- July 8, 2025

You probably don’t need me to remind you that it’s been about six months since the new Covid-sponsored reality has taken hold. But maybe it is worth pausing to reflect and wonder aloud, “has it really been that long?” It does, in some ways, feel like March was just yesterday, and yet it also seems like a lifetime ago.

However we perceive the time that has passed, I think it is fair to say that a lot has happened. The same is true in financial markets. Some developments are more important to us than others. Elon Musk ascending to the third highest net worth in the world is interesting but not terribly important to our investing lives.

What the Fed might do next, while somewhat important, is also something that can be interesting to contemplate but is completely out of our control and nearly impossible to predict. So, there is little value in attempting to reposition a long-term investment portfolio in response.

Yes, the price of gold has had a good run this year – after being one of the worst performing investments of the prior thirty years. Few people have the stomach for investing in something that produces negative real (after inflation) returns for decades in hopes for a large pay-off one day.

Buried in all of the interesting and attention-grabbing developments are many important, but often overlooked, lessons that have occurred or been validated in recent months. Let’s take a look at three key ones.

1. Markets can surprise us and do exactly as expected at the same time

To be sure, it has been a wild and, at times, stressful year for stock investors. Looking only at the S&P 500, stocks were down about 30% from the start of the year (34% from the index’s February peak) on March 23rd.

No matter how much we study and plan for market declines, there is always some sense of surprise when they actually happen. Perhaps the true surprise is the catalyst for the decline, while the ensuing market impact is the expected result.

At the time of this writing, the S&P 500 has posted a total return (including dividends) of 7.5% year to date. That translates to an annualized return of 11.2% if we were to extrapolate to the end of the year. Somewhere in the neighborhood of 11% is what the index has produced on average for the last 100 years or so.

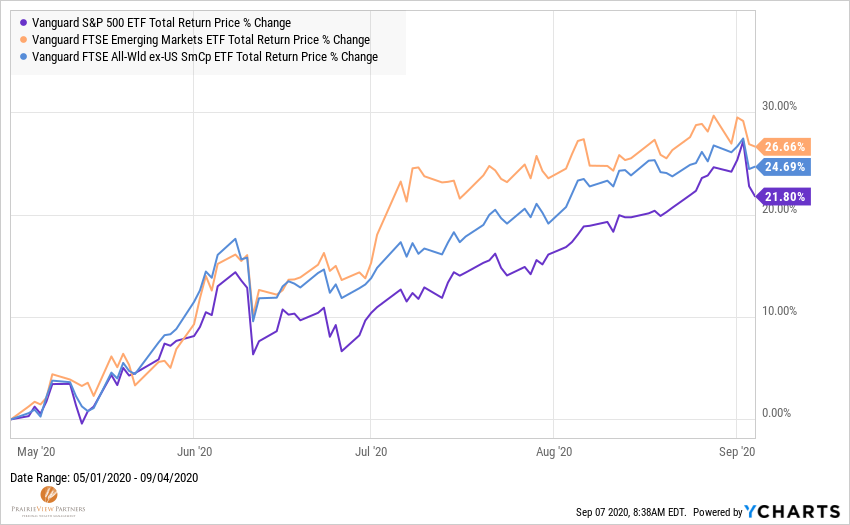

It seems as if the S&P 500, with its tech-stock-heavy composition, and even the US market more broadly, is now destined to be “the only game in town.” This has had an element of truth to it in recent years. However, since May 1st stocks of Emerging Markets and International Small Cap varieties have posted the best returns of major stock categories.

This is not to predict that these two categories are going to be the leaders from this point forward, but as my colleague, Sean, pointed out recently, the benefits of diversification tend to pay-off when least expected.

About the time we start to think that we don’t need diversification – such as after a multi-year period when one type of stock has trounced all others – is the time when we are reminded, and surprised, by the long expected benefit of diversification.

2. Investing is a long-term endeavor with short-term checkpoints

Yes, a long-term investment horizon is important, if not a requirement, for successful investing. However, unless you are Warren Buffett with his self-professed ideal investment holding period of “forever” and a multi-billion-dollar cash pile, the short-term is a reality that we all face.

We were all reminded of that reality earlier this year. The short-term is not solved by attempting to predict what stock prices, interest rates, economic growth, the Fed, or any other unpredictable factor, might do in the short-term. The short-term is solved by planning for the periodic surprises that are expected to happen from time to time by having sufficient cash, bonds, and other sources of liquidity.

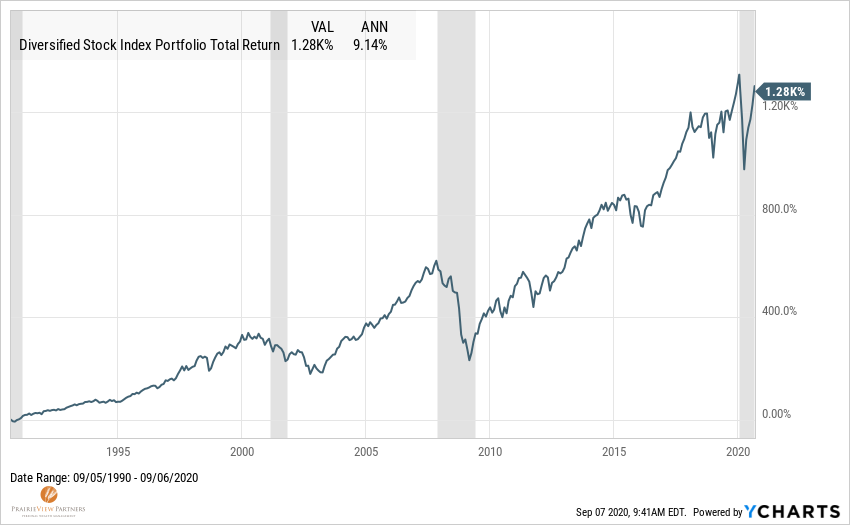

Successfully preparing for those short-terms provides the backdrop for long-term investing, where the real gains are earned. What has happened with stock prices since the end of March is only a microcosm of this. The last 30 years have seen multiple recessions, bear markets, and other events that were quite unsettling at the time. Through all of it, a globally diversified stock portfolio has produced annual returns over 9%.

Of course it’s easier to look back on a positive 30-year period than it is to steadfastly remain invested during all of the turbulent times along the way. But planning for the multiple short-terms with sufficient liquid resources is what allows us to take advantage of the long-term. While we may not need Warren’s multi-billion-dollar cash pile, having our own cash pile can turn our preferred stock holding period into nearly forever.

3. The best innovations and changes often come from the most difficult times

While airplanes and cars were not invented during times of war, their early uses were identified as tools for warfare. Even the Wright Brothers in 1908 identified their invention as being only useful to the war department rather than private industry. But after it was realized that they could carry guns and munitions as well as people, cars and airplanes were arguably some of the most influential innovations of the 20th century.

The list doesn’t stop there. Radar, the internet, microprocessors, jets, rockets, interstate highways, the microwave oven, GPS, synthetic rubber and many other things that we take for granted as part of our daily lives came out of difficult military situations.

The 1930s saw the biggest increase in economic productivity of any decade prior to that or since then. Much of this was from the electrification of the country and the construction of new roads. Other things that came about were supermarkets and new measures of quality control in factory production so as to reduce waste.

Economics is a field that studies incentives and how incentives influence decisions and results. The incentives for creativity and innovation tend to be higher in difficult situations as payoffs for success tend to be more valuable and consequences for failure to be more severe.

Maybe I am hopeful, but it seems as if 2020 is another opportunity for innovation and creativity that has the potential to positively affect future economic growth. We have opportunities to rethink medical improvements, delivery of education, the structure of our cities and housing, and many others.

In our very small corner of the world, one innovation of the last 20 or so years, that may have seemed at times like a last-ditch effort for productivity or connection but has become indispensable, is the video meeting. Before you dismiss this by saying, “yeah, everyone’s been adapting to that”, let me tell you a story.

By now, many of you have probably had an opportunity to meet with us via Zoom or other video interface from the comfort of your home. This has allowed you to avoid traffic, parking, and navigating the St. Paul skyway. In fact, if you never want to come to the office for a meeting again, we’ll miss seeing you, but we’ll understand.

A couple that I had the pleasure of connecting with recently in a video meeting took the experience to a whole new level. One of their retirement goals was to travel around the region and the country and ride their bicycles in new places. When I joined them on the video meeting, they were outside, taking a break from their ride in a town a few-hour drive from home. They were viewing the video and shared documents on their iPhones.

Maybe this example is not as important as a medical breakthrough, but I know this couple viewed this “innovation” as an indispensable and valuable new tool. Hopefully, many other important innovations will be developed during this difficult time.

We hope to see all of you in the office again for meetings before too long. But if we can have another medium to successfully connect and discuss financial goals – while actually experiencing those goals! – I’ll consider that a long-term win.

Matt Weier, CFA, CFP®

Partner

Director of Investments

Chartered Financial Analyst

Certified Financial Planner®