- July 8, 2025

4th Quarter and Full Year 2018 Market Summary

A long time ago, someone, somewhere bestowed upon stock investors that a Bear Market shall be defined as a 20% decline from the most recent market peak. Oh, and by the way, it technically only applies to the S&P 500, which comprises about 15% of US listed companies and 5% of global companies. By that measure 2018, when the S&P 500 fell 19.8% from September 21st through Christmas Eve, escapes earning the label of a Bear Market on a technicality. How about we round to the nearest whole percentage and call it what actually felt like happened?

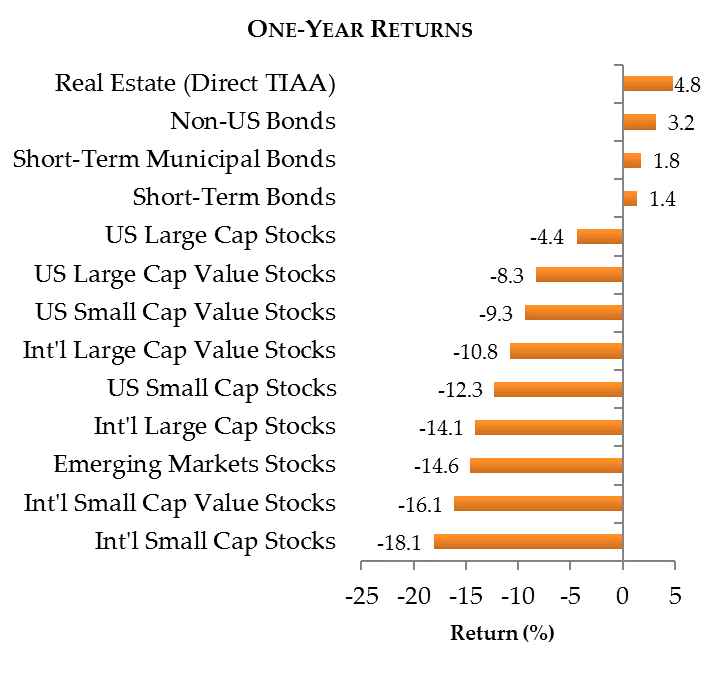

If we expand our lens beyond the S&P 500 we can see why 2018 is worthy of the Bear Market moniker. US Small Cap stocks reached a low of 27% below their all-time peak. US Value Stocks reached a low of 20% below their all-time peak. Market darlings Amazon and Apple, thought to be able to do no wrong, reached lows of 34% and 36% below their respective peaks. Even 3M stock reached a low of 30% below its all-time high. Looking outside the US, International Developed and Emerging Markets posted drawdowns from high to low levels of 25% and 26%, respectively. It seems as if a broader definition of a Bear Market that better reflects what we feel and experience as investors is more appropriate.

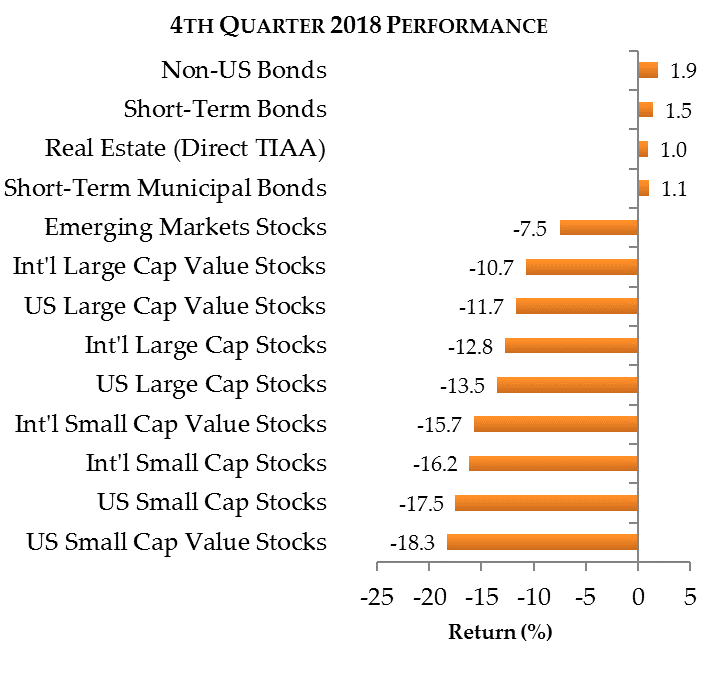

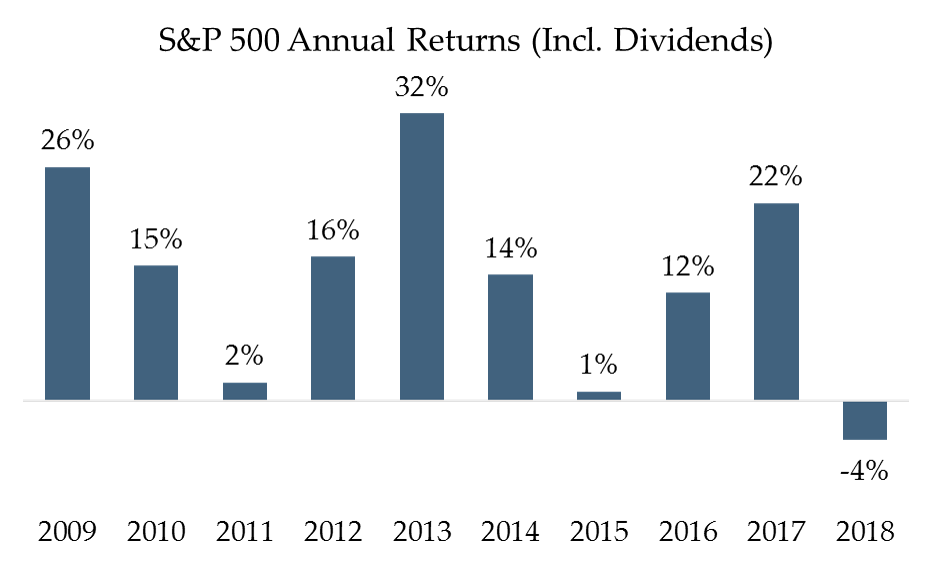

At the conclusion of trading for the year, the S&P 500 finished 2018 with a return of negative 4.4%, including dividends. It is understandable if you read that final return figure for 2018 and thought, “only negative 4.4%?” It might feel this way because the entire decline occurred in the final three months of the year; the S&P 500 declined 13.5% during the quarter and closed the year 14.5% below its September peak. The decline was more noticeable than the full year return indicates due to its recency, speed, and severity causing many to forget about the strong returns from the first nine months.

The volatility we experienced throughout 2018 after the unusual calm of 2017 also made 2018 feel worse than the closing numbers might reflect. While volatility was indeed higher in 2018 than 2017, what we experienced in 2018 was only slightly above average and it was in fact 2017 that was the outlier falling in the 1% of the calmest years ever seen by stock investors. Add in the constant bombast from the media reminding us how bad we should think this is and that we should be doing something because surely stocks are going to fall more, it’s understandable to feel nervous as stocks declined.

It is for times like this that most of us also own bonds in our portfolio and it’s worth highlighting how they fared during the year as they also had their own fair share of news. The Federal Reserve continued its progression of raising interest rates in 2018 in response to strengthening economic conditions and the return of inflation, albeit low still when compared to historical figures. As many of you may have noticed throughout the year, prices on bonds and bond funds declined in response to higher rates. However, the higher interest earned on bonds more than offset the price declines to produce positive returns in the face of lower stock prices. International diversification of our bond investments once again provided a benefit to our portfolios in 2018. Higher interest rates have also made it possible to earn 2% or more on our cash investments after nearly a decade of barely above zero rates.

Lastly, TIAA Real Estate continued to earn steady returns and provide diversification to both stock and bond market fluctuations.

Perspective, Planning, and Perseverance

Now that it’s been settled that we did in fact experience a Bear Market in 2018, the next logical questions might be: “What does it mean to me?” and “Where do we go from here?”. In a year with no shortage of sensational market headlines, statistics, and predictions – both positive and predominantly negative recently – some perspective on what we’ve experienced is helpful.

Headlines need perspective

Recently many commentators in the media have exclaimed that 2018 was the worst year for stocks since 2008 or that December 2018 was the worst month for stocks since October 2008 as if to predict certain further decline. These exclamations tend to leave out the fact that 2018 has been the only year with negative US stock returns since 2008 after nine straight years of positive returns. Of course, the first year in ten with a negative return will be the worst in ten years.

While those statistics may be interesting, they are not useful. The truth is that in the short term there is no script or simple mathematical formula to tell us “if this, then that” because in the short-term markets are governed by emotions and randomness. As a result, stock prices and expectations tend to overshoot their intrinsic values – both on the positive and negative sides because of extreme optimism or pessimism.

These expectations tend to feed on themselves. As we’re now in Market Prediction Season for the New Year, and in the midst of lower stock prices, the predictions tend to focus on how much lower prices will go or when will they begin rising again. Some even suggest selling stocks now in an effort to avoid a predicted further decline. During the 2018 Market Prediction Season, with stocks still strongly in an up-trend, these predictions focused on how high stocks might rise.

Acting on predictions such as we see now may result in turning temporary declines into permanent losses and avoiding future gains. Conversely, action taken on predictions a year ago may have resulted in taking on more risk than we can handle, thus resulting in experiencing a greater decline in our portfolio and a feeling that we should do something to avoid more decline. That certainly doesn’t sound like a sound long-term investment strategy. These predictions only serve as noise to long-term investors and are fueled by others’ agendas who don’t have your best interests in mind.

If there were a short-term stock investing script or “if this, then that” formula, risk would be removed from stock investing as would the returns we earn in exchange for accepting that risk. Periodic corrections and Bear Markets have been a normal part of stock investing and have served as the cost we pay in exchange for the long-term returns we expect from stocks. In a world where stocks have been the only reliable means of earning long-term above-inflation returns, this has been a fair trade off for investors – if we have a plan in place that recognizes their occurrence and ensures we have an appropriate amount of risk in our portfolios.

The importance of planning

Planning for the occurrence of stock declines helps us prepare for their arrival and avoid attempting to predict when they might arrive, how deep they may be, or how long they may last. This helps us prepare by having the right amount of risk in our portfolios before declines occur, so we can avoid reacting to short-term stock fluctuations. Becoming too conservative in the midst of a bear market, or chasing returns by becoming too aggressive during a rising market is never a recipe for success.

Let’s now return to the questions of “What does it mean to me?” and “Where do we go from here?”. It means that because we have planned for stock declines like we’ve recently experienced, they won’t harm your ability to meet your goals. In times like these we can fall back on the planning to help tune out the noise that too often distracts us from our goals and our plan.

But the best plan is one that can be followed, and it’s often noted that sticking to a strategy is harder than developing a strategy. With most things in life, sticking to a well thought out financial plan is the best way to achieve your goals. Also like most things, it does take a little more perseverance at times, but planning and preparation done before stock declines arrive will give us the confidence to adhere to the plan.

With so much of the news dominated by negativity, we’d like to leave you with a couple positive stories that you probably haven’t heard about. According to the Brookings Institute, for the first time since agriculture-based civilization began 10,000 years ago, the majority of humankind is no longer poor or vulnerable to falling into poverty. And in the US, more people who want jobs have them than at any time during the last half century.

No predictions from us

We don’t have a prediction for stock prices this year, or any year for that matter, but we do continue to believe that owning the best companies in the US and the world in the form of stock will compensate us over time for the risk taken by owning them. Because we cannot control stock prices it’s best to focus on things we can control, such as our reaction to both positive and negative price fluctuations, the risk in our portfolios, and our saving or spending – all of which have greater impacts on our financial success.

Thank you again for allowing us to serve you and please let us know if you have any questions or comments. We always look forward to hearing from you.

Best wishes,

The Partners of PrairieView

Source: YCharts. Indices: S&P 500, Russell 1000 Value, CRSP US Small Cap, CRSP US Small Cap Value, MSCI World Ex USA, MSCI ACWI Value, MSCI ACWI Small Cap Value, MSCI Small Cap World Ex USA, MSCI Emerging Markets, Barclays US Government/Credit 1-5 Year, Barclays Global Agg Ex-US Hedged, Barclays Municipal Bond 1-5 Year, TIAA Real Estate Account. All index returns presented as total return inclusive of dividends.

Matt Weier, CFA, CFP®

Partner

Director of Investments

Chartered Financial Analyst

Certified Financial Planner®