- July 8, 2025

Nothing.

This answer is not headline material and will never get me on CNBC or quoted in the Wall Street Journal. In fact, if I went on CNBC and said this they would probably cut to a commercial and never invite me back.

Admittedly, this is the short answer. There is a long version with more thought and detail.

The long answer is “Nothing Different.”

As outlined here, the behaviors that lead to successful investment outcomes for the long-term investor are the same when financial markets are rising as when they experience a temporary setback.

But while the actions (or inactions) that lead to successful investment outcomes are the same, they arguably take on an even greater importance during periods of choppy markets. It can be easier to “stick to the plan” when markets are rising and rewarding us. It’s not as easy to stick to the plan when markets are falling and all we see are declines.

What can seem like the safe thing to do – sell investments or seek out a different type of investment to reduce a specific risk – ends up being the riskier path for long-term investment success. It’s another form of market timing or speculating – both of which have historically spotty track records. But investments or actions considered to be a safer decision can develop a certain allure during times of market declines or other unexpected market dislocations.

The basic premise of investing is that accepting a certain amount of risk is rewarded proportionally in the form of return. This means that actions taken to avoid risk will also result in avoiding return. But an important factor to keep in mind is that risk doesn’t simply go away – it takes on different forms. Avoiding the risk of stock fluctuations also avoids the return from that risk. This brings upon the risk of not compounding wealth sufficiently to meet long-term financial goals** – often the more perilous risk for investors.

If you’re reading this you either already have a financial and investment plan to help guide you or are taking steps to develop one. So, you have the most important tools for success during markets like this. One, a projection that illustrates a path to successful long-term financial outcomes. And two, a diversified investment portfolio that reflects your circumstances to help you achieve your goals. These two, among others, make up the foundation of your “Bear Market toolbox.” All designed to ensure that come what may from markets, you’ll be ok.

What’s also worth mentioning is that all these tools include the assumptions of repeated Bear Markets on the path to long-term investment success. But that doesn’t make it any more enjoyable to see prices decline for weeks on end and it’s natural to wonder how long it will last and how painful it will be before it gets better.

Unfortunately, it’s difficult, if not impossible, to know what happens from here, but we can look to market history to give us an idea of probabilities. We are approximately five months into this decline and durations of similar past declines in the post-war era have averaged 14 months with a range of 1 to 31 months. So, we could be near the end or have more weakness from markets ahead.

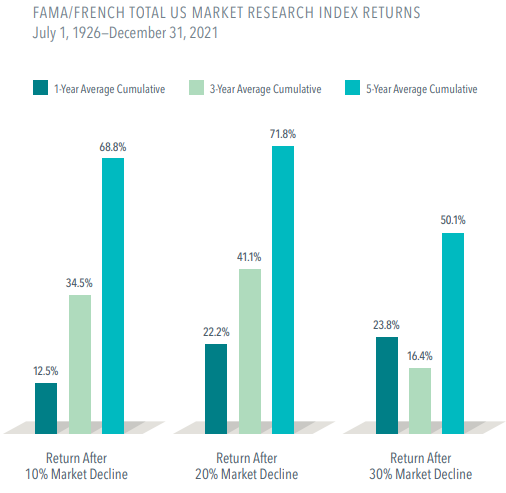

But the good news is that when the decline reaches a bottom, stocks’ track record from that point forward is impeccable. Recovery tends to come swiftly and when we least expect it. Unfortunately, we don’t know when that will happen either, but based on past recoveries illustrated below, it’s not something we want to miss.

Thanks for reading.

Matt Weier, CFA, CFP®

Partner

Director of Investments

Chartered Financial Analyst

Certified Financial Planner®