- July 8, 2025

Fact: The S&P 500 has experienced 54 record highs in 2021.

Fact(s): The S&P 500 has increased (including dividends) 99.9% (!) since the March 23, 2020 bottom, 17.5% year-to-date in 2021 and 32.3% since its pre-COVID peak on February 19, 2020.

Fact: So we don’t mistakenly assume straight-line growth, the S&P 500 also temporarily fell 34% from February 19, 2020 through March 23, 2020.

Fact: The yield on the 10-year Treasury is 1.54% (as of market close on October 6, 2021).

Fact: The US Core Consumer Price Index (the Fed’s preferred inflation gauge) rose 3.9% in August.

Fact: The Minnesota Twins finished in last place in the American League’s Central Division.*

One common element links these facts - they are all in the past. They tell us very little about the future. And as humans, we don’t handle future uncertainty well. A recent article from the Harvard Business Review highlights this point. It states that the human brain is not biologically adept to handle the uncertainty brought about from a lack of facts about the future.

Most of our evolutionary history was spent finding repeatable patterns as hunter-gatherers to the point of being able to put our brains on autopilot. This pattern-seeking evolution literally made us averse to uncertainty. So much so that, when things become less predictable, we “experience decreased motivation, agility, cooperative behavior, self-control, sense of purpose and meaning, and overall well-being.” Basically, we become less capable at almost everything.

We can try to mitigate these feelings when it comes to market uncertainty by planning ahead for various investment conditions before they occur. But both stock price declines and booms provide opportunities to get caught up in the moment, making it harder to make thoughtful investment decisions for the long-term.

Thankfully, we humans are also quite good at developing solutions to our shortcomings. The article goes on to describe three remedies for addressing our biological aversion to uncertainty, which can also be translated to investment success:

- Set expectations with realistic optimism

- Lift to bigger-picture thinking

- Embrace candor

Set market expectations with realistic optimism

Will the S&P 500 set another 54 record highs or increase 17.5% again in the next nine months? I don’t want to rule it out but it’s unlikely. The good news is that we don’t need this to happen for successful investment outcomes.

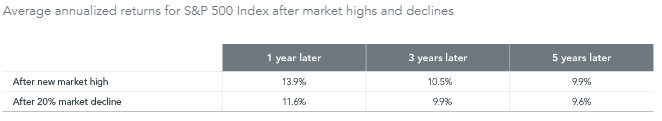

While we can’t know facts about the future, we can apply some probabilistic estimates of what the more likely outcome may be. Let’s take the 54 record highs for the S&P 500 this year (since the financial media likes to grasp on to record highs as if they foretell impending crashes and provide a reason to not invest). After every record high going back to 1926, the average annual return five years hence was 9.9%. In the same time period, the annual return five years following a 20% decline was 9.6%.

Source: Dimensional Fund Advisors, Standard and Poors

Source: Dimensional Fund Advisors, Standard and PoorsThe five-year result following either a market high or a 20% decline is basically a tie. We can set a realistically optimistic expectation that, regardless of prevailing conditions, we’re likely to be appropriately compensated for the risk of our investments. Importantly, the article mentions that unrealistic optimism consistently predicts failure. This may manifest itself in expecting speculative, undiversified investments to keep rising or that even diversified investments will rise in a straight line.

Lift to bigger-picture thinking when it comes to investing

The study in the article notes that when we think about a larger meaning or purpose, we’re “more inspired, motivated, and feel greater boosts to self-esteem and well-being.” However, we’re better at solving concrete problems and anticipating obstacles when focused in on the details. Ideally we would be able to shift between the two levels optimally based on the situation at hand. Unfortunately, because we’re human, we naturally shift down a level when faced with difficulty, often at a time when big-picture thinking would be most advantageous to our investment success.

When the S&P 500 fell 34% in February and March 2020, it was, understandably, easy and natural to fixate on this. Fortunately for most of us, this wasn’t the only thing that mattered. Let’s shift to a bigger-picture perspective. Intermediate-term Treasury bonds were positive 5% during this time and used precisely for their intended purpose - funding planned withdrawals during a stock decline. Additionally, for those of us still adding to our portfolios, this environment provided the cheapest purchase prices in years.

More recently, much financial media attention has focused on the fact that from early September into early October the S&P 500 experienced a 5% pullback. This, of course, ignores that even after this pullback, the year-to-date return remains an unequivocally attractive 17.5%.

Possibly more important to keep in mind during any difficult market condition, though, is that many market conditions are factored into planning. This ensures a portfolio can meet our goals through changing market conditions. These higher levels of thinking are shown to better position us to stay focused on what matters most in the face of challenges.

Embrace candor in investing

The third and final solution offered by this article addresses honest communication. While it may lead to learning things that aren’t entirely what we want a certain outcome to be, a study cited in the article notes that greater damage can be done in a lack of transparency and empathy. We have an ability to know when information is being withheld, and this leads to heightened uncertainty.

You may have read in these pieces in the past that this is a prediction-free zone. It continues to be. And while there are no facts about the future, we can draw some probabilistic comparisons from the past.

The past few years have seen returns above long-term expectations on US stocks and the opposite from non-US stocks. Below average returns tend to follow above average returns and vice versa but the timing of those shifts are unpredictable.

I can’t tell you where the 10-year Treasury yield will be in the future, but whether it’s next stop is 1% or 2% something will benefit and something won’t. A diversified approach is the best way to benefit from either direction. It’s also been said that if you’re comfortable with everything you own, you’re not diversified.

While I still happen to be in the camp that views recently higher inflation readings as short-term, even Jay Powell of the Fed likely doesn’t know how long short-term actually will be. And it’s similarly as easy for an economic commentator to suggest that the Fed should raise rates now as it is for a sports commentator to suggest that the key to the Twins’ woes is an ace starting pitcher. Both situations are likely far more complicated than a single variable.

Bottom line

Planning our needs from our investment portfolios can help ensure that we maintain appropriate risk levels. Whether recent stock returns have been poor or great, this method can help maintain realistic optimism, keep our thinking bigger-picture, and embrace the candor needed for success.

Thanks for reading.

Matt Weier, CFA, CFP®

Partner

Director of Investments

Chartered Financial Analyst

Certified Financial Planner®