- November 20, 2024

Last month, Congress passed the Coronavirus Aid, Relief, and Economic Security Act (known as the CARES Act) to assist with a wide swath of US business and consumer economic support. We’ve written previously about an overview of the CARES Act, as well as an in-depth discussion of the Paycheck Protection Program. Today, we’re taking a look at the provisions in the CARES Act regarding student loans.

How does the CARES Act affect student loans?

As a result of the stimulus package passed in the CARES Act, there is a mandated suspension on Federally held student loan payments and student loan interest. The suspension is retroactive to March 13th, 2020 and continues through September 30th, 2020. No new interest will accrue during this suspension period.

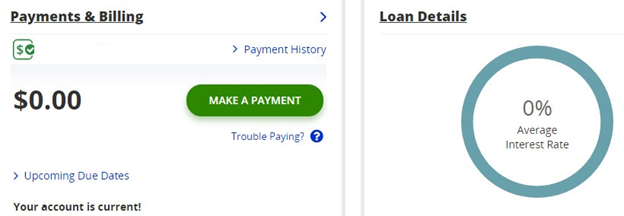

Eligible student loan holders should not have to request this suspension; it will be applied to the loan holder’s account similar to the screenshot below. Any automatic or recurring payments will be paused by the loan servicer.

Which types of student loans are eligible for suspension?

Most of the CARES Act student loan provisions apply to Direct Loans, PLUS Loans, Perkins Loans, and Federal Family Education (FFEL) Loans currently owned by the U.S. Department of Education. This is an important distinction, because there are several types of student loans that may not qualify for suspension at this time.

Legislation is being considered to extend these provisions to private loans, private PLUS Loans, and Perkins/FFEL Loans held with other servicers but has not yet been signed into law. If you are in doubt as to which type of loan you have, you can check with your specific lender or loan servicer for details.

What about loans that are in the Public Service Loan Forgiveness (PSLF) Program or rehabilitation?

Under the CARES Act, each month that a payment is suspended will be recorded as a month that a payment was made, for the purposes of the PSLF Program or loan rehabilitation. Currently, PSLF participants still need to be working full-time for their PSLF-eligible employer, but that may change with subsequent legislation.

Should I continue to make student loan payments during this temporary suspension period?

If you made a payment toward your Federally held qualifying student loan after March 13th, 2020, you can request a refund from your student loan servicer. However, if you choose to continue making payments on your student loan during the suspension, any payments you made or make after March 13th will be applied directly to principal.

This may be an important and attractive factor for those eager to pay down their balances faster, or who wish to take advantage of the temporary 0% interest rate to make payments directly onto their principal balances. If you plan to continue making payments, you should contact your loan servicer directly for further instructions.

Our team is happy to review your particular student loan scenarios, as well as any other provisions of the CARES Act that you may wish to clarify, discuss, or explore. We’re here to help.

Thanks so much for reading and be well.

Kelly

Kelly Jordan, FPQP™

Client Service & Operations Manager

Financial Paraplanner Qualified Professional™