- July 8, 2025

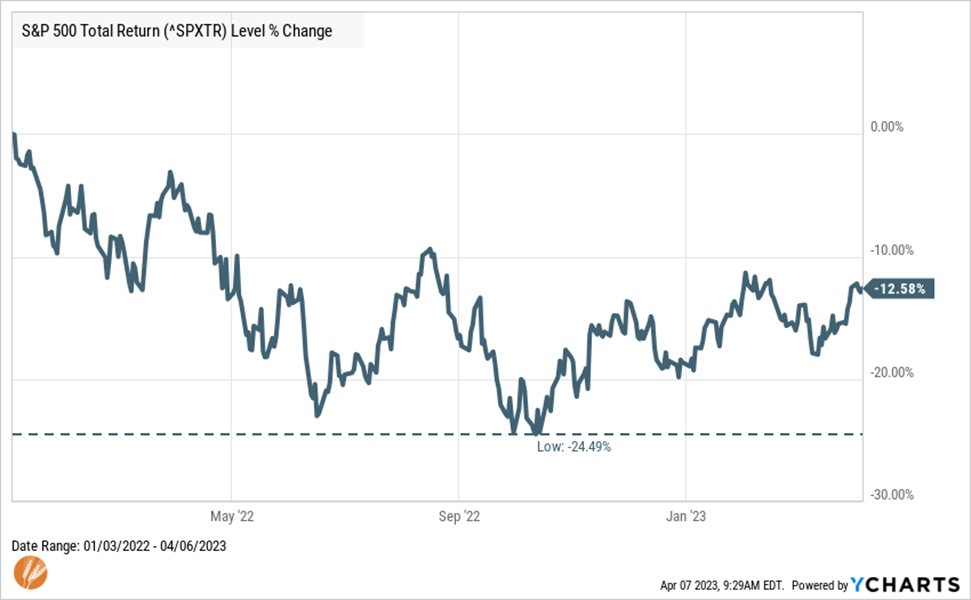

It has been about fifteen months since stock prices last peaked and nearly a year since entering Bear Market territory. After reaching a low in October, down 25%, the S&P 500 has recovered about half of this decline but remains 12% off its peak – including dividends.

This is the longest period stocks have been in a drawdown since the decline that started in the Financial Crisis of 2008. This is not to draw any particular comparison to that period, but rather to note that the Bear Markets of 2011, 2018 and 2020 were particularly short and drawdowns of this length have nearly become distant memories. The more recent short-lived drawdowns barely provided enough time for investors’ emotions to move beyond the scared or nervous states. Longer drawdowns allow investors to move through multiple emotional states including impatience, annoyance, frustration, hopelessness, and even back to scared or nervous.

Warren Buffet famously says investing is simple but it’s not easy. The latter part of this statement garners more attention in markets like this – particularly after it seemed so easy way back in 2021. It now seems hard to understand markets and remain invested amidst declining prices. But the “investing is simple” part is true whether it’s a 2021 market environment or 2023, as long as we stay focused on the basic elements for success – ones that don’t change with market conditions.

With baseball season upon us, I’ll make a timely (albeit cheesy) analogy. Much like fielding groundballs and taking extra batting practice, the following list may seem trivial. However, even though they don’t make the ESPN highlight reels, they’re the basics that win games and lead to championships.

1. Have a plan for your financial goals

A financial plan that incorporates the expectation of bull and bear markets is your best tool for risk management. It focuses on your goals and resources rather than arbitrary market indicators. It provides reassurance that bear markets, whether shorter or longer in nature, are a part of investing and that your success does not depend on the absence of bear markets. This reassurance can help prevent a desire to reach for more risk in an attempt to increase returns.

2. Allocate your sources of risk and return in alignment with your plan

Without a plan, a portfolio can become a random collection of investments. With a plan, a portfolio’s mix of assets – primarily stocks and bonds – provide a pre-determined amount of risk and return, along with sources of stability. These work in concert to help meet your goals. The pundit or billionaire on TV or the internet will make recommendations to increase or decrease risk based on their agenda, not yours. They are the ESPN highlight reel in a game most often won by fielding groundballs, consistently hitting singles and doubles, and minimizing errors.

3. Diversify across all major markets

The broader our diversification, the more confident we can be that we’ll earn the long-term risk premium expected from stocks. The narrower our diversification, the more we depend on the fortunes or misfortunes of the few, or wherever the lack of diversification lies. Concentration in a particular stock or market may work during a bull market, but the risk of this often becomes evident in bear markets.

In a broadly down market, it can seem like diversification doesn’t matter, but there are always markets that are down less than others, and even that relationship provides a benefit to long-term portfolios.

4. Think long-term

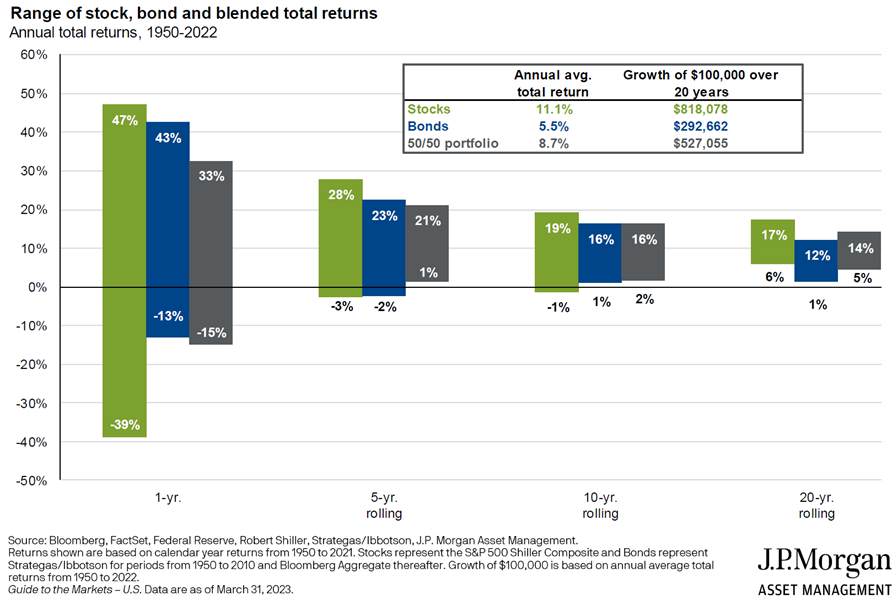

In a challenging market, a year can feel like a long time and three years can feel like an eternity. Both are still quite short-term in the context of a long-term investor. In the short-term, markets can deviate quite a lot from their expectations, but the longer the timeframe, the more closely market results will align with expectations. As long-term investors, we need to be thinking in terms of decades rather than months and years.

The image below shows the variability of stocks, bonds and a portfolio comprised of 50% of each asset over 1, 5, 10, and 20 year rolling periods. There is a clear trend that the longer the time frame, the less variability of returns, and the more likely they are to be positive.

5. “Don’t just do something, sit there”

When markets go through a period of time when they don’t provide their expected return, it can make us feel like there is something wrong with our investments and something should be done to find return elsewhere. This is rarely the case – particularly if the basics listed above have been followed.

The phrase used in the heading of this section is attributed to the founder of Vanguard, John Bogle. We’re often taught that in trying moments we shouldn’t just sit there but do something, and his point was that in successful investing, the opposite is true. Here are two other phrases that can be used to provide more depth to this concept:

“Bear markets are when stocks are returned to their rightful owners.” – Warren Buffett

“Never mistake activity for achievement” – John Wooden

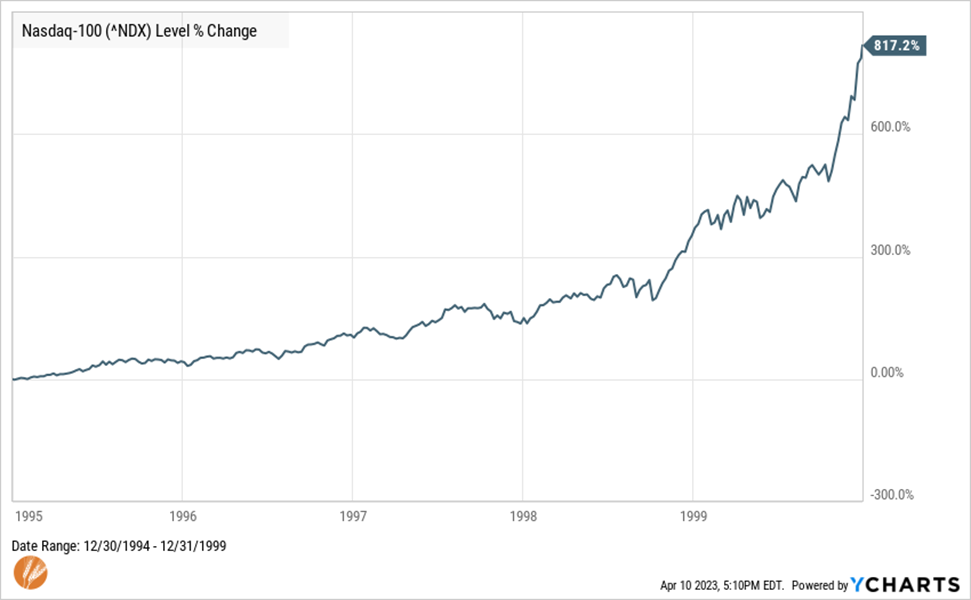

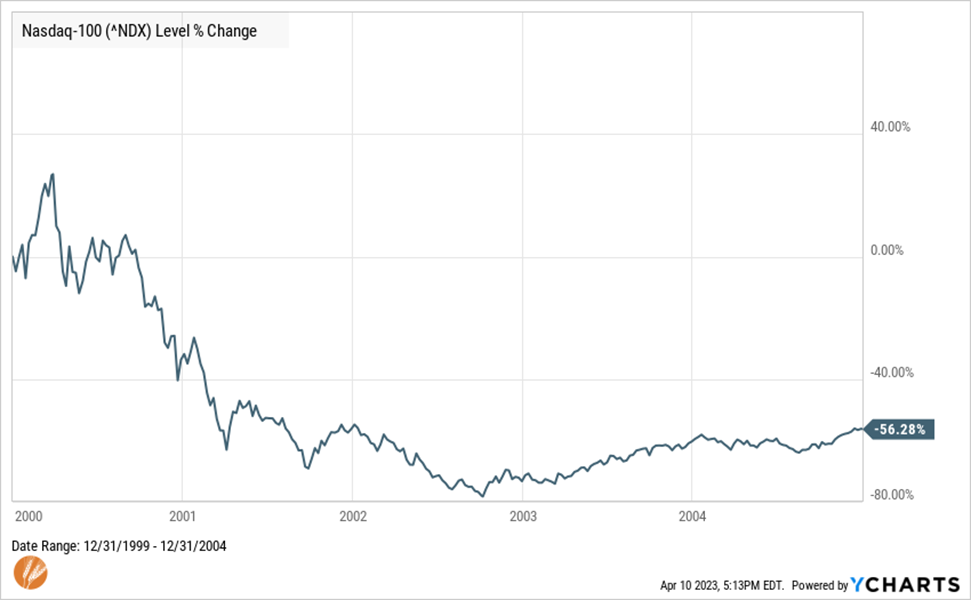

6. Know and understand the past, but don’t chase it

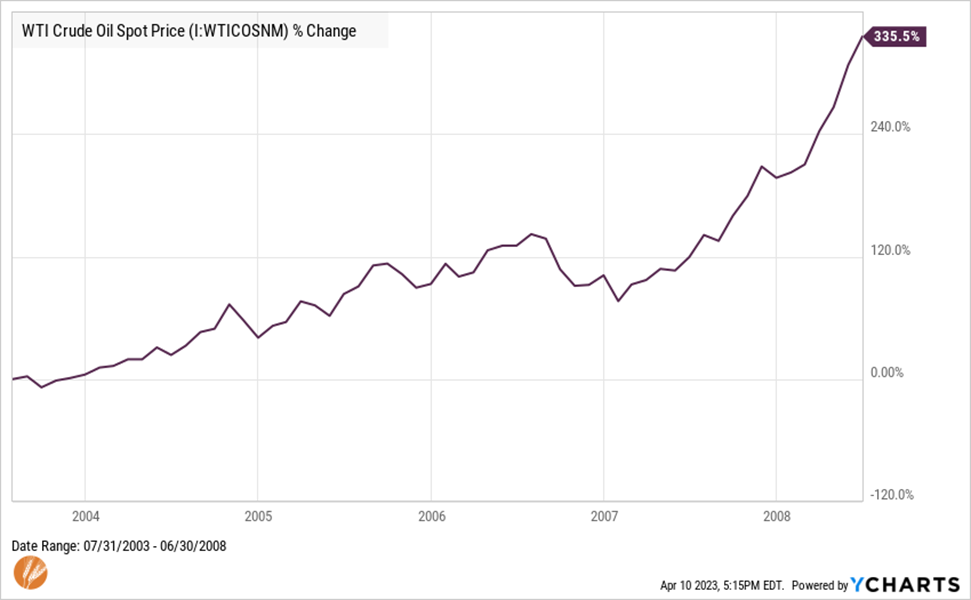

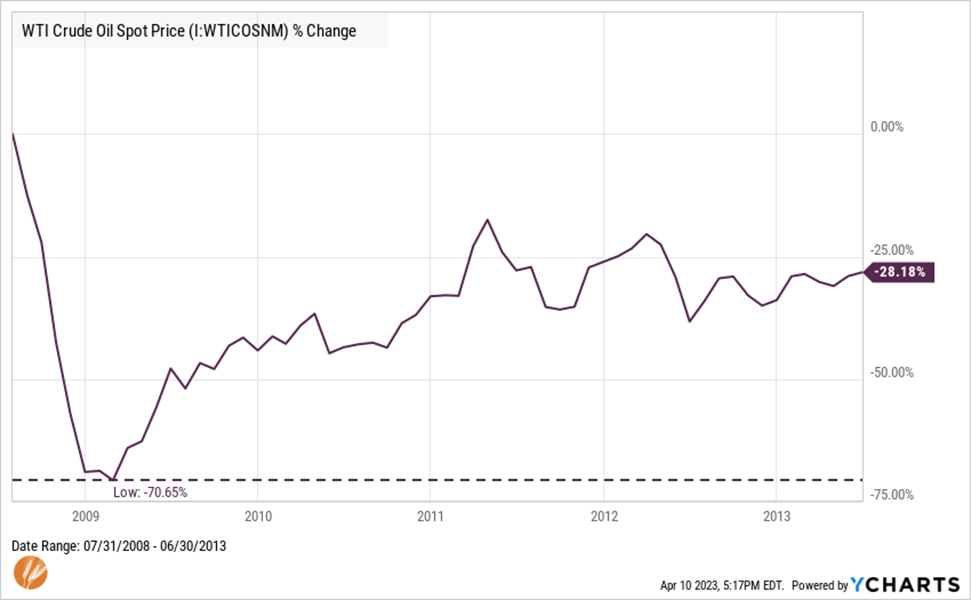

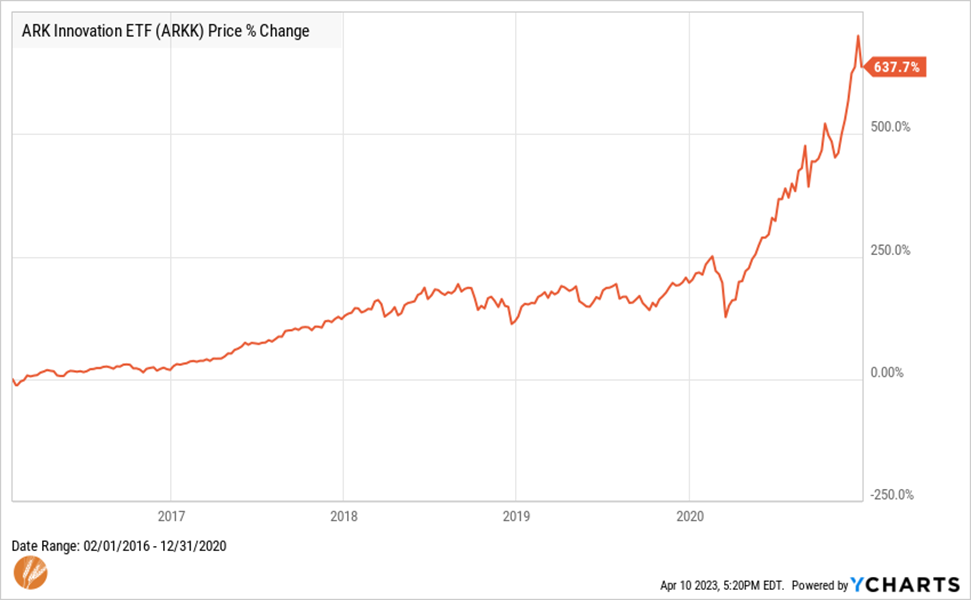

Sound investment strategies tend to be successful over many market cycles but sometimes can be pushed aside for “what’s working today.” What worked yesterday becomes what we think works today, which is rarely the same as what’s going to work tomorrow. Aligning your portfolio’s risk with your plan and diversification strategy helps with this, but the urge to do something different often remains. If that urge arises, refer to the heading of this section. Here are some examples of yesterday’s winners not being those of tomorrow:

These are only a few examples of short-lived investment waves, but the list goes on – Cryptocurrencies in recent years, Gold from 2006 through 2016 – and the pattern will likely repeat in the future.

7. Plan for the future but don’t try to predict it

It’s important to have a vision or set of assumptions for the future of our investments, but they should be broad and long-term. A sound financial plan should include the assumption of periodic bear markets occurring in the future but should not be predicated on predicting exactly when they will happen in order to avoid them.

It’s also reasonable to plan for a future in which bear markets, specifically the current one, end and we’re once again rewarded for the (plan-appropriate) investment risk we take. Planning for a future that involves both bull and bear markets takes into account: one, a level of risk that is sustained through both types of markets and two, personal circumstances, such as liquidity needs during bear markets. This can minimize an urge to try to predict a bear market or place confidence in those who do try to predict them.

“Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections themselves.” – Peter Lynch

8. Control the controllable

Perhaps one of the more frustrating aspects of bear markets is the feeling of a lack of control over our investments’ performance. But this is no different than during bull markets. It’s just that if we had control, the outcome achieved during bull markets is what we would target. Therefore anything less than this, say the returns we receive in a bear market, we feel more acutely.

There are, however, several aspects of investing that we can control. And the list happens to be the same regardless of if it’s a bear or a bull market.

- Risk, including regular rebalancing to maintain risk levels

- Diversification

- Cost of investment funds and trading

- Tax efficiency of investments

- How well we follow these basics

- The little things can make a big difference

9. The little things can make a big difference

How much is 15 minutes of your time worth? If you have extra cash in a checking account effectively earning 0% interest, 15 minutes could be worth a lot. That 15 minutes is about how long it takes to open an online savings account, which at present time is paying about 3.5% interest. So, if you have an extra $50k or $100k more than what’s needed for month-to-month spending in a checking account, opening an online savings account is a pretty good hourly rate for your 15 minutes. To put it in more tangible terms, 3.5% on $50k over the course of one year could cover the cost of a first-class domestic plane ticket – after taxes.

This is one example, but there are many more like it. Taken one by one, things like this may seem trivial – particularly after so many years of becoming accustomed to interest rates that rounded to 0% on a checking or savings account. However, small steps like this can add up if done consistently over time.

10. Review your plan

Even if every one of the preceding basic elements is followed, life circumstances can change, or events can happen that require a change in portfolio risk, cash flow, or liquidity needs. And these are the things that should lead to a change in an investment strategy. They are driven by your needs rather than changes in markets.

Or, simply looking back at the latest version of your plan could reassure you that bear markets are expected from time to time and your portfolio’s risk level is also built on that assumption. But the importance of your plan for successful investing – during bull or bear markets – is why this list starts and ends with your plan.

None of this is to suggest that bear markets are easy. They’re not. Particularly when they start to become longer than we’re used to. It is, though, to reassure you that bear markets are part of an otherwise successful investment plan. To use an often overused phrase, they are “a feature rather than a bug” in the system. The things we need to do to help ensure success are the same regardless of bull or bear market, and do, in fact, remain quite simple.

Thanks for reading.

Matt Weier, CFA, CFP®

Partner

Director of Investments

Chartered Financial Analyst

Certified Financial Planner®