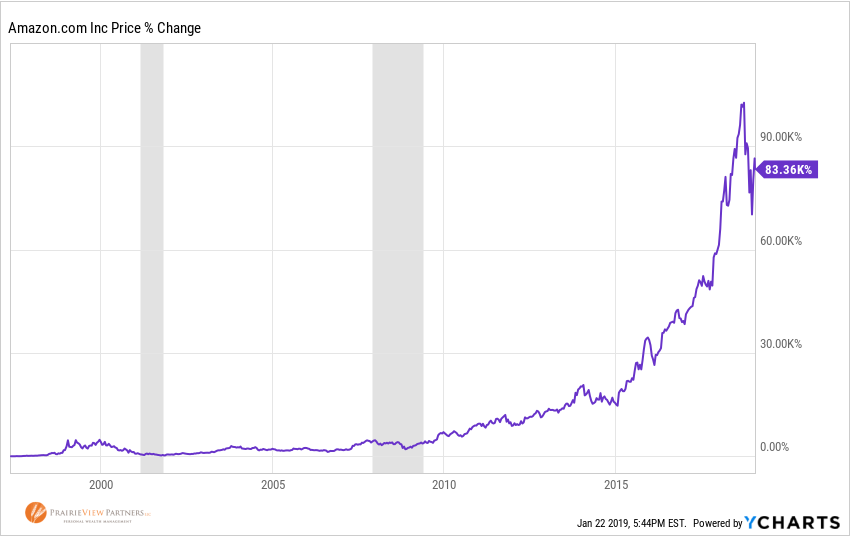

The global behemoth that we remember as having done nothing but grow exponentially since its IPO in 1997, has actually had a rough ride to the top. The most common refrain you hear from your friends and colleagues about this stock, or others like it, with 82,000% returns over the last 20 years, or 36.33% annualized, is “Man I wish I had bought that 5, 10, 15 years ago.” But even if you had, would you have had the stomach to hold on through the nausea inducing volatility?

In 1998, prior to the dot com bubble bursting, Amazon lost more than 40% of its value twice and gained it back both times within the span of 6 months. Then in 1999, Amazon fell more than 50% again, which it mostly recovered from by the end of year. At this point, the stock has experienced three 2008-like declines in the span of two years. Are you still steadfast that this online bookselling company will go on to become the world’s 2nd most valuable company, and turn your $1,000 investment into close to $1 million?

In the midst of the dot com bubble bursting, Amazon lost 93% of its value. Congratulations, your $1,000 investment is now worth $70 if you haven’t sold yet. At this point, probably the only two people who weren’t selling were Jeff Bezos himself, and the guy who couldn’t remember his Schwab password, lucky him. Amazon wouldn’t go on to recover its 1999 high until ten years later, after experiencing yet another 50% fall during the actual financial crisis.

Who knew if you owned today’s Amazon or Blockbuster?

Ok, enough with the data barrage, the point of this exercise is to highlight a couple ideas that don’t immediately come to mind when looking back at stocks that have experienced exponential returns in recent years. The chief one being uncertainty. Everyone knows now that Amazon is one of the most innovative and dynamic companies in the world, but when you’re watching your portfolio lose 10% of its value every day for weeks on end, could you be sure that you’ve invested in 2019 Amazon? Or have you invested in the 2019 versions of Blockbuster, Kodak, or AOL?

The second thing that is often overlooked is the reason that most of us didn’t buy the stock in the first place. It was so risky! There were hundreds of other tech companies that didn’t survive the dot com crisis, and hundreds more that got outcompeted by the likes of Amazon, Netflix, and Google. This is a good example of survivorship bias, as we rarely hear of the other hottest stocks of the dot com bubble because most of them didn’t survive. Anyone remember pets.com?

The story of Amazon above helps to highlight the importance of diversification in an uncertain world. While a diversified portfolio may not achieve an 82,000% return over 22 years, it will help us stay invested through the ups and downs of any one stock and avoid the pitfalls of chasing the next hot stock. Diversification also helps us avoid the risk that a singular company goes bankrupt, or under-performs the market for the next 20 years – no matter how well it’s done in the last 20 years. As Charlie Ellis so aptly puts it in his book, Winning the Losers Game , “The surest way to win in the investing world, is to simply not lose.”

Source for all data: YCharts

Citation: Ellis, Charles D. Winning the Loser’s Game: Timeless Strategies for Successful Investing. McGraw-Hill Education, 2017.

Matt Weier, CFA, CFP®

Partner

Director of Investments

Chartered Financial Analyst

Certified Financial Planner®