- November 20, 2024

Like many of you, my household has seen a steep increase in our online shopping habits over the past several months. As a result of the recent safer-at-home orders, our home’s rural location, telecommuting, and just plain boredom, we’ve become a frequent destination for delivery drivers. Admittedly, we’ve hit ‘submit’ on some impulse buys without really stopping to ponder whether our purchases were made safely.

In previous blog posts, we’ve discussed cybersecurity tips for working from home; today we’ll discuss a few best practices for keeping your home shopping habits safe as well.

Buy from reputable and secure websites

Social media is full of sponsored ads touting deals, gadgets, and boredom-busters (yes, I was almost tempted by the burrito blanket ad in my Facebook feed, why do you ask?). However, the websites behind the ads aren’t always legitimate.

Even longtime online retailers like Amazon and eBay aren’t always free from issues with their third-party selling affiliates. Be sure to check customer reviews, product specs, and ensure the site is secure when you reach the payment screen.

There are three easy ways you can check for site security. Does the beginning of the URL begin with “https://”?Does a lock icon appear in the URL field1? Does the domain name tie back to where you assumed you were buying from?

When possible, use a credit card

Credit card and debit card purchases are governed by two separate consumer protection laws. Each has different minimum levels of liability and time frames for reporting2. Because of this difference, credit cards typically have more consumer protection when it comes to fraudulent transactions.

A fraudulent claim with your debit card could mean that your bank account is frozen and funds tied up while the bank investigates the claim and reaches a resolution. This can be problematic, particularly for large purchases or multiple fraudulent transactions.

Explore virtual credit card options

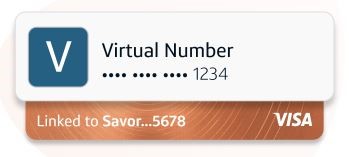

An increasing number of banks are offering virtual credit card programs for online purchases. These programs securely link your credit card number to a continually changing and encrypted ‘virtual’ card number to use online.

This can help prevent fraud since your actual credit card number never reaches the retailer. These programs operate similarly to in-person virtual payment systems such as Google or Apple Pay.

For example, my personal Capital One account offers Eno, a browser plugin that attaches the virtual card number during the checkout process.

Keep the receipts

The return process for an online shopping purchase can sometimes be daunting. Some brick-and-mortar retailers like Target and Best Buy will take online returns in-store. Kohls announced recently that it will take Amazon returns at their customer service counter.

However, for most retailers, online returns are a back-and-forth process of repacking, labeling, and waiting – and you definitely need your receipts!

Make sure to save any relevant emails or packing slips for needed retailer contact information, and review your purchase card’s account statement to make sure any refund amounts come through correctly.

However you decide to make your purchases, stay safe, secure, and thank you for reading.

1 https://www.ssl.com/faqs/what-is-https/

2 https://www.consumer.ftc.gov/articles/0219-disputing-credit-card-charges

Kelly Jordan, FPQP™

Client Service & Operations Manager

Financial Paraplanner Qualified Professional™