- May 12, 2022

Compensation. It’s top of mind for many job candidates seeking a new opportunity. Additionally, as a career progresses, compensation, among other factors, can be a key element to employee retention. In either case, an employee will want to ensure they are maximizing their available compensation benefits.

As your 3M career develops, you may find yourself with extra cash flow you can use to boost your savings. 3M’s Total Rewards compensation and benefits package provides Regular Employee(s)1 the opportunity to participate in the General Employee Stock Purchase Plan (GESPP). Through the GESPP, eligible employees can make periodic purchases of 3M stock at a discounted price through convenient payroll deductions.

Before looking under the hood of the GESPP, I encourage you to view this benefit through the lens of your overall saving and investment strategy. This perspective will be important over the years, as 3M stock, or the stock of any individual company for that matter, can go through periods when it performs better or worse than expected.

What is the General Employee Stock Purchase Plan (GESPP)?

Employee Stock Purchase Plans allow plan participants to periodically purchase shares in their company stock at a discounted price. Similar to the elective salary deferral into your 401k, the GESPP share purchases are made with deferrals from your paycheck. Different from your pre-tax 401k salary deferrals, GESPP salary deferrals are made with after-tax dollars. In the case of 3M stock, you can purchase shares at a 15% discount of the market price on the purchase date.2

What are the primary benefits of participating in the GESPP?

Participation in the 3M GESPP is another way to grow your net worth in a systematic fashion as part of your other saving and investing strategies. Automating good savings habits is associated with positive long-term investing outcomes. This strategy allows you to participate in the results of the company you work for and receive the dividends payable to shareholders. The icing on the cake: you get to purchase the shares of stock at a discount to the fair market value. Buying shares of 3M stock at a discount, combined with a diversification strategy, provides a discount to enter the investment market more broadly.

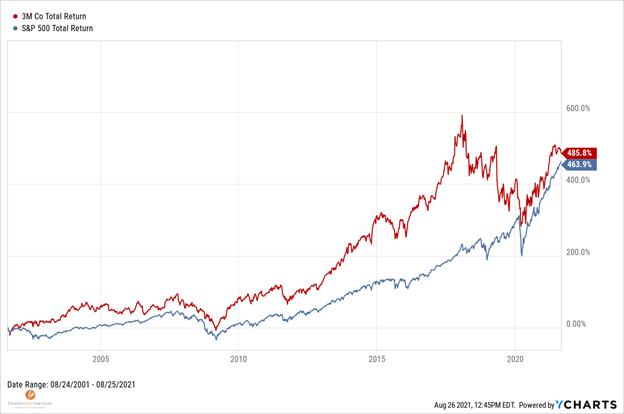

Over the last 20 years, the S&P 500 has grown in value over time. 3M stock has experienced similar growth over the same period of time.

How does the GESPP fit into my financial plan?

Whether you have been participating in the GESPP for years, looking to increase your participation level, or you are considering participation for the first time, this benefit can play an important role in your personal financial plan.

In addition to the GESPP, you are likely participating in tax-advantaged savings accounts in the form of your 401k, Roth IRA, Health Savings Account (HSA), and potentially 529 accounts. We tend to focus our savings strategies on these types of accounts first due to the significant advantage of tax-deferred growth and tax-free distributions (in certain accounts) when done properly.

For many employees, the first savings hurdle to clear is maxing out your 401k. The second savings hurdle to clear is maxing out any Roth contribution sources you may have available to you. The third option for maximizing your savings is to max out your HSA. If you have a goal around saving for college education expenses, ensure you are on track with 529 contributions.3

If you have reached this point and still have extra cash flow, allocating the additional savings to the GESPP could help further ratchet up your savings. Even if you have not yet maximized your tax-advantaged saving sources, you may still want to consider supplementing those sources with small GESPP contributions. Employees can begin their participation by contributing as little as 3% of earnings and may increase over time as the ability to save increases. If you are already participating, you can increase your participation level to build more after-tax wealth to support your retirement and non-retirement financial goals.4

What do my financial goals have to do with the GESPP?

Great question! Just like your 401k, the GESPP is another tool with unique attributes in your toolbox to fund your goals.

You are probably familiar with the 3M 401k Plan. If not, I recommend clicking here to learn more. Many employees associate their 401k plan with saving for their retirement goal. For most of us, we are introduced to our company’s 401k plan during the on-boarding process. The 401k plan has become one of the most common ways to save for retirement.

Your GESPP can be a source of retirement funding. However, unlike savings you accumulate in your tax-advantaged accounts, which in some cases cannot be accessed until age 59 ½, the shares you accumulate in your GESPP may be accessed for supplemental cash needs along the way.

The goals you fund with your GESPP contributions do not necessarily need to be known at the time you start investing, other than that there is a high likelihood you will want to accomplish something in the future where accumulated value in 3M stock (or diversified portions of your account) will be beneficial. Some common non-retirement goals we see funded with GESPP savings are:

- Child-related expenses

- College

- Cabins

- Condos

Case Study:

- Financial Goal – 3M family would like to purchase a cabin on Lake Winnibigoshish

- Target purchase price is $800,000 with $200,000 down payment

- Cash on hand is $100,000 but earmarked for on-going cash needs

- $2.5MM portfolio contains $500,000 of 3M stock from GESPP

- Cash-flow projection supports purchase and will fit with long-term financial plan

- 3M stock becomes an ideal funding source for down payment

- When used as a funding source for goals, taxes will be owed on the sale assuming shares have appreciated

Tax implications of the GESPP

Seasoned investors recognize the importance of diversification of investments for long-term financial success. In addition, diversification of investments’ taxability can play an important role. After-tax investments can provide flexibility in accessing liquidity for both pre- and during-retirement needs. Different from a 401k that grows tax-deferred until withdrawals begin and then is taxed as ordinary income, after-tax investments, such as the GESPP, are taxed annually based on activity. This activity could include capital gains and dividends. On the positive side of the ledger, which adds to these investments’ flexibility, capital gains and dividends are often taxed at lower rates than 401k or IRA withdrawals.

Taxes fall into two basic categories for after-tax investments in general: Dividends and Capital Gains. If you hold a stock like 3M that pays a regular dividend, you will owe taxes on those dividends every year. If you sell shares that have appreciated in value, the difference between your purchase price and the price at which you sell them is taxable in the year in which they are sold. Just because taxes on capital gains can be avoided by not selling shares, doesn’t necessarily mean this should be the objective. Taking periodic and incremental gains on appreciated shares to support diversification can help prevent one stock from becoming an overly large portion of your portfolio (see “Potential Risks” below).

In addition to the normal taxes associated with after-tax investments, there is one additional factor to be aware of for shares purchased in the GESPP. The 15% discount will be taxed (as compensation) at your ordinary income tax rate once you sell your shares. This additional tax on the discount is often viewed as a deterrent to participation. It doesn’t need to be. Yes, it is likely a higher tax than on the gain from the stock’s fair market value at purchase, but the fact remains that when you participate in the GESPP you are buying something for less than fair market value. Additionally, holding onto your shares for at least one year past the original purchase date or at least two years after the original offer date will ensure that you receive long-term capital gain rates treatment on your profits from the increase in the stock price.

Potential risks of the GESPP

While the GESPP has the potential to be a great source of long-term wealth accumulation, it does represent ownership in 3M stock, which can fluctuate in price and potentially be at a lower price when you need the funds. A concentrated stock position is an additional risk to keep in mind. Depending on how much 3M stock you are acquiring through the GESPP, RSUs, or Stock Options, you may find that your portfolio has too much single company stock risk. If you haven’t properly considered a plan for diversifying (selling) a portion of your 3M stock position, you may be taking on more risk than is appropriate for your plan.

When stock markets decline, the price movement of a single company stock (i.e. 3M) may decline more than a more broadly diversified portfolio of stocks.

Another detail to keep in mind is that a participant cannot sell or transfer the shares of stock during the one-year period following the date on which the option (to participate in the GESPP) was exercised, except in the case of death, retirement, or termination of employment. In other words, this is not a cash savings plan. Part of your financial plan should include sufficient short-term savings set aside to allow your GESPP savings strategy to materialize over time.

Conclusion

For 3Mers looking to supplement their savings as their careers and income grow, the GESPP compensation benefit has the potential to be a valuable tool in your toolbox.

Whether for long-term retirement savings or for more intermediate goals along the way, investments in after-tax accounts can create a more well-rounded set of financial resources and as a 3Mer, the GESPP can be valuable way to begin to accumulate these investments. Like many good things, though, too much can lead to additional risks, so regular diversification is important.

We’re happy to answer any other questions you may have on this benefit or how it fits in your financial plan.

Thank you for reading!

1 The term “Regular Employee” shall mean an individual recognized as such in the company employment records and information systems of the Company or a Designated Company. Temporary employees, including but not limited to independent contractors or leased employees, are specifically excluded; as well as those employees who have not attained the age of 18.

2 The option price for each share of Stock shall be eighty-five percent (85%) of the fair market value on such shares on the New York Stock Exchange on the date the option is granted, rounded up to the next higher even cent. The fair market value shall be the average of the high and low price for such shares on the New York Stock Exchange. Stock purchases occur on the last business day of each month.

3 Items 2 – 4 can be interchangeable in priority based on your specific goals.

4 Employees can contribute 3% to 10% of their gross earnings up to $25,000 (including the 15% discount) each calendar year. Participants may increase, decrease, or completely stop the amount of payroll deductions throughout the year.

Luke Murray, CFP®, CPWA®

Senior Wealth Manager

Certified Financial Planner®

Certified Private Wealth Advisor®