- November 20, 2024

Planning for college isn’t usually the first thing on the mind of a new parent. Adjusting to your “new normal” seems to take almost as long as preparing for the baby to come, and finding a balance between family, work, and life takes constant effort. Before you know it, you’re throwing a 5th birthday party, and haven’t thought once about planning for college. You may think to yourself – “I have time, they’re still young!” Sure, you still have time before your child reaches college age, but time is your greatest asset when investing for longer term goals like college and retirement.

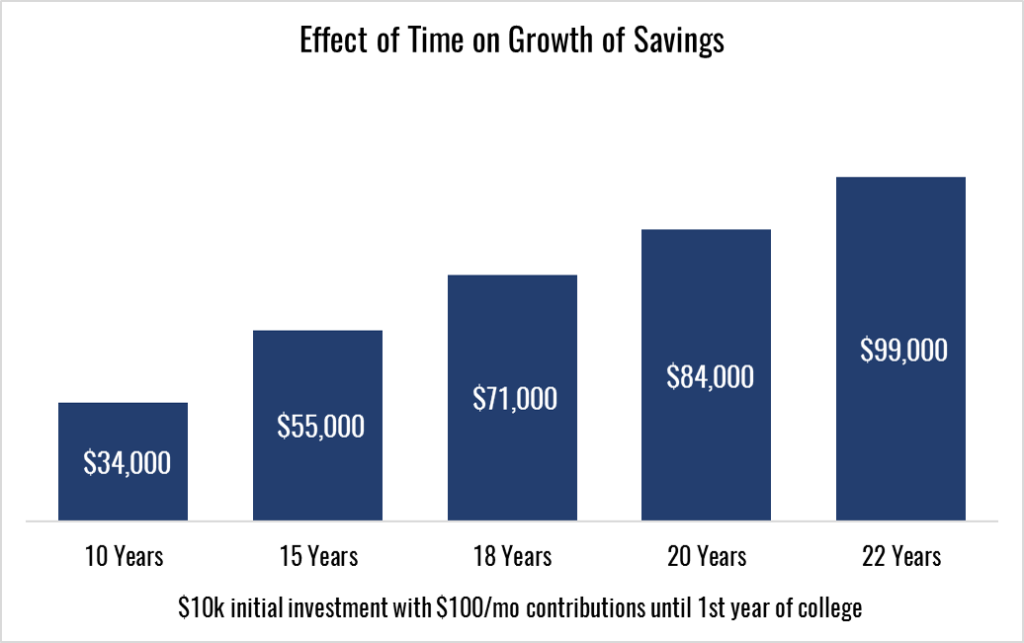

Albert Einstein described compound interest as “the eighth wonder of the world” so it shouldn’t surprise you that the longer you have to save for college, the better. The tough part about saving is that there is a seemingly endless list of immediate priorities, but there is also an immovable date when the money is needed. As you can see by the graph below, only a few extra years of compound interest can make a big difference.

Seen in the chart above, if (after an initial investment of $10,000) you made monthly contributions of $100 earning 7% every year, you would have nearly $34,000 after 10 years. By simply starting 5 years sooner (for a total of 15 years of savings), you increase the ending account value by over $20,000! Taking this concept one step further – If you’re currently 30 years old, and plan to have a child by age 34 or 35, you have (essentially) 22 years before your future child would start college. By simply beginning to save before your child is born you could substantially increase your chances of being able to fund all or part of college tuition.

What is The Best Way to Save?

We all know that saving for college is important, but sometimes aren’t sure of the best method to help achieve the goal. A few years back, my brother-in-law called me about setting up college savings accounts for my niece and nephew, and asked what vehicle I recommended. I told him – If you are saving strictly for college, few provide more benefits and flexibility than the Section 529 Savings Plan.

Using a 529 is an excellent way to save for college, as it allows you make contributions that grow tax-deferred, and can be withdrawn tax-free if used for qualified education expenses. Independent of the tax advantages associated with the account type, 529s also allow you to change the beneficiary to another member of the family without any tax consequences. For example: In the event that your daughter receives a full scholarship to play soccer in college, you can change the beneficiary from your daughter to your son and use the excess dollars to fund his unreduced expenses. This is an extremely attractive account feature for those with two children, especially if you get a late start saving, or save less than required for tuition.

As we observed earlier, time can make all the difference, but typically, we’re faced with a pre-determined number of years when saving for college. With college costs increasing at a rate of 5%/year on average, parents are often faced with having to choose between saving for college, or their own retirement. By funding a 529 plan long before college begins, parents can strike a balance between retirement and college savings, as well as allow compound interest to work its magic.

Giving Yourself a Head Start

Because of the flexibility surrounding account ownership and beneficiary designations for 529 plans, anyone (regardless of age) is able to open one, and designate themselves as the beneficiary. This provides a unique planning opportunity for young couples who know they will be starting a family in a few years, and would like to get a head start saving for college.

Under current rules, you could open a 529 with yourself as the beneficiary, then a few years later when you have a child, change the beneficiary into their name. This allows the account to be invested longer, and take advantage of additional years of compound interest.

Beginning to save before you have a child can also offer your future household budget a bit of breathing room, as it will not have to shoulder as much of the cost required to keep up with rising tuition rates. By starting early, you provide yourself more options when it comes to saving for your own retirement, ultimately resulting in a larger nest egg as you approach your golden years.

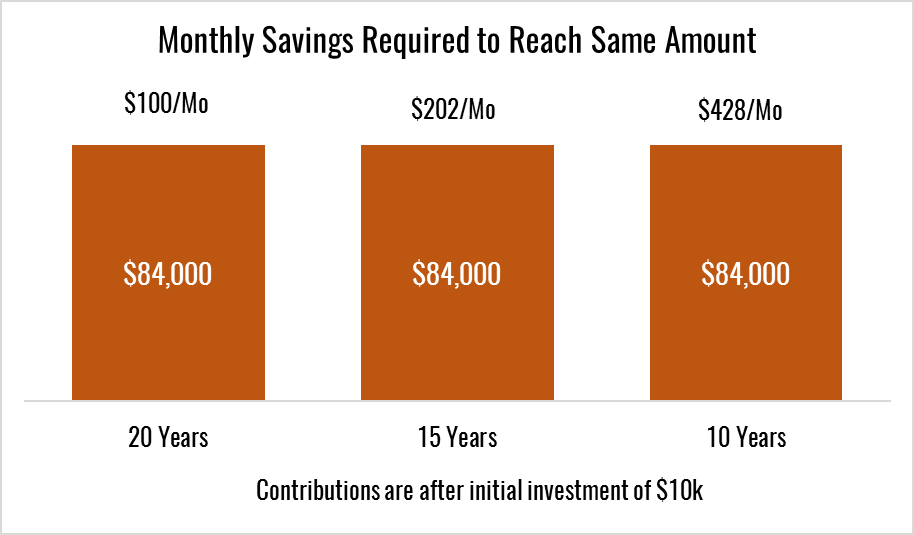

As shown in the graph above, an initial investment of $10,000, with $100 monthly contributions stacked on top, grows to approximately $84,000 in 20 years. If you delayed saving by only 5 years, you would have to more than double your monthly contribution to achieve a similar ending value. If you delayed saving by 10 years, your monthly contributions would have to more than quadruple!

Not a “One-Size Fits All” Approach

Making the decision to start saving for college before your child is born isn’t for everyone. In order for this to be considered a reasonable planning strategy, eventually, you should be prepared to use the account to fund educational expenses for a future child or another family member. Otherwise, you will be subject to taxes and penalties should the account balance be used on anything other than qualified education expenses.

As most of you know, life is full of trade-offs. There is only so much to go around when it comes to saving for longer-term goals, and striking a balance between them all is far from easy. When a client asks how to best prioritize their retirement and education savings goals, I like to say – Your kids can take out loans for college, but you can’t take out loans for your retirement.

While everyone’s priorities are different, achieving success (regardless of the goal) comes down to focusing on what you can control: how much you save.

Matt Weier, CFA, CFP®

Partner

Director of Investments

Chartered Financial Analyst

Certified Financial Planner®